Monday, September 28th 2015

GlobalFoundries 14 nm LPP FinFET Node Taped Out, Yields Good

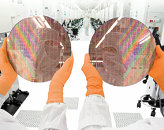

GlobalFoundries' move to leapfrog several silicon fab steps to get straight to 14 nanometer (nm) is on the verge of paying off, with the company taping out its 14 nm LPP (low-power plus) FinFET node, and claiming good yields on its test/QA chips. This takes the node one step closer to accepting orders for manufacturing of extremely complex chips, such as CPUs and GPUs.

AMD is expected to remain the company's biggest client, with plans to build its next-generation "Zen" processor on this node. The company's "Arctic Islands" graphics chips are also rumored to be built on the 14 nm node, although which foundry will handle its mass production remains unclear. A big chunk of AMD's R&D budget is allocated to getting the "Zen" architecture right, with key stages of its development being handled by Jim Keller, the brains behind some of AMD's most commercially successful CPU cores.

Source:

Expreview

AMD is expected to remain the company's biggest client, with plans to build its next-generation "Zen" processor on this node. The company's "Arctic Islands" graphics chips are also rumored to be built on the 14 nm node, although which foundry will handle its mass production remains unclear. A big chunk of AMD's R&D budget is allocated to getting the "Zen" architecture right, with key stages of its development being handled by Jim Keller, the brains behind some of AMD's most commercially successful CPU cores.

28 Comments on GlobalFoundries 14 nm LPP FinFET Node Taped Out, Yields Good

inb4 PC Gamer Master Race rage against me. My girlfriend wants a Wii U, not paying £230 for a console so she can play only Mario Kart.

This is very exciting news because AMD will be:

1) nipping at the heels of Intel again.

2) have a 2 nm advantage on NVIDIA's TSMC production.

3) AMD can compete in mobile/low power products again.

I just always find it funny how companies always find money for suit wearing briefcase carrying men with ties and shiny shoes but never have the money for engineers who make products which fuel the whole operation. Sure marketing is also a big part of it, but you can't sell hot water as the best thing after sliced bread. You need solid products that you can then use to brag about. If boards would value workers below them more, I'm certain companies would operate better product and financially wise.

Which means it's pretty damn high on the cool scale :)

1. This news originates from Globalfoundries. Their record on public pronouncements of their yields in the past haven't exactly tallied with what actually happened (see Llano, Bulldozer et al)., and

2. Zen, I believe, was generally supposed to be a GloFo 14nm product. 14nm LPE wasn't an option by the sounds of it, andindustry speculation was that 14nm LPP yields weren't great. I don't think 14nm LPE/LPP was ever a serious contender for GPUs (at least not the large die ones) since the process (as GloFo themselves are stating) is geared towards lower power applications.

I'd be glad if they did because things were looking like 2017 for Zen instead of 16.

All I stated was that both GloFo AND TSMC will both probably have a share of the business, and GloFo's press releases may not reflect actuality in regards process maturity- which might account for any rumours you may have seen regarding TSMC having all AMD's business (although I have seen no credible information to say this is so). To my mind, these can (and probably are) mutually exclusive, which is why deliberately itemized them.

GloFo's timetable and yield need have no impact on whether it gets AMD's business - the only variable is the timeframe for production of the parts.

Any other inference is yours.Can't say I've seen that - at least not from a creditable source. AFAIK, the rumour/report was that Samsung and GloFo had production ramp issues that had two knock-on effects - Zen's introduction has been put back to early 2017 (announced by AMD themselves), and Apple diverting a greater share of A9 production to TSMCfrom GloFo and Samsung because of their concerns, which led to TSMC securing the A10 contract.

amd TSMC - Αναζήτηση Google

I hope I don't ask for too much.

=)

1) What exactly is "good yields?" The human part of me wants to say reasonably high, but the PR side of me says that it's anything in the ballpark of what they were expecting. If that was 80%, and they actually only got 75%, it's not a "good yield" by the 25% loss but it's about the 80% they were expecting.

2) Closer to accepting orders isn't closer to getting an in control and volume producing run. These test runs are limited batch quantities, intelligent workers, and highly controlled environments. None of this reflects day to day operations, where sometimes people do stupid things.

3) Global Foundries is always late. Despite having a whole generation where there was no shrink they're just now getting this stuff in order. You'll excuse me, but volume production by late 2016 sounds like they're pushing it. Samples still need to be analyzed, manufacturing still needs to have time to adopt the process, and AMD is going to have to do some subsequent design work. This definitely sounds like PR/damage control, rather than a triumph.

This said, it'd be nice if Global Foundries got their stuff together. Hopefully this will give AMD an advantage in the GPU market, and bring them back to the table with CPUs. I'm not holding my breath for the latter, but the former may be how AMD can actually start digging themselves out of their current hole.

Third link PCGH - which actually analysed what was said by expreview ( which in turn came from some obscure Italian site - Bits and Chips) rather than what was conjured out of thin air:As I said - I haven't seen any evidence that AMD has moved Zen production from GloFo to TSMC, and don't believe it to be the case. You on the other hand may see it differently, but if you're trying to convince me, you'll need to do better than a 2-second Google search which brings up the usual clickbait suspects all getting their info from a single unsubstantiated rumour.

Sorry if you have a distaste for the English language used correctly. If it causes you so much angst maybe you can just skip more of the words in my posts (which you tend to do in any case), or just stop reading them altogether. Problem solved.14nm LPE and LPP are the same process. The E in LPE stands for "Early" and as such isn't as well optimized for power, voltage leakage etc. LPP is the mature (and later) version. As for FinFET process nodes, Google is your friend for general articles. This one looks like a decent introductory primer. For a more in depth analysis of foundry processes I would suggest SemiWiki that provides good non-partisan overviews of the industry.

You seem to be nurturing a persecution complex....all because of what? Because we both made public predictions that I said I would revisit? What is the point of making predictions if you don't want them found to be true or not?

Do yourself a favour - don't read my postings. I'd hate to be the cause of you keeling over from hypertension.

Don't do like you don't understand. First post "bear in mind", so I missed something, then "You made the statement that you thought", "rumours you may have seen" "Any other inference is yours.". Should I add here the results of your psychological examination about me, my distaste for the English language, the angst, and me nurturing a persecution complex. And you shouldn't have problem if I am not.... reading all the words when you conveniently bypass every part of my posts you prefer to ignore. I have no problem if you "gave an opinion on what you thought was the most creditable", but try leaving me out of your opinion.

Anyway, they are just rumors and a PR from a company about itself. Nothing can taken as truth or even close to truth. Thing like that we keep them in the back of our heads and just wait to see if confirmations will come out in the future. For now we can only speculate and that's all. It's too early to conclude, or even guess what speculations, could be closer to reality.

PS Going to make a lemonade now for my hypertension that you diagnosed over the internet.

Add in the cancelled processes, the late ramp and bad yields of those it has undertaken, and you can see why GloFo probably aren't too forthcoming with information.They probably share adjoining work stations in that cozy environment you can see in the background.