Global Fab Equipment Spending Expected to Reach Record $109B in 2022, SEMI Reports

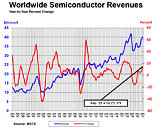

Global fab equipment spending for front-end facilities is expected to increase 20% year-over-year (YOY) to an all-time high of US$109 billion in 2022, marking a third consecutive year of growth following a 42% surge in 2021, SEMI announced today in its latest quarterly World Fab Forecast report. Fab equipment investment in 2023 is expected to remain strong.

"The global semiconductor equipment industry remains on track to cross the $100 billion threshold for the first time as shown in our latest update of the World Fab Forecast,"said Ajit Manocha, president and CEO of SEMI. "This historic milestone puts an exclamation point on the current run of unprecedented industry growth."

"The global semiconductor equipment industry remains on track to cross the $100 billion threshold for the first time as shown in our latest update of the World Fab Forecast,"said Ajit Manocha, president and CEO of SEMI. "This historic milestone puts an exclamation point on the current run of unprecedented industry growth."