Monday, August 18th 2014

JPR Reports AMD Jumps 11% in GPU Shipments in Q2, Intel up 4%, NVIDIA Slips

Jon Peddie Research (JPR), the industry's research and consulting firm for graphics and multimedia, announced estimated graphics chip shipments and suppliers' market share for 2014 2Q.

Graphics chips are without doubt one of the most powerful, exciting, and essential components in tech today: not only does every computer require one (or more), but the technology is entering into major new markets like supercomputers, remote workstations, and simulators almost on a daily basis. New technologies and compute programs are taking advantage of the ability of GPU power to scale. On top of that, PC gaming momentum continues to build. It would be no exaggeration to say that GPUs are becoming the 800-pound gorilla in the room.The big drop in graphics shipments in Q1 has been partially offset by a small rise this quarter. Shipments were up 3.2% quarter-to-quarter, and down 4.5% compared to the same quarter last year.

Quick highlights:

GPUs are traditionally a leading indicator of the market, since a GPU goes into every system before it is shipped, and most of the PC vendors are guiding cautiously up to flat for Q3'14.

The Gaming PC segment, where higher-end GPUs are used, was a bright spot in the market in Q1. Nvidia and AMD high-end GPUs sales were strong, lifting the ASPs for the discrete GPU market.

Q2 2014 saw the first decline in tablet sales, and one of the few increases in PC sales. The CAGR for total PC graphics from 2014 to 2017 is basically flat. We expect the total shipments of graphics chips in 2017 to be 418 million units. In 2013, 438.3 million GPUs were shipped and the forecast for 2014 is 414.2 million.

The quarter in general

Graphics chips (GPUs) and chips with graphics (IGPs, APUs, and EPGs) are a leading indicator for the PC market. At least one and often two GPUs are present in every PC shipped. It can take the form of a discrete chip, a GPU integrated in the chipset or embedded in the CPU. The average has grown from 1.2 GPUs per PC in 2001 to almost 1.35 GPUs per PC.

It is critical to get a proper grip on this highly complex technology and understand its future direction.

This detailed 50-page report will provide you with all the data, analysis and insight you need to clearly understand where this technology is today and where it's headed.

This fact and data-based report does not pull any punches: frankly, you will be shocked by some of the analysis and insight.

Our findings include discrete and integrated graphics (CPU and chipset) for Desktops, Notebooks (and Netbooks), and PC-based commercial (i.e., POS) and industrial/scientific and embedded. This report does not include the x86 game consoles, handhelds (i.e., mobile phones), x86 Servers or ARM-based Tablets (i.e. iPad and Android-based Tablets),or ARM-based Servers. It does include x86-based tablets, Chromebooks, and embedded systems.

We have been providing quarterly reports on the PC graphics market shipments since 1988.

Graphics chips are without doubt one of the most powerful, exciting, and essential components in tech today: not only does every computer require one (or more), but the technology is entering into major new markets like supercomputers, remote workstations, and simulators almost on a daily basis. New technologies and compute programs are taking advantage of the ability of GPU power to scale. On top of that, PC gaming momentum continues to build. It would be no exaggeration to say that GPUs are becoming the 800-pound gorilla in the room.The big drop in graphics shipments in Q1 has been partially offset by a small rise this quarter. Shipments were up 3.2% quarter-to-quarter, and down 4.5% compared to the same quarter last year.

Quick highlights:

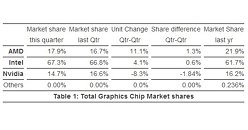

- AMD's overall unit shipments increased 11% quarter-to-quarter, Intel's total shipments increased 4% from last quarter, and Nvidia's decreased 8.3%.

- The attach rate of GPUs (includes integrated and discrete GPUs) to PCs, for the quarter was 139% (up 3.2%) and 32% of PCs had discrete GPUs, (down 3.6%) which mean 68% of the PCs are using the embedded graphics in the CPU.

- The overall PC market increased 1.3% quarter-to-quarter, and decreased 1.7% year-to-year.

- Desktop graphics add-in boards (AIBs) that use discrete GPUs declined 17.5%.

GPUs are traditionally a leading indicator of the market, since a GPU goes into every system before it is shipped, and most of the PC vendors are guiding cautiously up to flat for Q3'14.

The Gaming PC segment, where higher-end GPUs are used, was a bright spot in the market in Q1. Nvidia and AMD high-end GPUs sales were strong, lifting the ASPs for the discrete GPU market.

Q2 2014 saw the first decline in tablet sales, and one of the few increases in PC sales. The CAGR for total PC graphics from 2014 to 2017 is basically flat. We expect the total shipments of graphics chips in 2017 to be 418 million units. In 2013, 438.3 million GPUs were shipped and the forecast for 2014 is 414.2 million.

The quarter in general

- AMD's shipments of desktop heterogeneous GPU/CPUs, i.e., APUs increased 16.7% from the previous quarter, and increased 10.3% in notebooks. AMD's discrete desktop shipments decreased 10.7% and notebook discrete shipments increased 30.6%. The company's overall PC graphics shipments increased 11%.

- Intel's desktop processor embedded graphics (EPGs) shipments increased from last quarter by 7.2%, and notebooks increased by 1.9%. The company's overall PC graphics shipments increased 4.1%.

