News Archive

Wednesday, April 23rd 2025

Today's Reviews

CPU Coolers

Graphics Cards

Headphones

Monitors

Motherboards

Notebooks

Processors

Colorful iGame B860M Ultra V20 Review

At $165, this is one of the cheapest LGA1851 motherboards and it includes a surprisingly decent specification with USB4, PCIe Gen 5, and Wi-Fi 7. The Ultra V20 handled a Core Ultra 9 285K just fine too. But has Colorful done enough to compete with better-known manufacturers overall?

Ghost of Yotei Gets October 2 PS5 Exclusive Release Date with $249.99 Collector's Edition

Ghost of Yōtei's release date has finally been confirmed as October 2 of this year. Sony Entertainment today announced the October 2 release date, which is slated to be exclusive to the PlayStation 5 console for the time being, alongside new special editions of the upcoming action-adventure game. All pre-orders for Ghost of Yōtei, which start on May 2 at 10:00 AM, will include seven PSN avatars—representing Atsu and the Yōtei Six—and an in-game mask cosmetic. The base game will cost $69.99, while the $79.99 Digital Deluxe Edition will include the full digital base game, four cosmetic unlocks, and an early unlock for the Travelers Map. The Collector's Edition bundle will include an array of physical collectibles—a replica of Atsu's mask from the game, a sash, tsuba, art cards, zeni hajiki coin game and pouch, and a papercraft ginko tree—along with the same in-game items as included in the Digital Deluxe Edition. All of that comes at a whopping $249.99.

Sucker Punch also released a new trailer for Ghost of Yōtei, which reveals the villainous Yōtei Six and their brutal slaughter of Atsu's people, which serve as the motivation for her revenge story. It's unclear when Ghost of Yōtei will expand to PC and other console gaming platforms, but speculation suggests that 2027 is the earliest we will see a cross-platform launch for the Ghost of Tsushima sequel. Previous reports also indicated that there will be a Ghost of Tsushima expanded universe, with possible TV and movie spin-offs on the cards.

Sucker Punch also released a new trailer for Ghost of Yōtei, which reveals the villainous Yōtei Six and their brutal slaughter of Atsu's people, which serve as the motivation for her revenge story. It's unclear when Ghost of Yōtei will expand to PC and other console gaming platforms, but speculation suggests that 2027 is the earliest we will see a cross-platform launch for the Ghost of Tsushima sequel. Previous reports also indicated that there will be a Ghost of Tsushima expanded universe, with possible TV and movie spin-offs on the cards.

Old Skies Out Now on PC, Linux & Nintendo Switch

As the subject title says, Old Skies has officially launched on Steam and GOG! Join ChronoZen agent Fia Quinn on a time-travel adventure spanning 200 years. Old Skies is a story of love, loss and legacy. Plus it's 10% off during the first week! Dive into the past with time agent Fia Quinn as she embarks on seven trips through time. History is up for grabs—from the speakeasies of Prohibition, to the vicious gangs of the Gilded Age, to the World Trade Center on September 10, 2001.

Your job is to keep close watch on seven travelers who have the desire (and the bank accounts) to sightsee in the past. Some are simply curious. Others have unfinished business to resolve. And they've all put down a lot of money for the trip, so it's vital that you keep them happy while ensuring they follow the rules. But what could go wrong? It's only time travel, after all.

Your job is to keep close watch on seven travelers who have the desire (and the bank accounts) to sightsee in the past. Some are simply curious. Others have unfinished business to resolve. And they've all put down a lot of money for the trip, so it's vital that you keep them happy while ensuring they follow the rules. But what could go wrong? It's only time travel, after all.

How Do HKMLC Smart Boards Help in Teaching?

Chalkboards are an old-school thing now. About 67% of global classrooms now have adopted interactive technology, such as smart boards, to keep up with the times (UNESCO 2023 report). But how exactly do smart boards improve teaching? Let's dive into it, using HKMLC smart boards as a real-world example—and answer some of the most common questions teachers ask.How HKMLC Smart Boards Solve Real Classroom Challenges

1. Boosting Student Engagement

Static whiteboards hardly keep students focused, especially those K-12 education learners. HKMLC interactive whiteboards change the game with dynamic and interactive lessons. Teachers can easily explain abstract concepts with videos, images, and 3D models. With the Essential 55 smart board, educators can launch quizzes and include Kahoot! Learning games to increase participation. Multiple students can draw on the screen as if using a tablet—all thanks to its 20-point multitouch display and ultra-precise 2 mm positioning.

For more information and to purchase, visit this page.

1. Boosting Student Engagement

Static whiteboards hardly keep students focused, especially those K-12 education learners. HKMLC interactive whiteboards change the game with dynamic and interactive lessons. Teachers can easily explain abstract concepts with videos, images, and 3D models. With the Essential 55 smart board, educators can launch quizzes and include Kahoot! Learning games to increase participation. Multiple students can draw on the screen as if using a tablet—all thanks to its 20-point multitouch display and ultra-precise 2 mm positioning.

For more information and to purchase, visit this page.

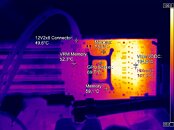

PC Enthusiasts Discover Samsung GDDR6 Modules in Radeon RX 9070 XT Cards

Just before the official launch of Radeon RX 9070 XT graphics cards, members of the Chiphell forum expressed concerns about unnamed evaluation samples exhibiting worrying memory module temperatures. Days later, Western review outlets published similar findings across several board partner specimens. Typically, pre-launch and retail units have utilized SK hynix GDDR6 VRAM modules—TechPowerUp's W1zzard uncovered numerous examples of the manufacturer's "H56G42AS8DX-014" model during teardown sessions. Curiously, Chinese PC hardware enthusiasts have happened upon Radeon RX 9070 XT cards that utilize Samsung GDDR6 memory modules. It is not clear whether Yeston has outfitted its flagship Sakura Atlantis OC SKU with Samsung components from the very beginning, but one owner documented a GPU-Z diagnostics session—late last month—showing "GDDR6 (Samsung)" onboard. Earlier this month, insiders posited that NVIDIA was in the process of changing its main GDDR7 memory vendor—from Samsung to SK hynix—for the GeForce RTX 50-series.

According to a recent Guru3D news piece, additional cases were reported. Online conjecture points to "higher end" custom models being updated with "cooler" modules. Hilbert Hagedoorn—Guru3D's head honcho—has gathered compelling information via community feedback channels: "the transition to Samsung memory has yielded noticeable thermal advantages. Early reviews and comparisons indicate that the new memory modules help lower temperatures significantly. Custom RX 9070 XT models running demanding benchmarks like Furmark have demonstrated memory temperatures of 75°C or lower without necessitating an increase in voltage or a reduction in clock speeds. Notable manufacturers, including Sapphire, XFX, and GIGABYTE, have already integrated Samsung's GDDR6 into their custom variants. However, as of now, AMD has not authorized its partners to explicitly differentiate between models with SK hynix and Samsung memory, likely to avoid confusion among consumers and maintain a consistent product lineup." Additionally, TechPowerUp forum members have found Samsung GDDR6 memory on Radeon RX 9070 XT and RX 9070 custom models. Thanks for the tip, Fluffmeister.

According to a recent Guru3D news piece, additional cases were reported. Online conjecture points to "higher end" custom models being updated with "cooler" modules. Hilbert Hagedoorn—Guru3D's head honcho—has gathered compelling information via community feedback channels: "the transition to Samsung memory has yielded noticeable thermal advantages. Early reviews and comparisons indicate that the new memory modules help lower temperatures significantly. Custom RX 9070 XT models running demanding benchmarks like Furmark have demonstrated memory temperatures of 75°C or lower without necessitating an increase in voltage or a reduction in clock speeds. Notable manufacturers, including Sapphire, XFX, and GIGABYTE, have already integrated Samsung's GDDR6 into their custom variants. However, as of now, AMD has not authorized its partners to explicitly differentiate between models with SK hynix and Samsung memory, likely to avoid confusion among consumers and maintain a consistent product lineup." Additionally, TechPowerUp forum members have found Samsung GDDR6 memory on Radeon RX 9070 XT and RX 9070 custom models. Thanks for the tip, Fluffmeister.

TSMC Unveils Next-Generation A14 Process at North America Technology Symposium

TSMC today unveiled its next cutting-edge logic process technology, A14, at the Company's North America Technology Symposium. Representing a significant advancement from TSMC's industry-leading N2 process, A14 is designed to drive AI transformation forward by delivering faster computing and greater power efficiency. It is also expected to enhance smartphones by improving their on-board AI capabilities, making them even smarter. Planned to enter production in 2028, the current A14 development is progressing smoothly with yield performance ahead of schedule.

Compared with the N2 process, which is about to enter volume production later this year, A14 will offer up to 15% speed improvement at the same power, or up to 30% power reduction at the same speed, along with more than 20% increase in logic density. Leveraging the Company's experience in design-technology co-optimization for nanosheet transistor, TSMC is also evolving its TSMC NanoFlex standard cell architecture to NanoFlex Pro, enabling greater performance, power efficiency and design flexibility.

