Saturday, February 22nd 2014

Graphics Add-In Board Market Up in Q4 2013

Jon Peddie Research (JPR), the industry's research and consulting firm for graphics and multimedia, announced estimated graphics add-in-board (AIB) shipments and suppliers' market share for 2013 4Q.

JPR's AIB Report tracks computer add-in graphics boards, which carry discrete graphics chips. AIBs are used in desktop PCs, workstations, servers, and other devices such as scientific instruments. They are sold directly to customers as aftermarket products, or are factory installed. In all cases, AIBs represent the higher end of the graphics industry using discrete chips and private high-speed memory, as compared to the integrated GPUs in CPUs that share slower system memory.The news was encouraging; quarter-to-quarter, the market grew 3 % (compared to the desktop PC market, which increased 4.45%).

On a year-to-year basis we found that total AIB shipments during the quarter increased 3%, which is more than desktop PCs which declined of 6.1%.

GPUs are traditionally a leading indicator of the market because a GPU goes into every system before it is shipped; most of the PC vendors are guiding down to flat for the next quarter.

The overall PC desktop market increased quarter-to-quarter including double-attach-the adding of a second (or third) AIB to a system with integrated processor graphics-and to a lesser extent, dual AIBs in performance desktop machines using either AMD's Crossfire or Nvidia's SLI technology.

The attach rate of AIBs to desktop PCs has declined from a high of 63% in Q1 2008 to 42.8% in 2013 4Q, and from 43.4% last quarter.

The quarter in general

JPR found that AIB shipments during 2013 4Q behaved according to past years with regard to seasonality, but the increase was less than the 10-year average. AIB shipments increased 3.% from the last quarter (the 10-year average is 12%).

In addition to privately branded AIBs offered worldwide, about a dozen PC suppliers offer AIBs as part of a system, and/or as an option, and some that offer AIBs as separate aftermarket products.

JPR's AIB Report tracks computer add-in graphics boards, which carry discrete graphics chips. AIBs are used in desktop PCs, workstations, servers, and other devices such as scientific instruments. They are sold directly to customers as aftermarket products, or are factory installed. In all cases, AIBs represent the higher end of the graphics industry using discrete chips and private high-speed memory, as compared to the integrated GPUs in CPUs that share slower system memory.The news was encouraging; quarter-to-quarter, the market grew 3 % (compared to the desktop PC market, which increased 4.45%).

On a year-to-year basis we found that total AIB shipments during the quarter increased 3%, which is more than desktop PCs which declined of 6.1%.

GPUs are traditionally a leading indicator of the market because a GPU goes into every system before it is shipped; most of the PC vendors are guiding down to flat for the next quarter.

The overall PC desktop market increased quarter-to-quarter including double-attach-the adding of a second (or third) AIB to a system with integrated processor graphics-and to a lesser extent, dual AIBs in performance desktop machines using either AMD's Crossfire or Nvidia's SLI technology.

The attach rate of AIBs to desktop PCs has declined from a high of 63% in Q1 2008 to 42.8% in 2013 4Q, and from 43.4% last quarter.

The quarter in general

JPR found that AIB shipments during 2013 4Q behaved according to past years with regard to seasonality, but the increase was less than the 10-year average. AIB shipments increased 3.% from the last quarter (the 10-year average is 12%).

- Total AIB shipments increased this quarter to 15 million units.

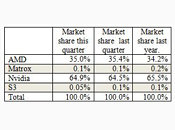

- AMD's quarter-to-quarter total desktop AIB unit shipments decreased 3%.

- Nvidia's quarter-to-quarter unit shipments increased 3.6%.

- Nvidia continues to hold a dominant market share position at 65%.

- Figures for the other suppliers were flat to declining.

In addition to privately branded AIBs offered worldwide, about a dozen PC suppliers offer AIBs as part of a system, and/or as an option, and some that offer AIBs as separate aftermarket products.

25 Comments on Graphics Add-In Board Market Up in Q4 2013

On the other hand... AMD should have a good if not decent 2014 with all the miners out there just snatchin' their graphic cards up.

but the whole broken crossfire thing had quite a detrimental effect on sales im guessing. There are a lot more people going with Dual GPU configs these days then ever before. and if they cant have that then they just wont buy.

One day.... One day I will learn to give up dual GPU set ups... but ive been doing it since 4870 days so its not something i can give up cold turkey :cry: Its like an addiction man.

The R600 also demonstrated the effectiveness of the "halo" part. Nvidia might not have sold a boatload of 8800GTX and 8800Ultra's, but their unchallenged status (except by Nvidia's own cheaper 8800 GTS G92) effectively sent AMD's market share into a tailspin. The fact that between the success of the G80/G92 and the relative failure of R600 sent AMD scurrying back to drawing board and as far from the big die strategy as possible meant that nothing of note (at the high end) came out of AMD until the RV770 arrived over 2 years later.

There are plenty of circumstances when AMD had opportunities to nail home an advantage, but tripped over themselves. Evergreen (HD 5000) series coincided at a time when Nvidia's plans fell apart because of a lack of preparedness with TSMC's 40nm process node. AMD promptly shot itself in the foot with the PowerPlay (Grey Screen of Death) issue and conservative silicon wafer orders.

AMD usually end up playing "follow the leader" (GPU compute, software analogues of Nvidia's Optimus, GeForce Experience, frame metering, G-Sync, GPU boost states etc, TWIMTBP partnerships), and consumers react to market leaders rather than market followers. Even when ATI/AMD have had an advantage it is seldom fully exploited.Won't make much difference. Mining targets higher priced/lower production boards. The bulk of discrete sales comes from the low end of the spectrum. If I were AMD I'd be a little concerned about the power efficiency demonstrated by Nvidia's GM107. With GM108 and a probable 28nm GM106(?) to arrive shortly - well before before any 20nm GPUs turn up, AMD is at a distinct disadvantage at performance per watt in the high volume OEM markets.