- Nvidia's desktop discrete shipments decreased 21% from last quarter; and the company's notebook discrete shipments increased 6.9%. The company's overall PC graphics shipments decreased 8.3%.

- Year-to-year this quarter AMD's overall PC shipments decreased 22%, Intel increased 4.2%, Nvidia decreased 12.7%, and others essentially went away.

- Total discrete GPU (desktop and notebook) shipments from the last quarter decreased 3.6%, and decreased 13.3% from last year. Sales of discrete GPUs fluctuate due to a variety of factors (timing, memory pricing, etc.) and the influence of integrated graphics. Overall, the trend for discrete GPUs has increased with a CAGR from 2014 to 2017 now of -5.6% (from -10%).

- Ninety nine percent of Intel's non-server processors have graphics, and over 65% of AMD's non-server processors contain integrated graphics; AMD still ships integrated graphics chipsets (IGPs).

Graphics chips (GPUs) and chips with graphics (IGPs, APUs, and EPGs) are a leading indicator for the PC market. At least one and often two GPUs are present in every PC shipped. It can take the form of a discrete chip, a GPU integrated in the chipset or embedded in the CPU. The average has grown from 1.2 GPUs per PC in 2001 to almost 1.35 GPUs per PC.

It is critical to get a proper grip on this highly complex technology and understand its future direction.

This detailed 50-page report will provide you with all the data, analysis and insight you need to clearly understand where this technology is today and where it's headed.

This fact and data-based report does not pull any punches: frankly, you will be shocked by some of the analysis and insight.

Our findings include discrete and integrated graphics (CPU and chipset) for Desktops, Notebooks (and Netbooks), and PC-based commercial (i.e., POS) and industrial/scientific and embedded. This report does not include the x86 game consoles, handhelds (i.e., mobile phones), x86 Servers or ARM-based Tablets (i.e. iPad and Android-based Tablets),or ARM-based Servers. It does include x86-based tablets, Chromebooks, and embedded systems.

We have been providing quarterly reports on the PC graphics market shipments since 1988.

14 Comments on JPR Reports AMD Jumps 11% in GPU Shipments in Q2, Intel up 4%, NVIDIA Slips

Until AMD has a competitive cpu in both desktop and mobile (2016?), Intel is probably going to carry about 2/3 of the integrated market. It makes sense AMD is gaining a little, as Kaveri raised the bar for AMD's value (especially for cheap, low-rez laptops) while prices remained low; Intel stayed more-or-less stagnant. At some point broadwell will show up though, and that will probably swing things back.

While I'm certainly not privy to asp on laptop gpus, desktop looks about right as well. As prices fell back to msrp post crytocraze, the two were about on even keel for price performance (not counting 780ti). Now, as prices have fallen further on AMD's side, to the point their stack is posititioned similar to a tier down from nvidia, they are usually a slightly (to largely) better value depending on segment. Factoring in nvidia's stronger brand name, it shows more or less where AMD has to be to compete. Perhaps not at prices this low, but slightly cheaper or better value comparably (not counting overclocking). IOW, essentially exactly the drum Roy Taylor has been pounding (but I think I phrased slightly more realistically).

Market share is computed on units sold. You think that a handful of Titan-Z's and 295X's represent anything at all statistically in 100 million GPUs shipped ?

OK I am exaggerating here. They do have Tegra (seriously) and they will use it in tablets, laptops and latter even desktops to gain back market share. K1 is a strong indicator of this.

But the decline in x86 market, is the main reason discrete GPU's prices are going up the last years and Nvidia's CEO in an interview recently said that prices will climb more. 4K gaming will be a good excuse to see discrete GPUs prices going much higher than what they are today.

As for VIA selling its license - it has no leverage. The only possible workable solution would be a merger between Nvidia and VIA. Oddly enough, an AMD+Nvidia merger or acquisition would have leverage since while the x86 license could be nullified by a change in company ownership, Intel itself is on the hook for use of AMD64 IP instructions - the only problems would be that AMD's debt burden makes an acquisition a non starter, and Nvidia would face the same problem that AMD presently faces - competition with Intel in the x86 market on one side, and pressure from big bankroll ARM licensees on the other.

AMD would be grossly overvalued for what Nvidia would get from the deal. Excepting increased R&D funding - which is a debatable point if Nvidia used its $3+bn cash reserves to secure the acquisition of AMD - buying or merging with AMD nets them what? An unequal fight with Intel in the x86 market that AMD with all its supposed in-place knowledge base can't turn around? Graphics IP which on the balance of things isn't markedly different from what the company already has? Assets? - not really since AMD has been divesting itself of those for some time. Software??? verrrrry unlikely. Tying up 99.99% of the discrete graphics market in a combined company might also bring some unwanted scrutiny from the FTO. Both companies are already steering a course with ARM, and both having in-place architectural licenses and roadmaps it would be pretty hard to see how a merger/buyout offers any value.

I would agree, except the growth is coming from APU sales, and I am not sure if they are counting the ones in the peasant boxes.

If Nvidia bought VIA, and were granted the X86 license, they could make some more competition for two companies who are seeming to stagnate, and also help push along better process nodes which is good for all of us. I don't think a Nvidia/AMD thing would ever happen, just like there is no way an Intel/AMD or Intel/Nvidia thing will ever happen, trust laws prevent it.