Compared with the N2 process, which is about to enter volume production later this year, A14 will offer up to 15% speed improvement at the same power, or up to 30% power reduction at the same speed, along with more than 20% increase in logic density. Leveraging the Company's experience in design-technology co-optimization for nanosheet transistor, TSMC is also evolving its TSMC NanoFlex standard cell architecture to NanoFlex Pro, enabling greater performance, power efficiency and design flexibility.

Bandai Namco Announces August 28 Launch Date of SUPER ROBOT WARS Y

Players will get to fight epic battles in SUPER ROBOT WARS Y, slated to release on 28 of August 2025. Part of the SUPER ROBOT WARS series, the title will bring this grid-based tactical JRPG to PC via Steam. Also, digital pre-orders are now opened for PC via Steam. In SUPER ROBOT WARS Y, players will compete in turn-based tactical combat on grid-based maps while controlling a team of pilots with various abilities. They will get to enjoy fan-favorite units from past games, as well brand-new ones to the franchise, including some appearing on console for the very first time.

Conquer fate and embark on a journey into the new saga in SUPER ROBOT WARS Y. Published by Bandai Namco Entertainment America Inc. and developed by Bandai Namco Forge Digitals Inc. SUPER ROBOT WARS Y is a grid-based tactical combat RPG that brings mechs and pilots from beloved series like Mobile Suit Gundam the Witch from Mercury Season 1, Code Geass Lelouch of the Re;surrection, Mobile Suit Gundam Wing: Endless Waltz, SSSS.DYNAZENON, Getter Robo Arc, Macross Delta: Passionate Walküre and more to battle mutual foes. The game will be available on consoles and PC beginning August 28.

Conquer fate and embark on a journey into the new saga in SUPER ROBOT WARS Y. Published by Bandai Namco Entertainment America Inc. and developed by Bandai Namco Forge Digitals Inc. SUPER ROBOT WARS Y is a grid-based tactical combat RPG that brings mechs and pilots from beloved series like Mobile Suit Gundam the Witch from Mercury Season 1, Code Geass Lelouch of the Re;surrection, Mobile Suit Gundam Wing: Endless Waltz, SSSS.DYNAZENON, Getter Robo Arc, Macross Delta: Passionate Walküre and more to battle mutual foes. The game will be available on consoles and PC beginning August 28.

Upgrading to Windows 11 Pro is Only $15 Right Now

In October of 2025, Microsoft will phase out support for Windows 10. For many users, it's free to upgrade, but the baseline version of Windows 11 is limited in what it can do. If you want a more advanced OS with improved security, a refined user interface, and even improvements for gaming, try Windows 11 Pro. Windows 11 Pro extends beyond the standard Windows 11 feature set, giving you advanced capabilities tailored to professional workloads. BitLocker device encryption, Hyper-V virtualization, and Windows Sandbox now come pre-loaded for secure data management and isolated testing environments.

Snap layouts and virtual desktops streamline multitasking. TPM 2.0 and Smart App Control bolster security with hardware and software-level protection. DirectX 12 Ultimate also improves GPU performance for graphics-intensive tasks like art or even gaming.

It would normally cost $199 to upgrade to Windows 11 Pro, but during this limited-time sale, it's only $14.97. No coupon needed.

Snap layouts and virtual desktops streamline multitasking. TPM 2.0 and Smart App Control bolster security with hardware and software-level protection. DirectX 12 Ultimate also improves GPU performance for graphics-intensive tasks like art or even gaming.

It would normally cost $199 to upgrade to Windows 11 Pro, but during this limited-time sale, it's only $14.97. No coupon needed.

Avicena Works with TSMC to Enable PD Arrays for LightBundle MicroLED-Based Interconnects

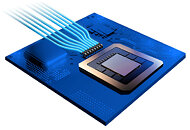

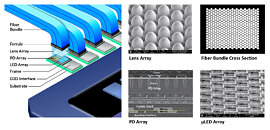

Avicena, headquartered in Sunnyvale, CA, announced today that the company will work with TSMC to optimize photodetector (PD) arrays for Avicena's revolutionary LightBundle microLED-based interconnects. LightBundle supports > 1Tbps/mm shoreline density and extends ultra-high density die-to-die (D2D) connections to > 10 meters at class-leading sub-pJ/bit energy efficiency. This will enable AI scale-up networks to support large clusters of GPUs across multiple racks, eliminating reach limitations of current copper interconnects while drastically reducing power consumption.

Increasingly sophisticated AI models are driving an unprecedented surge in demand for compute and memory performance, requiring interconnects with higher density, lower power, and longer reach for both processor-to-processor (P2P) and processor-to-memory (P2M) connectivity.

Increasingly sophisticated AI models are driving an unprecedented surge in demand for compute and memory performance, requiring interconnects with higher density, lower power, and longer reach for both processor-to-processor (P2P) and processor-to-memory (P2M) connectivity.

Nintendo Switch 2's Chipset Reportedly Confirmed as Tegra "T239" Unit

An alleged partial close-up capture of the Nintendo Switch 2's chipset has leaked out; courtesy of Kurnal (@Kurnalsalts). This fresh leak is being hyped up as putting an end to all online debate regarding the upcoming hybrid console's technological underpinnings. Despite late 2024/early 2025 reports pointing to a custom NVIDIA "T239" SoC design, certain voices continued to produce conjecture about a more "cutting edge" solution. Surprisingly, Team Green's PR department did issue a statement about the Switch 2 being powered by: "a custom processor featuring an NVIDIA GPU with dedicated RT Cores and Tensor Cores for stunning visuals and AI-driven enhancements."

As expected, Nintendo staffers remained guarded during recent press junkets—in-depth tech talk was deferred in NVIDIA's general direction. Kurnal's sharing of a speculative "T239" partial die shot does not provide any major new revelations or insights—as discussed on the Nintendo Switch 2 Subreddit, tech enthusiasts continue to rely on specification details from the big hack of NVIDIA repositories (three years ago). Newer speculation has focused on Nintendo's choice of foundry—Digital Foundry's Richard Leadbetter continues to express his personal belief that Nintendo has selected a Samsung 8 nm DUV foundry node. In opposition, certain critics have persisted with a 5 nm EUV node process theory.

As expected, Nintendo staffers remained guarded during recent press junkets—in-depth tech talk was deferred in NVIDIA's general direction. Kurnal's sharing of a speculative "T239" partial die shot does not provide any major new revelations or insights—as discussed on the Nintendo Switch 2 Subreddit, tech enthusiasts continue to rely on specification details from the big hack of NVIDIA repositories (three years ago). Newer speculation has focused on Nintendo's choice of foundry—Digital Foundry's Richard Leadbetter continues to express his personal belief that Nintendo has selected a Samsung 8 nm DUV foundry node. In opposition, certain critics have persisted with a 5 nm EUV node process theory.

LG Brings Xbox Cloud Gaming (Beta) Experience Directly to LG Smart TV Screens

LG Electronics (LG) has announced the arrival of the highly anticipated Xbox app on LG Smart TVs this week, allowing users to stream Xbox games on the big screen at home. LG Smart TV owners in over 25 countries are now able to play the latest indie hit to the biggest AAA titles directly through the Xbox app on their LG Smart TVs.

Conveniently accessible from the Gaming Portal and the LG Apps, the Xbox app enables LG TV owners to jump straight into gameplay from day one with Xbox Game Pass Ultimate, launching hundreds of titles from Activision, Bethesda, Blizzard, Mojang, Xbox Game Studios and more - with just a compatible controller. The Xbox app is available on LG TVs and select smart monitors running the latest webOS 24 and newer versions, and it will soon be available on StanbyME screens.

Conveniently accessible from the Gaming Portal and the LG Apps, the Xbox app enables LG TV owners to jump straight into gameplay from day one with Xbox Game Pass Ultimate, launching hundreds of titles from Activision, Bethesda, Blizzard, Mojang, Xbox Game Studios and more - with just a compatible controller. The Xbox app is available on LG TVs and select smart monitors running the latest webOS 24 and newer versions, and it will soon be available on StanbyME screens.

NVIDIA's Project G-Assist Plug-In Builder Explained: Anyone Can Customize AI on GeForce RTX AI PCs

AI is rapidly reshaping what's possible on a PC—whether for real-time image generation or voice-controlled workflows. As AI capabilities grow, so does their complexity. Tapping into the power of AI can entail navigating a maze of system settings, software and hardware configurations. Enabling users to explore how on-device AI can simplify and enhance the PC experience, Project G-Assist—an AI assistant that helps tune, control and optimize GeForce RTX systems—is now available as an experimental feature in the NVIDIA app. Developers can try out AI-powered voice and text commands for tasks like monitoring performance, adjusting settings and interacting with supporting peripherals. Users can even summon other AIs powered by GeForce RTX AI PCs.

