Friday, April 22nd 2011

AMD Reports First Quarter Results

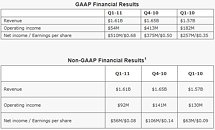

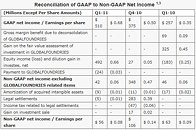

AMD today announced revenue for the first quarter of 2011 of $1.61 billion, net income of $510 million, or $0.68 per share, and operating income of $54 million. The company reported non-GAAP net income of $56 million, or $0.08 per share, and non-GAAP operating income of $92 million.

"First quarter operating results were highlighted by strong demand for our first generation of AMD Fusion Accelerated Processing Units (APUs)," said Thomas Seifert, CFO and interim CEO. "APU unit shipments greatly exceeded our expectations, and we are excited to build on that momentum now that we are shipping our 'Llano' APU."Quarterly Summary

AMD's outlook statements are based on current expectations. The following statements are forward looking, and actual results could differ materially depending on market conditions and the factors set forth under "Cautionary Statement" below.

AMD expects revenue to be flat to slightly down sequentially for the second quarter of 2011.For additional detail regarding AMD's results and outlook please see the CFO commentary posted at quarterlyearnings.amd.com.

"First quarter operating results were highlighted by strong demand for our first generation of AMD Fusion Accelerated Processing Units (APUs)," said Thomas Seifert, CFO and interim CEO. "APU unit shipments greatly exceeded our expectations, and we are excited to build on that momentum now that we are shipping our 'Llano' APU."Quarterly Summary

- Gross margin was 43 percent.

o Non-GAAP gross margin was 45 percent, flat sequentially. - Cash, cash equivalents and marketable securities balance at the end of the quarter was $1.75 billion.

- Computing Solutions segment revenue decreased 2 percent sequentially and increased 3 percent year-over-year. The sequential decrease was driven primarily by lower average selling price (ASP) partially offset by higher desktop microprocessor sales. The year-over-year increase was primarily driven by strong microprocessor unit sales in the channel.

o Operating income was $100 million, compared with $91 million in Q410 and $146 million in Q110.

o Microprocessor ASP decreased sequentially and year-over-year.

o AMD commenced revenue shipments of AMD's first Fusion APU for mainstream notebooks (codenamed "Llano") that combines discrete-class graphics capabilities, personal supercomputing performance and AMD AllDay power.

o Acer, Asus, Dell, Fujitsu, HP, Lenovo, MSI, Sony and Toshiba shipped sleek new thin-and-light notebooks based on AMD's low-power APUs capable of delivering high definition visual experiences and extended battery life.

o More than 50 applications from software companies including Adobe, ArcSoft, Corel, CyberLink and Microsoft take advantage of the incredible compute power found in AMD's APUs and GPUs to dramatically improve application performance and power efficiency.

o AMD launched the world's first APU specifically designed for embedded systems with a record number of embedded partners for the company. Fujitsu, Kontron, Quixant and Congatec announced APU-based solutions for graphics-intensive markets like digital signage, Internet-ready set top boxes, casino gaming machines and point-of-sale kiosks. Acer, Cray, Dell, HP, SGI and other server manufacturers launched new or updated systems based on five newly introduced AMD Opteron 6100 series processors.

o In the high performance computing market (HPC), AMD Opteron-based solutions continue to gain traction based on their greater scalability. New customer wins include Lockheed Martin's cluster for the US Department of Defense and the University of Sao Paulo's cluster to enable advanced scientific astronomical research.

o AMD expanded its enthusiast desktop offerings with the introduction of its fastest four-core processor, the AMD Phenom II X4 975 Black Edition. - Graphics segment revenue decreased 3 percent sequentially and was flat year-over-year. The sequential decrease was driven primarily by a seasonal decline in royalties received in connection with the sale of game console systems.

o Operating income was $19 million, compared with $68 million in Q410 and $47 million in Q110.

o GPU ASP decreased sequentially and year-over-year.

o AMD maintained its graphics performance leadership position with the launch of the world's fastest graphics card, the AMD Radeon HD 6990.

o Apple refreshed its Macbook Pro line-up with the new AMD Radeon HD 6490M and HD 6750M graphics chips. AMD now provides discrete graphics solutions across Apple's iMac and Macbook Pro product lines.

o Strong industry adoption of AMD's mobile graphics continued, as HP and Dell launched new designs powered by the new AMD Radeon HD 6000M family of graphics processors.

AMD's outlook statements are based on current expectations. The following statements are forward looking, and actual results could differ materially depending on market conditions and the factors set forth under "Cautionary Statement" below.

AMD expects revenue to be flat to slightly down sequentially for the second quarter of 2011.For additional detail regarding AMD's results and outlook please see the CFO commentary posted at quarterlyearnings.amd.com.

19 Comments on AMD Reports First Quarter Results

Some reading

www.channelregister.co.uk/2011/04/21/amd_q1_2011_numbers/

Is it real?

NO LOSS THIS QUARTER? (!)

I mean... Is it good news or what?

but it would be interesting to see a break-out of how the discrete GPU division is doing.Nevermind, it's in there. lol

they offer the more affordable route around most things (CPU's, GPU's and their motherboard's are cheap even if they dont produce them :p) which is good for the average buyer who doesnt always need the best performance.

i hope they keep it this way, but challenge more in the high end market so nobody can complain :p!

Future is mobile business, small powerful netbooks and handheld devices are going to be the next storm in IT. I wish AMD will jump into the mobile phone chip making band and make an impact (if they don't have a chip yet).

This is it people. AMD has bet the company on future sales figures of Bulldozer. If it flops, which I don't think will happen, AMD will owe GF a lot of money next year.

Can't even remember what devices they were in but it was a lot.

snapdragon :P

intels igp's are also amd design.

but yeah, might have paid off to keep cellphone gpu division alive for a little while longer.

maybe make a new one ? :P

Another example of an Intel APU is the Atom 510, 525, 410, 425 and so on... they all have integrated graphics on the CPU die. "APU" is just some invented term (marketing blurb), the technology and the products existed long before AMD cooked up their first ever APU.