Nvidia seem to have downplayed the GM107's mining ability - there seems no mention of it in the review press release kit, and given the 750/750 Ti seem markedly improved...

...it makes me wonder whether Nvidia realize that mining dilutes the effectiveness of their main discrete graphics focus.

Another interesting titbit in the Extremetech article:So it looks like the current architectures (GCN 1.1/2.0 vs Maxwell) might well be shouldering the burden for a while. Hopefully for AMD's sake the 20nm products Nvidia have on TSMC's booksare SoC's.[Source]

1. Now. It doesn't alter the fact that the market (any market) has to overcome inertia. So, going forward Mantle may help sales/visibility, but as many have already noted, Mantle is more a CPU/APU optimizer than GPU. In one respect Mantle looks (sort of) innovative, in another respect it looks like AMD playing catch-up to Intel.

2. Late. Promises of a December launch faded along with a lot of (what remains) of EA/DICE's credibility with a bug ridden game. A lot depends on what kind of state further Mantle optimized games launch at, but I suspect that with AMD not commanding the greater share of integrated or discrete graphics, Mantle needs to be opened up to Intel and Nvidia architectures to succeed...and opening up to these two vendors throws away AMD's advantage. Both Intel and Nvidia have considerably more resources and experience with software than AMD enjoys.

DICE have already called formulti vendor support

3. AMD paid handsomely for the partnership with EA DICE for BF4. If Mantle remains niche (something that it is bound to be if it remains AMD GCN-only hardware /EA DICE compatible), means AMD putting its hand in its pocket continuously. That means that increased Radeon/APU sales directly attributable to gaming are imperative to cover costs.

From what I understand on the requirements of mantle for hardware, Nvidia can support it. Remember, it's an open API, that's close to the metal but not that close to the metal. It's not as close as they'd like you to think, but it's still closer than what you get with openGL and D3D. There's nothing locking out other venders as long as their GPU's can support it. I'm not certain if Intel can support it as of right now, but that's because I don't know much about Intel's gpu's.

Even AMD's own Q&A is pretty vagueciting "later in 2014" for a dev kit. So Nvidia see an SDK in "late 2014" - they still have to be able to put together code to implement it- not quite an overnight exercise. Considering Mantle is already running in a AAA title, it seems like a case of putting the cart before the horse....unless of course, AMD intend to lock out other vendors until their own position is ensured...which seems to be the case.

If the code ready for implementation (BF4 bugs notwithstanding) why not release the code ?

Performance, drivers,crossfire and all the other excuses are irrelevant because, As has been said, the vast majority of the add-in market is the low end single GPU and performance/price is comparable across both companies.

I've been following this stuff long enough to know the game is rigged. Nvidia and AMD have the market share they planned to have. Its not a conspiracy because AMD and Nvidia have already been busted colluding, just like most other areas of computer manufacture like memory and display panels. When theres only a couple of manufacturers, they get together to figure out how to milk the most out of consumers.

We see the same kind of cycles of high-power to power efficient chips, every generation gives us incremental improvements over the last. Just enough to get us buying new GPUs, mean while a new $1,000 GPU can barely run 1440p, a standard that has been out for several years, let alone 4K. Its the biggest rort around.....

Seems as though if you need to make a comparison of how far the GPU has come then you'd best compare how well the later generation boards handle some of the older game engines (and API versions) prevalent when 1600p/1440p started gaining traction - and without all the recent game i.q. additions.

That's some pretty cheap hardware churning out 60+ fps (at maximum in-game image settings) at 2560x1600

[Source]

Interview on mantle going into some of the finer details, like hints at how it works.

www.tomshardware.com/reviews/johan-andersson-battlefield-4-interview,3688-7.html

Interview with John Addersson.

There's other mantle related slides all over the net. The main thing is to understand how GPU's work. Technically if it works on GCN, it should work on Maxwell and maybe even Kepler with a bit of overhead.

The code might by ready, but it's not really finished. I could easily understand why they're not releasing it to the public if it's not a finished product. Furthermore only one of their drivers supports it and it's a beta driver. They most likely want to get out all the bugs and make sure the full public release of it is well supported.

Edit: Or at least works

On to the topic, I expected that. Initially the R9 was a late comer. Then the effect added by the miner's price jump is certainly going to get some buyers moving to the green team.

What's even more sad is that even until now, the 290 still sell for a whooping $600 opposing to the $450 price at launch. What are those greedy guys thinking? With some GTX 780 still selling for $520, surely gamers are going to choose the 780. Disgusting to be honest.

Also (sorry OOT), 750 Ti is quite interesting in terms of mining efficiency. I hope Maxwell's mining efficiency can bring Card prices down.

www.xbitlabs.com/news/cpu/display/20120316164155_Intel_Continues_to_Dominate_But_AMD_Managed_to_Slightly_Gain_CPU_Market_Share_in_2011_IDC.html

You're right about the market share. I forgot that we are just a small community only effecting less than 10% of the market share :banghead:. But That another question will come after that, Which is probably "What affects AMD's drop and Nvidia's Rise?"

They dont directly cater towards the commercial market though their cards are available in very very very limited supply and a few big name e-tails, Most of the time they list the cards as 'ordered upon request' which means they dont actually stock the goods but will source one for you.

Matrox is more of an industrial market thing. I know a lot of stock traders in the city that use Matrox cards for multi-monitor setups if not just one of them break out boxes for HDMi that can split the connection between 3 or 4 monitors.