And it doesn't stop there. For those looking to expand Project G-Assist capabilities in creative ways, the AI supports custom plug-ins. With the new ChatGPT-based G-Assist Plug-In Builder, developers and enthusiasts can create and customize G-Assist's functionality, adding new commands, connecting external tools and building AI workflows tailored to specific needs. With the plug-in builder, users can generate properly formatted code with AI, then integrate the code into G-Assist—enabling quick, AI-assisted functionality that responds to text and voice commands.

And it doesn't stop there. For those looking to expand Project G-Assist capabilities in creative ways, the AI supports custom plug-ins. With the new ChatGPT-based G-Assist Plug-In Builder, developers and enthusiasts can create and customize G-Assist's functionality, adding new commands, connecting external tools and building AI workflows tailored to specific needs. With the plug-in builder, users can generate properly formatted code with AI, then integrate the code into G-Assist—enabling quick, AI-assisted functionality that responds to text and voice commands.

COLORFUL Expands GeForce RTX 5060 Ti Graphics Card Range with MEOW Editions

Last week, COLORFUL introduced an impressive selection of GeForce RTX 5060 Ti and RTX 5060 models—across Advanced, iGame, Ultra W and NB product lines. Barring their "youthful" graffiti-decorated iGame options, the Chinese manufacturer's brand-new lineup largely consisted of very sober looking affairs. Earlier in the week, VideoCardz noticed that COLORFUL had updated its native website with two new entries; under the company's COLORFIRE sub-brand. Previous generation MEOW Series graphics cards debuted almost two years ago; starting with custom GeForce RTX 4060 Ti 8 GB and RTX 4060 8 GB models.

Beyond making brightly-colored graphics card designs, COLORFIRE's MEOW product line consists of equally "loud" motherboards, cases, laptops and peripherals. COLORFIRE's new generation MEOW desktop graphics cards—available in GeForce RTX 5060 Ti 16 GB or 8 GB configurations—have appeared with a new triple-fan shroud and backplate design. The 2.5-slot thick enclosure seems to house reference spec-conforming hardware. VideoCardz expects these fairly basic white/orange offerings to launch "at or near" baseline MSRP. It is refreshing to see the emergence of another feline pet/mascot-themed product; as opposed to the recent dearth of cute "idol" or "waifu"-decorated options. Nearby rival manufacturers—including ASUS, Yeston, and ZOTAC—have resorted to utilizing such clichéd marketing tactics.

Beyond making brightly-colored graphics card designs, COLORFIRE's MEOW product line consists of equally "loud" motherboards, cases, laptops and peripherals. COLORFIRE's new generation MEOW desktop graphics cards—available in GeForce RTX 5060 Ti 16 GB or 8 GB configurations—have appeared with a new triple-fan shroud and backplate design. The 2.5-slot thick enclosure seems to house reference spec-conforming hardware. VideoCardz expects these fairly basic white/orange offerings to launch "at or near" baseline MSRP. It is refreshing to see the emergence of another feline pet/mascot-themed product; as opposed to the recent dearth of cute "idol" or "waifu"-decorated options. Nearby rival manufacturers—including ASUS, Yeston, and ZOTAC—have resorted to utilizing such clichéd marketing tactics.

Sony PlayStation 5 Pro Lead Designers Perform Official Teardown of Flagship Console

PlayStation 5 Pro console—the most innovative PlayStation console to date—elevates gaming experiences to the next level with features like upgraded GPU, advanced ray tracing, and PlayStation Spectral Super Resolution (PSSR) - an AI-driven upscaling that delivers super sharp image clarity with high framerate gameplay. Today we're providing a closer look at the console's internal architecture, as Sony Interactive Entertainment engineers Shinya Tsuchida, PS5 Pro Mechanical Design Lead and Shinya Hiromitsu, PS5 Pro Electrical Design Lead, provide a deep-dive into the console's innovative technology and design philosophy.

Note: in this article, we refer to the PlayStation 5 model released in 2020 as the "original PS5," the PS5 released in 2023 as the "current PS5," and the PS5 Pro released in 2024 as the "PS5 Pro." Do not try this at home. Risk of fires, and exposure to electric shock or other injuries. Disassembling your console will invalidate your manufacturer's guarantee.

Note: in this article, we refer to the PlayStation 5 model released in 2020 as the "original PS5," the PS5 released in 2023 as the "current PS5," and the PS5 Pro released in 2024 as the "PS5 Pro." Do not try this at home. Risk of fires, and exposure to electric shock or other injuries. Disassembling your console will invalidate your manufacturer's guarantee.

ASUS Debuts TX Gaming GeForce RTX 5070 12 GB Card Design in China

ASUS China showcased a compelling new custom graphics card design during their presentation of a Hatsune Miku-themed product collection. Global audiences were treated to TUF Gaming x Hatsune Miku crossover peripherals/accessories, but Chinese gamers will get access to a wider gamut of options—under the TX Gaming banner; a regional spin-off of TUF Gaming—including a cutely decorated GeForce RTX 5060 Ti 8 GB model. ASUS seems to be reusing this card's basic shroud/backplate design—minus elaborate character illustrations and graphics—on a brand-new TX Gaming GeForce RTX 5070 12 GB SKU. A "Born to be Different" message adorns a largely plain white front section, and familiar "GeForce RTX" texts are placed on a side panel and on the 2.5-slot thick card's metallic silver backplate. A large X-formation cut-out grants a glimpse at an enclosed fin stack.

In the past, ASUS TX Gaming products have been accompanied by sci-fi "idol" characters—on related retail box art and in promotional material. Evidently, ASUS has extended this "marketing technique" into the NVIDIA "Blackwell" GPU generation. As expected, the TX Gaming GeForce RTX 5070 models—in standard and factory overclocked forms—will launch as Chinese market exclusives. VideoCardz did not find any global listings of these offerings, nor launch details—e.g. a release date and MSRPs. They noted that a TUF Gaming equivalent model features five display connectors; as opposed to the TX Gaming's deployment of four (1x HDMI 2.1b, 3x DisplayPort 2.1b).

In the past, ASUS TX Gaming products have been accompanied by sci-fi "idol" characters—on related retail box art and in promotional material. Evidently, ASUS has extended this "marketing technique" into the NVIDIA "Blackwell" GPU generation. As expected, the TX Gaming GeForce RTX 5070 models—in standard and factory overclocked forms—will launch as Chinese market exclusives. VideoCardz did not find any global listings of these offerings, nor launch details—e.g. a release date and MSRPs. They noted that a TUF Gaming equivalent model features five display connectors; as opposed to the TX Gaming's deployment of four (1x HDMI 2.1b, 3x DisplayPort 2.1b).

Bethesda Celebrates Surprise Launch of The Elder Scrolls IV: Oblivion Remastered

It's been thrilling for all of us here at Bethesda to revisit a game so close to our hearts with Oblivion Remastered. When we started this project in 2021, we aimed to breathe new life into a chapter of The Elder Scrolls that set the path for so many of our games after it. We never wanted to remake it—but remaster it—where the original game was there as you remember playing it, but seen through today's technology.

We were so fortunate to work with an unbelievable team and partners at Virtuos. Even though we had worked together before, we had never attempted something on this scale. Every piece of art, animation, special effects, and part of the world would be remastered. Some new voices would be recorded, while keeping the originals there as well. Game systems were updated to feel better in your hands. Leveling systems modified for smoother progression and balance. We looked at every part and carefully upgraded it. But most of all, we never wanted to change the core. It's still a game from a previous era and should feel like one.

We were so fortunate to work with an unbelievable team and partners at Virtuos. Even though we had worked together before, we had never attempted something on this scale. Every piece of art, animation, special effects, and part of the world would be remastered. Some new voices would be recorded, while keeping the originals there as well. Game systems were updated to feel better in your hands. Leveling systems modified for smoother progression and balance. We looked at every part and carefully upgraded it. But most of all, we never wanted to change the core. It's still a game from a previous era and should feel like one.

