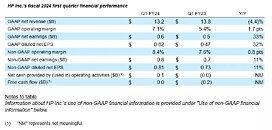

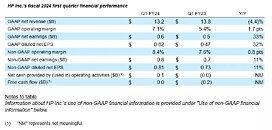

HP Inc. and its subsidiaries ("HP") announced fiscal 2024 first quarter net revenue of $13.2 billion, down 4.4% (down 4.9% in constant currency) from the prior-year period. First quarter GAAP diluted net EPS was $0.62, up from $0.47 in the prior-year period and within the previously provided outlook of $0.60 to $0.70. First quarter non-GAAP diluted net EPS was $0.81, up from $0.73 in the prior-year period and within the previously provided outlook of $0.76 to $0.86. First quarter non-GAAP net earnings and non-GAAP diluted net EPS excludes after-tax adjustments of $186 million, or $0.19 per diluted share, related to restructuring and other charges, acquisition and divestiture charges, amortization of intangible assets, non-operating retirement-related credits and tax adjustments.

"Our Q1 results reflect continued progress against our Future Ready plan," said Enrique Lores, HP President and CEO. "We are bringing terrific innovation to our customers while driving disciplined execution across every facet of the business. As a result, we delivered solid earnings growth this quarter and we are well positioned to accelerate as the market recovers."

Asset Management

HP's net cash provided by operating activities in the first quarter of fiscal 2024 was $121 million. Accounts receivable ended the quarter at $3.8 billion, down 2 days quarter over quarter to 26 days. Inventory ended the quarter at $6.9 billion, up 4 days quarter over quarter to 61 days. Accounts payable ended the quarter at $13.3 billion, down 1 day quarter over quarter to 116 days.

HP generated $25 million of free cash flow in the first quarter. Free cash flow includes net cash provided by operating activities of $121 million adjusted for net investments in leases of $62 million and net investments in property, plant and equipment of $158 million.

HP's dividend payment of $0.2756 per share in the first quarter resulted in cash usage of $0.3 billion. HP also utilized $0.5 billion of cash during the quarter to repurchase approximately 16.7 million shares of common stock in the open market. HP exited the quarter with $2.4 billion in gross cash, which includes cash and cash equivalents of $2.3 billion, restricted cash of $154 million, and short-term investments of $3 million included in other current assets. Restricted cash relates to amounts collected and held on behalf of a third party for trade receivables previously sold.

Fiscal 2024 first quarter segment results

Outlook

For the fiscal 2024 second quarter, HP estimates GAAP diluted net EPS to be in the range of $0.58 to $0.68 and non-GAAP diluted net EPS to be in the range of $0.76 to $0.86. Fiscal 2024 second quarter non-GAAP diluted net EPS estimates exclude $0.18 per diluted share, primarily related to restructuring and other charges, acquisition and divestiture charges, amortization of intangible assets, non-operating retirement-related credits, tax adjustments and the related tax impact on these items.

For fiscal 2024, HP estimates GAAP diluted net EPS to be in the range of $2.61 to $3.01 and non-GAAP diluted net EPS to be in the range of $3.25 to $3.65. Fiscal 2024 non-GAAP diluted net EPS estimates exclude $0.64 per diluted share, primarily related to restructuring and other charges, acquisition and divestiture charges, amortization of intangible assets, non-operating retirement-related credits, tax adjustments and the related tax impact on these items. For fiscal 2024, HP anticipates generating free cash flow in the range of $3.1 to $3.6 billion.

View at TechPowerUp Main Site | Source

"Our Q1 results reflect continued progress against our Future Ready plan," said Enrique Lores, HP President and CEO. "We are bringing terrific innovation to our customers while driving disciplined execution across every facet of the business. As a result, we delivered solid earnings growth this quarter and we are well positioned to accelerate as the market recovers."

Asset Management

HP's net cash provided by operating activities in the first quarter of fiscal 2024 was $121 million. Accounts receivable ended the quarter at $3.8 billion, down 2 days quarter over quarter to 26 days. Inventory ended the quarter at $6.9 billion, up 4 days quarter over quarter to 61 days. Accounts payable ended the quarter at $13.3 billion, down 1 day quarter over quarter to 116 days.

HP generated $25 million of free cash flow in the first quarter. Free cash flow includes net cash provided by operating activities of $121 million adjusted for net investments in leases of $62 million and net investments in property, plant and equipment of $158 million.

HP's dividend payment of $0.2756 per share in the first quarter resulted in cash usage of $0.3 billion. HP also utilized $0.5 billion of cash during the quarter to repurchase approximately 16.7 million shares of common stock in the open market. HP exited the quarter with $2.4 billion in gross cash, which includes cash and cash equivalents of $2.3 billion, restricted cash of $154 million, and short-term investments of $3 million included in other current assets. Restricted cash relates to amounts collected and held on behalf of a third party for trade receivables previously sold.

Fiscal 2024 first quarter segment results

- Personal Systems net revenue was $8.8 billion, down 4% year over year (down 5% in constant currency) with a 6.1% operating margin. Consumer PS net revenue was down 1% and Commercial PS net revenue was down 5%. Total units were up 5% with Consumer PS units up 10% and Commercial PS units up 2%.

- Printing net revenue was $4.4 billion, down 5% year over year (down 5% in constant currency) with a 19.9% operating margin. Consumer Printing net revenue was down 22% and Commercial Printing net revenue was down 12%. Supplies net revenue was flat (up 1% in constant currency). Total hardware units were down 17%, with Consumer Printing units down 15% and Commercial Printing units down 18%.

Outlook

For the fiscal 2024 second quarter, HP estimates GAAP diluted net EPS to be in the range of $0.58 to $0.68 and non-GAAP diluted net EPS to be in the range of $0.76 to $0.86. Fiscal 2024 second quarter non-GAAP diluted net EPS estimates exclude $0.18 per diluted share, primarily related to restructuring and other charges, acquisition and divestiture charges, amortization of intangible assets, non-operating retirement-related credits, tax adjustments and the related tax impact on these items.

For fiscal 2024, HP estimates GAAP diluted net EPS to be in the range of $2.61 to $3.01 and non-GAAP diluted net EPS to be in the range of $3.25 to $3.65. Fiscal 2024 non-GAAP diluted net EPS estimates exclude $0.64 per diluted share, primarily related to restructuring and other charges, acquisition and divestiture charges, amortization of intangible assets, non-operating retirement-related credits, tax adjustments and the related tax impact on these items. For fiscal 2024, HP anticipates generating free cash flow in the range of $3.1 to $3.6 billion.

View at TechPowerUp Main Site | Source