NVIDIA Reportedly Warns Chinese AICs About Potential GeForce RTX 5090D GPU Supply Cut-off

Mid-way through April, we heard about sanctions affecting shipments of NVIDIA's H20 AI chips into China. Despite (rumored) best efforts made by Jensen Huang and colleagues, the US government has banned the export of Team Green's formerly sanction-conformant design. Similarly, NVIDIA prepared a slightly less potent GPU for gaming applications—exclusively for the Chinese market. Despite sporting a restricted GB202 "Blackwell" GPU die, the GeForce RTX 5090D 32 GB is still a monstrous prospect. According to Chinese PC hardware news sources, Team Green representatives have sent alerts to "all" of its Chinese add-in-card partners (AICs)—early warning signs have indicated a possible cut-off of GB202 GPUs in the near future. A member of the Chiphell forum disclosed some insider knowledge and dismissed unfounded speculation about RTX 5090D cards being replaced by "full fat" RTX 5090 options.

sthuasheng commented on Team Green's alleged bulletin—distributed at some point last week: "the notice only said that the supply of RTX 5090D was suspended, ...this did not mean any sales or transportation ban; it urged everyone not to make any speculations or judgments unless there was an official notice issued at a later date. After this notice was issued, each AIC began to notify agents to suspend sales, because the inventory of 5090D has always been very small, so it is necessary to keep these stocks to observe the subsequent situation and deal with the subsequent after-sales. At the same time, we might as well speculate that each AIC and dealer may also have the intention to stockpile 5090D units and then sell them at an elevated price." BenchLife.info decided to reach out to industry moles, following an absorption of various Chiphell whispers.

sthuasheng commented on Team Green's alleged bulletin—distributed at some point last week: "the notice only said that the supply of RTX 5090D was suspended, ...this did not mean any sales or transportation ban; it urged everyone not to make any speculations or judgments unless there was an official notice issued at a later date. After this notice was issued, each AIC began to notify agents to suspend sales, because the inventory of 5090D has always been very small, so it is necessary to keep these stocks to observe the subsequent situation and deal with the subsequent after-sales. At the same time, we might as well speculate that each AIC and dealer may also have the intention to stockpile 5090D units and then sell them at an elevated price." BenchLife.info decided to reach out to industry moles, following an absorption of various Chiphell whispers.

AMD Announces Press Conference & Livestream at Computex 2025

AMD today announced that it will be hosting a press conference during Computex 2025. The in-person and livestreamed press conference will take place on Wednesday, May 21, 2025, at 11 a.m. UTC+8, Taipei, at the Grand Hyatt, Taipei. The event will showcase the advancements AMD has driven with AI in gaming, PCs and professional workloads.

AMD senior vice president and general manager of the Computing and Graphics Group Jack Huynh, along with industry partners, will discuss how AMD is expanding its leadership across gaming, workstations, and AI PCs, and highlight the breadth of the company's high-performance computing and AI product portfolio. The livestream will start at 8 p.m. PT/11 p.m. ET on Tuesday, May 20 on AMD.com, with replay available after the conclusion of the livestream event.

AMD senior vice president and general manager of the Computing and Graphics Group Jack Huynh, along with industry partners, will discuss how AMD is expanding its leadership across gaming, workstations, and AI PCs, and highlight the breadth of the company's high-performance computing and AI product portfolio. The livestream will start at 8 p.m. PT/11 p.m. ET on Tuesday, May 20 on AMD.com, with replay available after the conclusion of the livestream event.

Sapphire Launches NITRO+ Radeon RX 9070 Model, a Month+ After Flagship XT Variant

Sapphire introduced two brand-new NITRO+ models prior to the official launch of AMD's RDNA 4 graphics card generation. The manufacturer rolled out its flagship Radeon RX 9070 XT card on day one—March 6—but the "lesser" NITRO+ sibling was absent at retail. Late last week, ITHome revealed that Sapphire had finally got round to globally releasing their NITRO+ Radeon RX 9070 16 GB SKU. At the time of writing, Overclockers UK seems to have cards in stock—priced at £629.99 (including VAT). Unsurprisingly, the freshly launched NITRO+ Radeon RX 9070 model utilizes the exact same shroud and backplate design that is present on Sapphire's range-topper.

The latest entry retains all of the more expensive unit's mod cons—including a Quick Connect MagniPlate feature, STEALTH hidden power cable, 12V-2x6 (H++) external power connector, Tri-X cooling technology, optimized composite heatpipes, and Honeywell PTM7950 TIM. Major differences are disclosed in Sapphire's "engine clock" specs: "boost clock up to 2700 MHz" and "game clock up to 2210 MHz." The Hong Kong-based company has not officially commented on circumstances that led to the delay of its NITRO+ Radeon RX 9070 graphics card. VideoCardz has dismissed claims about this particular model being postponed due to rumors of a displacement by forthcoming Radeon RX 9070 GRE 12 GB options.

The latest entry retains all of the more expensive unit's mod cons—including a Quick Connect MagniPlate feature, STEALTH hidden power cable, 12V-2x6 (H++) external power connector, Tri-X cooling technology, optimized composite heatpipes, and Honeywell PTM7950 TIM. Major differences are disclosed in Sapphire's "engine clock" specs: "boost clock up to 2700 MHz" and "game clock up to 2210 MHz." The Hong Kong-based company has not officially commented on circumstances that led to the delay of its NITRO+ Radeon RX 9070 graphics card. VideoCardz has dismissed claims about this particular model being postponed due to rumors of a displacement by forthcoming Radeon RX 9070 GRE 12 GB options.

Athena Worlds Announces Xenomorph, a Spiritual Sequel to Alien Vs Predator

Athena Worlds, a video games studio founded by video games veterans of titles such as Alien Vs Predator, Forza Horizon, Goldeneye N64, The Sims, Microsoft Flight Simulator and a slew of chart-topping games are proud to announce "Xenomorph."

Alien Vs Predator for Atari, defined Jane Whittaker's career. It also defined a genre, often regarded as the first true survival game, with over 100 awards and recently honored with number 3 in the top 10 scariest games of all-time awards. It spawned an enduring franchise. AvP for the Atari Jaguar was programmed by Mike Beaton (3D engine / gameplay designer) and Jane (AI and gameplay programmer/designer) and produced by James Purple Hampton. It is no exaggeration to say this cult classic changed the face of gaming.

Alien Vs Predator for Atari, defined Jane Whittaker's career. It also defined a genre, often regarded as the first true survival game, with over 100 awards and recently honored with number 3 in the top 10 scariest games of all-time awards. It spawned an enduring franchise. AvP for the Atari Jaguar was programmed by Mike Beaton (3D engine / gameplay designer) and Jane (AI and gameplay programmer/designer) and produced by James Purple Hampton. It is no exaggeration to say this cult classic changed the face of gaming.

Marvell Announces Successful Interoperability of Structera CXL Portfolio with AMD EPYC CPU and 5th Gen Intel Xeon Scalable Platforms

Marvell Technology, Inc., a leader in data infrastructure semiconductor solutions, today announced the successful interoperability of the Marvell Structera portfolio of Compute Express Link (CXL) with AMD EPYC CPUs and 5th Gen Intel Xeon platforms. This achievement underscores the commitment of Marvell to advancing an open and interoperable CXL ecosystem, addressing the growing demands for memory bandwidth and capacity in next-generation cloud data centers.

Marvell collaborated with AMD and Intel to extensively test Structera CXL products with AMD EPYC and 5th Gen Intel Xeon Scalable platforms across various configurations, workloads, and operating conditions. The results demonstrated seamless interoperability, delivering stability, scalability, and high-performance memory expansion that cloud data center providers need for mass deployment.

Marvell collaborated with AMD and Intel to extensively test Structera CXL products with AMD EPYC and 5th Gen Intel Xeon Scalable platforms across various configurations, workloads, and operating conditions. The results demonstrated seamless interoperability, delivering stability, scalability, and high-performance memory expansion that cloud data center providers need for mass deployment.

Drop Introduces The Lord of Rings The Argonath Desk Mat

BEHOLD THE ARGONATH, THE PILLARS OF THE KINGS! Standing guard over the northern borders of Gondor, the Argonath is a pair of statues without compare—even in a place like Middle- earth. Now, it's found a place on your desk. Follow the Fellowship South through storied statues. Depicted in stunning impressionist style by the talented artists at Dwarf Factory, the scene on this mat is pulled straight from The Fellowship of the Ring, following our nine heroes as they go south along the river Anduin.

GLIDE ACROSS A WATER-REPELLANT SURFACE WITH SPACE TO SPARE

Towering statues aren't the only breathtaking structures here. Nearly as impressive is our mat itself, measuring 36 inches wide, 16 inches tall, and 4 millimeters thick. It's also water-repellant-perfect for any accidental rivers across your desk. Work and play on mythical materials: made from high-density, low-friction Mercerized fabric and eco-friendly anti-slip rubber, this mat stays put and feels exceptional. It may just last as long as the Argonath itself.

GLIDE ACROSS A WATER-REPELLANT SURFACE WITH SPACE TO SPARE

Towering statues aren't the only breathtaking structures here. Nearly as impressive is our mat itself, measuring 36 inches wide, 16 inches tall, and 4 millimeters thick. It's also water-repellant-perfect for any accidental rivers across your desk. Work and play on mythical materials: made from high-density, low-friction Mercerized fabric and eco-friendly anti-slip rubber, this mat stays put and feels exceptional. It may just last as long as the Argonath itself.

Lenovo Introduces New ThinkPad Mobile Workstations and Business Laptops Designed for the AI-Ready Workforce

Lenovo today unveiled a refreshed portfolio of ThinkPad devices engineered to meet the evolving needs of modern professionals—from content creators and engineers to knowledge workers and hybrid teams. The lineup includes powerful Copilot+ PCs, such as the ThinkPad P14s Gen 6 AMD and ThinkPad P16s Gen 4 AMD mobile workstations, alongside new ThinkPad L Series business laptops and expands its ThinkPad X1 Aura Editions, delivering the performance, manageability, and intelligence today's AI-powered workflows demand.

Together, these latest ThinkPad systems reflect Lenovo's commitment to delivering smarter, more adaptive solutions that support advanced workloads, sustainability goals, and flexible work models—whether users are building complex simulations or collaborating across teams.

Together, these latest ThinkPad systems reflect Lenovo's commitment to delivering smarter, more adaptive solutions that support advanced workloads, sustainability goals, and flexible work models—whether users are building complex simulations or collaborating across teams.

TechPowerUp Releases NVCleanstall v1.19.0

TechPowerUp today released the latest version of NVCleanstall, our lightweight utility that lets you download and install NVIDIA GeForce drivers with a much higher level of customization than NVIDIA's installer permits. This utility lets you disable (or enable) several components in the GeForce driver package that you can't find in the NVIDIA installer's "Custom install" page, including important settings such as telemetry. Version 1.19.0 comes with a few important fixes. To begin with, a bug that causes installation to not start correctly with GeForce 576.02 drivers has been fixed. A checkbox has been added on the first screen to bypass the Cloudflare CDN. This option comes in handy in countries with Cloudflare censorship, such as Russia and Spain.

Next up, we've tweaked the internal process that compresses files into the driver package so it uses a maximum of 8 CPU threads, down from 20, which should correct certain "out of memory" errors. The description of NV Platform Controllers component has been updated to make it clear that it is applicable only to laptop platforms. On laptops, the "recommended" preset selects NV Platform Controllers. Grab NVCleanstall from the link below.

DOWNLOAD: TechPowerUp NVCleanstall 1.19.0

Next up, we've tweaked the internal process that compresses files into the driver package so it uses a maximum of 8 CPU threads, down from 20, which should correct certain "out of memory" errors. The description of NV Platform Controllers component has been updated to make it clear that it is applicable only to laptop platforms. On laptops, the "recommended" preset selects NV Platform Controllers. Grab NVCleanstall from the link below.

DOWNLOAD: TechPowerUp NVCleanstall 1.19.0

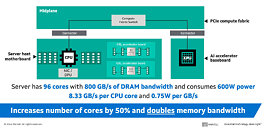

Rebuilding Intel: Q1 Results to Reveal Tan's Blueprint for Reversing Decline

Intel is at a crossroads as the company prepares to report earnings on April 24, 2025. Investors are hoping that Lip-Bu Tan, Intel's new CEO, can turn the company's fortunes around and stem its revenue losses. Currently, Intel is projected to report its fourth straight quarter of revenue decline with a 3.4% revenue loss, according to Reuters, and expects a significant widening of its losses to approximately $945 million compared with a loss of $381 million a year ago. Intel continues to lose market share to AMD in both personal computing and data center markets, while NVIDIA dominates the highly lucrative AI chip market. In addition, Intel's PC division is likely to report an 11% revenue decrease to $6.73 billion, and its data center business is probably facing its twelfth consecutive quarter of declines. "The most important thing for Intel now is Lip-Bu Tan's playbook... How he can give investors confidence that he is the person who can turn Intel around and whether a turnaround is possible in the first place," said Hendi Susanto, portfolio manager at Gabelli Funds, which holds Intel shares.

Tan has been implementing sweeping changes as part of his turnaround plan, cutting more than 20% of the employees at Intel and a change in the leadership model to provide quicker decisions. The company is seeing significant geopolitical threats as U.S.-China trade tensions are rolling back. China is threatening to impose retaliatory tariffs of up to 85% on all chips produced in the U.S. and along these lines has also imposed a requirement for licenses to sell some high-end AI products to the Chinese customers. Likely, as part of this, the company is presumed to be moving the production of its 3 nm chips from Arizona to Ireland in late 2025. Under all of these factors, Intel could eventually receive a temporary boost if PC shipments are pulled forward ahead of these tariffs that may ultimately positively impact a significant portion of Intel's sales (nearly one-third of total revenues).

Tan has been implementing sweeping changes as part of his turnaround plan, cutting more than 20% of the employees at Intel and a change in the leadership model to provide quicker decisions. The company is seeing significant geopolitical threats as U.S.-China trade tensions are rolling back. China is threatening to impose retaliatory tariffs of up to 85% on all chips produced in the U.S. and along these lines has also imposed a requirement for licenses to sell some high-end AI products to the Chinese customers. Likely, as part of this, the company is presumed to be moving the production of its 3 nm chips from Arizona to Ireland in late 2025. Under all of these factors, Intel could eventually receive a temporary boost if PC shipments are pulled forward ahead of these tariffs that may ultimately positively impact a significant portion of Intel's sales (nearly one-third of total revenues).

Silicon Power Launches "Inspire" microSDXC Card for Action Cameras and Content Creation

Silicon Power (SP) is proud to announce the launch of the Inspire microSDXC card, a powerful new memory solution tailored for content creation, 4K video production, and handheld gaming. With blazing fast read speeds up to 170 MB/s and write speeds up to 160 MB/s, the Inspire card offers the speed, reliability, and versatility that today's creators and gamers demand.

Built for Speed, Ready for Action

Designed with UHS-I U3 and V30 video speed ratings, the Inspire card is ideal for applications that demand high-speed data processing—from capturing ultra-high-definition 4K video on drones and action cameras to supporting mobile gaming and professional content creation on portable game consoles and Android devices. With capacity options of 128 GB, 256 GB, and 512 GB, users can choose the perfect fit for their storage needs. For power users who require even more storage, a 1 TB option is slated for release in Q2 of this year.

Built for Speed, Ready for Action

Designed with UHS-I U3 and V30 video speed ratings, the Inspire card is ideal for applications that demand high-speed data processing—from capturing ultra-high-definition 4K video on drones and action cameras to supporting mobile gaming and professional content creation on portable game consoles and Android devices. With capacity options of 128 GB, 256 GB, and 512 GB, users can choose the perfect fit for their storage needs. For power users who require even more storage, a 1 TB option is slated for release in Q2 of this year.

Samsung Display Achieves Industry-First True Bright Marketing Claim Verification from UL Solutions

Samsung Display today announced that the company has earned Marketing Claim Verification from global safety science company UL Solutions for claims related to perceived brightness. This marks the first time UL Solutions has issued a Marketing Claim Verification for a technology that leverages PCL calculations.

To achieve UL Solutions' Marketing Claim Verification, Samsung's True Bright, which is a distinction Samsung gives to displays that provides greater perceived brightness when compared to LCDs of the same PCL score, was evaluated for Perceptual Contrast Length (PCL) to quantify the brightness of the black of a display. PCL, which has been adopted as an industry standard by SEMI, refers to the brightness of a display specifically as perceived by the human eye. This metric acknowledges that perceived brightness is influenced not only by the physical light emitted by the panel but also by its contrast ratio. OLED displays typically have a contrast ratio of 1,000,000:1—over a thousand times that of standard LCDs. The enhanced contrast of OLEDs ensures that the same image is perceived as brighter when compared to LCD displays.

To achieve UL Solutions' Marketing Claim Verification, Samsung's True Bright, which is a distinction Samsung gives to displays that provides greater perceived brightness when compared to LCDs of the same PCL score, was evaluated for Perceptual Contrast Length (PCL) to quantify the brightness of the black of a display. PCL, which has been adopted as an industry standard by SEMI, refers to the brightness of a display specifically as perceived by the human eye. This metric acknowledges that perceived brightness is influenced not only by the physical light emitted by the panel but also by its contrast ratio. OLED displays typically have a contrast ratio of 1,000,000:1—over a thousand times that of standard LCDs. The enhanced contrast of OLEDs ensures that the same image is perceived as brighter when compared to LCD displays.

addlink Launches P30 USB 4.0 Super-Speed Magnetic SSD

addlink Technology Co., Ltd., a trailblazer in cutting-edge storage solutions, is excited to unveil the P30 USB4.0 Super-Speed Magnetic SSD, a next-generation external drive engineered for speed, portability, and innovation. Designed to meet the demands of modern mobile users, the P30 combines record-breaking performance with a stylish, compact form factor.SD, a cutting-edge portable storage device that combines exceptional speed, robust durability, and sleek design.

P30 USB4.0 SSD: Blazing Speed and Smart Design

Harnessing the power of USB4.0 technology, the P30 achieves transfer speeds of up to 4000 MB/s, allowing users to transfer a 10 GB file in a mere 2.5 seconds. Whether you're working with 4K ProRes videos, high-resolution photos, or massive game libraries, this SSD delivers unparalleled efficiency for professionals and enthusiasts alike.

P30 USB4.0 SSD: Blazing Speed and Smart Design

Harnessing the power of USB4.0 technology, the P30 achieves transfer speeds of up to 4000 MB/s, allowing users to transfer a 10 GB file in a mere 2.5 seconds. Whether you're working with 4K ProRes videos, high-resolution photos, or massive game libraries, this SSD delivers unparalleled efficiency for professionals and enthusiasts alike.

SK hynix Completes Customer Validation of CXL 2.0-based DDR5

SK hynix Inc. announced today that it has completed customer validation of 96 GB CMM (CXL Memory Module) - DDR5, a DRAM solution product based on CXL 2.0. The company said that it can process 36 GB/s due to a 50% increase in capacity when the product is applied to the server systems and a 30% improvement in the bandwidth compared to previous DDR5 modules. This can contribute to drastically reducing the total cost of ownership by customers in building and operating data centers.

Following the 96 GB product validation, the company is proceeding with the validation process for 128 GB product with another customer. This product, equipped with 32 Gb DDR5 DRAM using the 1bnm process, or the fifth-generation of the 10-nanometer technology, has high performance per watt. The company plans to complete the ongoing 128 GB validation as soon as possible to establish a CXL product portfolio to support customers in a timely manner. SK hynix is making efforts to expand the CXL ecosystem along with the development of CXL DRAM. The company developed HMSDK, software optimized for CMM-DDR5 and integrated it on Linux, the world's largest open-source operating system, in September, improving the performance of CXL applied systems.

Following the 96 GB product validation, the company is proceeding with the validation process for 128 GB product with another customer. This product, equipped with 32 Gb DDR5 DRAM using the 1bnm process, or the fifth-generation of the 10-nanometer technology, has high performance per watt. The company plans to complete the ongoing 128 GB validation as soon as possible to establish a CXL product portfolio to support customers in a timely manner. SK hynix is making efforts to expand the CXL ecosystem along with the development of CXL DRAM. The company developed HMSDK, software optimized for CMM-DDR5 and integrated it on Linux, the world's largest open-source operating system, in September, improving the performance of CXL applied systems.

G.Skill Releases DDR5 Memory Support List for Intel 200S Boost

G.SKILL International Enterprise Co., Ltd., the world's leading brand of performance overclock memory and PC components, is excited to unveil a list of compatible G.SKILL DDR5 memory kits that support the newly announced Intel 200S Boost program, introduced by Intel to improve system and gaming performance for platforms with unlocked Intel Core Ultra 200S series desktop processors and a compliant Intel Z890 chipset motherboard.

Intel 200S Boost - What is it?

The Intel 200S Boost is a new overclocking feature designed by Intel to work in conjunction with their latest unlocked Intel Core Ultra 200S series desktop processor, a compliant Intel Z890 chipset motherboard and validated DDR5 memory kits with an Intel XMP 3.0 memory overclock profile of up to DDR5-8000 and a maximum rated voltage of 1.4 V. Enabling this feature in the motherboard BIOS will automatically set your XMP values whilst boosting various CPU parameters to gain extra system performance.

Intel 200S Boost - What is it?

The Intel 200S Boost is a new overclocking feature designed by Intel to work in conjunction with their latest unlocked Intel Core Ultra 200S series desktop processor, a compliant Intel Z890 chipset motherboard and validated DDR5 memory kits with an Intel XMP 3.0 memory overclock profile of up to DDR5-8000 and a maximum rated voltage of 1.4 V. Enabling this feature in the motherboard BIOS will automatically set your XMP values whilst boosting various CPU parameters to gain extra system performance.

AMD Readies Radeon RX 9060 XT for May 18 Launch

AMD is preparing to launch its mid-thru-performance segment graphics card, the Radeon RX 9060 XT, on May 18, 2025. The mid-May launch could likely clash with that of the NVIDIA GeForce RTX 5060 (non-Ti). With the RX 9060 XT, AMD is introducing its second silicon based on the RDNA 4 architecture, the 4 nm "Navi 44." The full chip is rumored to be exactly half that of the "Navi 48" powering the RX 9070 series, with 32 compute units. This works out to 2,048 stream processors, 64 AI accelerators, 32 RT accelerators, 128 TMUs, and possibly 64 ROPs. The memory bus is expected to be 128-bit wide, with 8 GB and 16 GB memory variants expected. The company might stick with 20 Gbps GDDR6 for 320 GB/s of memory bandwidth. The host interface is expected to be PCI-Express 5.0 x8. Although it comes with a rather low shader count of 2,048, the RX 9060 XT is expected to come with higher engine clocks, boosting well over 3.20 GHz.

Given how the RX 9070 series ended up being competitive with the RTX 5070 and in some cases even the RTX 5070 Ti; it becomes plausible that the RX 9060 XT ends up competitive with the RTX 5060 series. Then there's the matter of the RX 9070 GRE. While the RX 9060 XT is 50% of the RX 9070 XT specs-sheet on paper the RX 9070 GRE is expected to be 75% of it—think 48 CU, 192-bit memory bus. This SKU is based on the "Navi 48" with its ASIC designation "Navi 48 XL." It's now being rumored that launch of this SKU has been significantly delayed to Q4 2025. May 18 happens to be the Sunday before Computex 2025 in Taipei, and so it's possible that AMD is holding some kind of client computing or gaming-specific event there, where it will show off the RX 9060 XT. The company might even announce mobile variants of its RX 9070 series.

Given how the RX 9070 series ended up being competitive with the RTX 5070 and in some cases even the RTX 5070 Ti; it becomes plausible that the RX 9060 XT ends up competitive with the RTX 5060 series. Then there's the matter of the RX 9070 GRE. While the RX 9060 XT is 50% of the RX 9070 XT specs-sheet on paper the RX 9070 GRE is expected to be 75% of it—think 48 CU, 192-bit memory bus. This SKU is based on the "Navi 48" with its ASIC designation "Navi 48 XL." It's now being rumored that launch of this SKU has been significantly delayed to Q4 2025. May 18 happens to be the Sunday before Computex 2025 in Taipei, and so it's possible that AMD is holding some kind of client computing or gaming-specific event there, where it will show off the RX 9060 XT. The company might even announce mobile variants of its RX 9070 series.

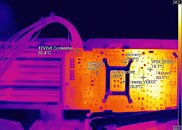

Parts of NVIDIA GeForce RTX 50 Series GPU PCB Reach Over 100°C: Report

Igor's Lab has run independent testing and thermal analysis of NVIDIA's latest GeForce RTX 50-series graphics cards, including the add-in card partner design RTX 5080, 5070 Ti, and 5060 Ti, which are now attracting attention for surprising thermal "hotspots" on the back of their PCBs. These hotspots are just the areas on PCB that get hot under load, and not the "Hot Spot" sensor NVIDIA removed with RTX 50 series. Infrared tests have shown temperatures climbing above 100°C in the power delivery region, even though the GPU die stays below 80°C. This isn't a problem with the silicon but with concentrated heating in clusters of thin copper planes and via arrays. Card makers like Palit, PNY, and MSI have all seen the same issue since they closely follow NVIDIA's reference PCB layout and use similar cooler mounting. A big part of the trouble comes down to how PCB designers and cooler engineers work separately.

NVIDIA's Thermal Design Guide gives AIC partners detailed power-loss budgets, listing worst-case dissipation for the GPU, memory, NVVDD and FBVDDQ rails, inductors, MOSFETs, and other components, and it recommends ideal thermal interface materials and mounting pressures. The guide assumes that even heat is spreading and that there is perfect airflow in a wind tunnel, but actual consumer PCs don't match those conditions. Multi-layer PCBs force high currents through 35 to 70 µm copper layers, which join at tight via clusters under the VRMs. Without dedicated thermal bridges or reinforced vias, these areas become bottlenecks where heat builds up, and the standard backplate plus heat-pipe layout can't pull it away fast enough.

NVIDIA's Thermal Design Guide gives AIC partners detailed power-loss budgets, listing worst-case dissipation for the GPU, memory, NVVDD and FBVDDQ rails, inductors, MOSFETs, and other components, and it recommends ideal thermal interface materials and mounting pressures. The guide assumes that even heat is spreading and that there is perfect airflow in a wind tunnel, but actual consumer PCs don't match those conditions. Multi-layer PCBs force high currents through 35 to 70 µm copper layers, which join at tight via clusters under the VRMs. Without dedicated thermal bridges or reinforced vias, these areas become bottlenecks where heat builds up, and the standard backplate plus heat-pipe layout can't pull it away fast enough.

AMD Software Adrenalin 25.4.1 Beta Drivers Released

Yesterday, AMD released Radeon Software Adrenalin Edition 25.4.1 Optional Beta drivers that add FidelityFX Super Resolution 4 to The Elder Scrolls IV: Oblivion Remastered, Assassin's Creed Shadows, Kingdom Come Deliverance 2, Dynasty Warriors Origin, Civilization 7, and Naraka Bladepoint. It also brings Amuse 3 support and AMD-optimized models to Radeon RX 9000 and RX 7000 series graphics cards alongside Ryzen AI 300 series processors. Among the many fixes you'll find corrected lighting artifacts in Topaz Photo AI's Adjust Lighting features on RX 9000 series cards, removed flicker when using AMD FreeSync, improved DirectML and GenAI performance in Amuse 3.0 on RX 7000 GPUs and Ryzen AI 300 series chips, and patched image corruption in certain diffuser models on RX 9000 hardware.

The update also smooths out stutter and performance drops in World of Warcraft's Western Plaguelands, restores integrated camera detection after factory resets on Ryzen AI Max devices, and addresses AMD Chat installation hangs. Since this is still an optional beta with some known issues, like FSR 4 not activating in Naraka Bladepoint on Windows 10, crashes in The Last of Us Part 2, memory leaks in SteamVR on RX 9000 cards, or intermittent launch and stability hiccups in games like Cyberpunk 2077, Fantasy VII Rebirth, Battlefield 1, Monster Hunter Wilds and Marvel's Spider-Man 2, AMD recommends using the suggested workarounds such as disabling motion smoothing or integrated graphics in your BIOS and holding out for your system vendor's certified driver to ensure full compatibility.

DOWNLOAD: AMD Software Adrenalin 25.4.1 Beta

The update also smooths out stutter and performance drops in World of Warcraft's Western Plaguelands, restores integrated camera detection after factory resets on Ryzen AI Max devices, and addresses AMD Chat installation hangs. Since this is still an optional beta with some known issues, like FSR 4 not activating in Naraka Bladepoint on Windows 10, crashes in The Last of Us Part 2, memory leaks in SteamVR on RX 9000 cards, or intermittent launch and stability hiccups in games like Cyberpunk 2077, Fantasy VII Rebirth, Battlefield 1, Monster Hunter Wilds and Marvel's Spider-Man 2, AMD recommends using the suggested workarounds such as disabling motion smoothing or integrated graphics in your BIOS and holding out for your system vendor's certified driver to ensure full compatibility.

DOWNLOAD: AMD Software Adrenalin 25.4.1 Beta

Tuesday, April 22nd 2025

Today's Files

Today's Reviews

Cases

Headphones

Keyboards

PSUs

NVIDIA GeForce RTX 5060 Ti 8 GB Review - So Many Compromises

We review NVIDIA's GeForce RTX 5060 Ti 8 GB, the card that NVIDIA doesn't want tested. Especially in VRAM-heavy titles the performance drops, but many games are running fine, especially if you focus on 1080p, and disable ray tracing. But is that the way it's meant to be played in 2025?

Corsair Void Wireless v2 Review - Reborn and Better Than Ever

The $120 Corsair's Void Wireless v2 nails it: engaging sound, excellent wearing comfort, dual wireless connectivity, and Dolby Atmos - all at half the price of premium rivals. Find out why this might be the new best headset in its price bracket.

Steel Seed Launches Today on PC, PlayStation 5 & Xbox Series X|S

Today ESDigital Games and developer Storm in a Teacup are excited to release Steel Seed, the new stealth-action game set in a dark sci-fi world where humanity stands on the brink of extinction. Available today on PC via Steam and the Epic Games Store, PlayStation 5, and Xbox Series X|S for $39.99 (with an additional 15% launch discount available on PC, Xbox, and PlayStation for PlayStation Plus subscribers), Steel Seed is a gripping action-adventure experience from the visionary team behind the critically acclaimed Close to the Sun.

Steam and Epic Games Store players can also grab the Deluxe Edition of Steel Seed today for $44.99 (with an additional 15% launch discount available), which includes the game's 15-track digital OST composed by Andrea Remini, a digital artbook, two unique in-game costumes, and 23 HD wallpapers. The Deluxe Edition will be available digitally on PlayStation 5 and Xbox Series X|S, alongside a physical edition of Steel Seed on PlayStation 5, starting May 23.

Steam and Epic Games Store players can also grab the Deluxe Edition of Steel Seed today for $44.99 (with an additional 15% launch discount available), which includes the game's 15-track digital OST composed by Andrea Remini, a digital artbook, two unique in-game costumes, and 23 HD wallpapers. The Deluxe Edition will be available digitally on PlayStation 5 and Xbox Series X|S, alongside a physical edition of Steel Seed on PlayStation 5, starting May 23.

Synology Forcing Owners of its Plus Series NAS Appliances to Use Own Brand Hard Drives

Last week Synology put out a press release on its European website, informing its customers that the Plus Series—which starts with simple two bay devices—will only support its own brand of hard drives, if you want to be able to take advantage of basic NAS features like creating a storage pool or do a lifespan analysis. More advanced features like volume-wide deduplication will also not be available. Synology has already done this on its XS Plus and rack mounted NAS appliances—which in itself wouldn't be acceptable to many considering getting a NAS—but at least these are pricier, high-end devices. Now the company has moved down to the $300 price bracket, which just doesn't sit right.

Admittedly this will only affect new customers, as the company will start to roll out the limitation with its 2025 SKUs and all other models will continue to work as is. The problem here is that Synology isn't a hard drive manufacturer and according to Arstechnica, the company is simply re-branding Toshiba hard drives and charges an extra $50 or so for their basic tier of drives, with higher-end tiers having a much higher premium. Synology obviously claims that this is for the benefit of their customers and you can find the full statement below. However, we doubt many customers will be happy to pay extra for something that was working just fine, until Synology figured out it could charge its customers extra for it. For now, there has been no indication that this will happen outside of the European market, but it's likely to be rolled out globally, as something like this is rarely limited to one market.

Admittedly this will only affect new customers, as the company will start to roll out the limitation with its 2025 SKUs and all other models will continue to work as is. The problem here is that Synology isn't a hard drive manufacturer and according to Arstechnica, the company is simply re-branding Toshiba hard drives and charges an extra $50 or so for their basic tier of drives, with higher-end tiers having a much higher premium. Synology obviously claims that this is for the benefit of their customers and you can find the full statement below. However, we doubt many customers will be happy to pay extra for something that was working just fine, until Synology figured out it could charge its customers extra for it. For now, there has been no indication that this will happen outside of the European market, but it's likely to be rolled out globally, as something like this is rarely limited to one market.

Post Trauma Out Now on PC & Current-gen Consoles

Hello everyone, after three years of development, I'm thrilled, excited (and a little bit scared) to announce that Post Trauma is now available on Steam (PC), PlayStation 5 and Xbox Series X|S. And if you're on Steam, you can also pick up an exclusive Supporter Edition which includes the game's full official soundtrack from Myuu alongside the base game. On behalf of myself and Red Soul Games, I want to thank you for your passion, your patience and support of Post Trauma. Whether you've been with me since the beginning or you're just joining us here in The Gloom, I'm incredibly grateful and can't wait to hear what you think of the game.

This development journey has been an incredible ride, from the initial demo on Itch.io, to announcing a partnership with Raw Fury and re-announcing the game at The Game Awards, demoing at Gamescom twice and seeing the game be exhibited all around the world, from Tokyo Game Show, to being hosted by PlayStation at BitSummit and taking part in Fantastic Fest in Texas. Our small team has accomplished so much and despite a few bumps in the road, we're incredibly proud of what we've been able to achieve. We hope you feel the same.

This development journey has been an incredible ride, from the initial demo on Itch.io, to announcing a partnership with Raw Fury and re-announcing the game at The Game Awards, demoing at Gamescom twice and seeing the game be exhibited all around the world, from Tokyo Game Show, to being hosted by PlayStation at BitSummit and taking part in Fantastic Fest in Texas. Our small team has accomplished so much and despite a few bumps in the road, we're incredibly proud of what we've been able to achieve. We hope you feel the same.

Sparkle Rep Mentions Arc Xe2 "Battlemage" Graphics Card Configured with 24 GB VRAM

Not long after Intel's launch of the Arc Xe2 "Battlemage" B580 12 GB graphics card design, insiders started generating noise about potential spin-offs bound for release in 2025. In theory, the speculated "B580 24 GB" variant could arrive as a workstation-oriented discrete graphics solution—possibly lined up as a next-gen entry within Team Blue's Arc Pro family. Three mysterious BMG (aka "Battlemage") PCI identifiers turned up at the end of January; sending online PC hardware debates into overdrive; one faction believed that Team Blue was readying fabled productivity-focused B-series cards—complete with enlarged pools of GDDR6 VRAM. Apparently, Sparkle's Chinese branch has provided comment on newer rumors—from March, according to VideoCardz. The Taiwanese manufacturer is a key Intel board partner in the field of Arc GPU-based graphics card products—across gaming and professional desktop lines. Unfortunately, the company's head office (in Taiwan) has dismissed "official" claims about a May/June launch of an unnamed 24 GB model. Sparkle's Chinese social media account engaged with members of the PC hardware community, and outlined an "original plan" to release something new within the second quarter of 2025—apparently the incoming card is "still being arranged."

ViewSonic 27" ColorPro 5K Mac-Compatible Monitor Now Available Globally

ViewSonic Corp, a leading global provider of visual solutions, announces the worldwide availability of 27-inch flagship ColorPro VP2788-5K, an iF Design Award-winning monitor designed for seamless integration with both Mac and PC ecosystems. Featuring 5K UHD+ resolution, industry-leading color accuracy, and Thunderbolt 4 connectivity for daisy chaining of dual 5K monitors, it is an ideal solution for designers, photographers, and videographers to boost productivity and streamline workflows.

"The VP2788-5K combines ViewSonic's ColorPro color accuracy with advanced functionalities to optimize productivity in creative sectors," said Oscar Lin, General Manager of the Monitor Business Unit at ViewSonic. "This monitor offers top-tier color fidelity and clarity, along with easy multi-display setups, establishing a new benchmark for professional displays both within the ViewSonic community and beyond."

"The VP2788-5K combines ViewSonic's ColorPro color accuracy with advanced functionalities to optimize productivity in creative sectors," said Oscar Lin, General Manager of the Monitor Business Unit at ViewSonic. "This monitor offers top-tier color fidelity and clarity, along with easy multi-display setups, establishing a new benchmark for professional displays both within the ViewSonic community and beyond."

MSI Z890 Motherboards Fully Support Intel 200S Boost Technology

MSI proudly announces full support for Intel 200S Boost technology for the latest Z890 motherboard lineup, empowering gamers, creators, and enthusiasts to unlock next-level performance with a single click. Intel 200S Boost is a cutting edge memory enhancement technology that allows users to safely elevate DDR5 memory performance when paired with Intel Core Ultra 200S Series Desktop "K-SKU" processors and "Z890 series motherboards". To fully optimize this feature, MSI has forged strong partnerships with leading memory brands. Together, we've rigorously tested and validated a wide range of DDR5 modules to meet Intel 200S Boost standards, delivering exceptional performance, stability, and compatibility. Learn more about Intel 200S Boost.

Once a compatible processor and supported memory kit are installed, users can instantly activate 200S Boost via MSI Click BIOS X, no manual tuning or technical expertise required. This one click feature enables real performance improvements in gaming, content creation, and everyday multitasking. To support this breakthrough, MSI has released the latest BIOS for all Z890 series motherboards, ensuring full compatibility with Intel 200S Boost. Users are encouraged to visit MSI's official website and product pages for the latest BIOS updates.

Once a compatible processor and supported memory kit are installed, users can instantly activate 200S Boost via MSI Click BIOS X, no manual tuning or technical expertise required. This one click feature enables real performance improvements in gaming, content creation, and everyday multitasking. To support this breakthrough, MSI has released the latest BIOS for all Z890 series motherboards, ensuring full compatibility with Intel 200S Boost. Users are encouraged to visit MSI's official website and product pages for the latest BIOS updates.

Ubisoft Previews Star Wars Outlaws: A Pirate's Fortune Expansion, Launches May 15

A first-look trailer for Star Wars Outlaws: A Pirate's Fortune, the game's second story pack releasing on May 15, debuted at Star Wars Celebration. A free demo that features select parts of Star Wars Outlaws is now available on Xbox Series X|S, PlayStation 5, and PC via Ubisoft Connect, the Epic Games Store, and Steam. Plus, Star Wars Outlaws is coming to Nintendo Switch 2 on September 4. The new trailer shows Kay Vess embarking on a mysterious adventure where she encounters pirates and lost treasures. Kay and her companion Nix team up with infamous pirate Hondo Ohnaka to face off against Stinger Tash and her Rokana Raiders to uncover the hidden riches within the dangerous Khepi Tomb. Along the way, they'll discover the Miyuki Trade League who offer new rewards for the Trailblazer in exchange for smuggling dangerous goods across the galaxy.

To access Star Wars Outlaws: A Pirate's Fortune, players must complete the main storyline in the base game. This second story pack will be automatically accessible and free for Star Wars Outlaws Season Pass owners, or available as a separate purchase. With the release of Star Wars Outlaws: A Pirate's Fortune, Ultimate and Deluxe Edition owners also receive the Naboo Nobility and Desert Nomad cosmetic packs. All players will be gifted cosmetic items inspired by Star Wars: Skeleton Crew as part of the Title Update launching alongside A Pirate's Fortune. After downloading and installing the update, the gift will appear in the player's delivery crate on the Trailblazer.

To access Star Wars Outlaws: A Pirate's Fortune, players must complete the main storyline in the base game. This second story pack will be automatically accessible and free for Star Wars Outlaws Season Pass owners, or available as a separate purchase. With the release of Star Wars Outlaws: A Pirate's Fortune, Ultimate and Deluxe Edition owners also receive the Naboo Nobility and Desert Nomad cosmetic packs. All players will be gifted cosmetic items inspired by Star Wars: Skeleton Crew as part of the Title Update launching alongside A Pirate's Fortune. After downloading and installing the update, the gift will appear in the player's delivery crate on the Trailblazer.

SAPPHIRE PULSE Radeon RX 9070 Series Expanded with "METAL ALLOY" Options

Sapphire has quietly expanded its existing Radeon RX 9070 Series lineup with two new additions: PULSE METAL ALLOY Radeon RX 9070 XT and RX 9070. According to VideoCardz, the manufacturer's Chinese website was updated with new product listings at some point last week. Sapphire's regional branch has not issued any fresh press material, regarding an official launch of these gray-shaded options. Sapphire's graphics card team has seemingly refreshed their standard black PULSE (RDNA 4 generation) triple and dual-fan shroud and backplate designs with new metallic tones and finishes. Fancier enclosures will not arrive alongside bump-up in specs—as mentioned in freshly-published official product pages, company engineers have stuck with AMD's reference figures for the Radeon RX 9070 XT and RX 9070. VideoCardz reckons that the PURE METAL ALLOY cards will debut in China; possibly as starting off as exclusives. Currently, the manufacturer's various global online presences only list the readily available black PULSE cards. Interestingly, the white PURE series shares the same overall (triple-fan) shroud and backplate setup—Sapphire's pale-shaded offerings feature very mild overclocks over "baseline MSRP" configurations. Chinese market pricing—for the two PULSE METAL ALLOY SKUs—was not available at the time of publication.

Intel Prepares "200S Boost" Overclocking Profile for "Arrow Lake-S" Processors

Today, Intel introduced a new "200S Boost" factory-approved overclocking profile for the unlocked Intel Core Ultra 200S "Arrow Lake" processors. Namely, the Core Ultra 9 285K, 7 265K/265KF, and 5 245K/245KF SKUs are supported when installed on a compatible Intel Z890 motherboard with one‑DIMM‑per‑channel Intel XMP DDR5 memory. Activating the 200S Boost profile in the BIOS raises the System-on-Chip (fabric) clock from 2.6 GHz to up to 3.2 GHz and the die‑to‑die interconnect from 2.1 GHz to up to 3.2 GHz (within VccSA ≤ 1.20 V) while pushing DDR5 speeds from stock 6,400 MT/s to as much as 8,000 MT/s (VDD2/VDDQ ≤ 1.40 V). Intel has validated the profile on a selection of Z890 boards, including ASRock Z890 Taichi OCF, ASUS ROG Maximus Z890 Hero, Gigabyte Z890 Aorus Master, MSI MEG Z890 Ace, and others. For memory kits, Intel validated DDR5 memory kits from ADATA, Corsair, G.SKILL, Team Groupp, and V‑COLOR.

Enabling 200S Boost requires a BIOS update, selecting the "Intel 200S Boost" preset under the overclocking menu, and rebooting; stability should then be verified with benchmarks like Cinebench, and thermals/voltages monitored via Intel XTU or similar tools. Perhaps the most important fact is that using the 200S Boost profile does not void Intel's three‑year limited warranty on boxed Core Ultra 200S CPUs, provided they weren't manually overclocked before profile activation. Intel cautions that actual gains depend on motherboard design, cooling, and memory quality, that two‑DIMM‑per‑channel setups aren't officially supported, and that damage to non‑Intel components remains outside warranty coverage. This is more of a safe heaven for anyone wanting to do manual tuning, but not wanting to break any warranty and thus risk damaging their CPU without a backup plan.

Enabling 200S Boost requires a BIOS update, selecting the "Intel 200S Boost" preset under the overclocking menu, and rebooting; stability should then be verified with benchmarks like Cinebench, and thermals/voltages monitored via Intel XTU or similar tools. Perhaps the most important fact is that using the 200S Boost profile does not void Intel's three‑year limited warranty on boxed Core Ultra 200S CPUs, provided they weren't manually overclocked before profile activation. Intel cautions that actual gains depend on motherboard design, cooling, and memory quality, that two‑DIMM‑per‑channel setups aren't officially supported, and that damage to non‑Intel components remains outside warranty coverage. This is more of a safe heaven for anyone wanting to do manual tuning, but not wanting to break any warranty and thus risk damaging their CPU without a backup plan.

The Elder Scrolls IV: Oblivion Remastered Launches Today - Available on PC, Xbox X|S & PS5