Qubic Cryptocurrency Mining Craze Causes AMD Ryzen 9 7950X Stocks to Evaporate

It looks like cryptocurrency mining is back in craze, as miners are firing up their old mining hardware from 2022 to cash in. Bitcoin is now north of $72,000, and is dragging up the value of several other cryptocurrencies, one such being Qubic (QBIC). Profitability calculators put 24 hours of Qubic mining on an AMD Ryzen 9 7950X 16-core processor at around $3, after subtracting energy costs involved in running the chip at its default 170 W TDP. "Zen 4" processors such as the 7950X tend to retain much of their performance with slight underclocking, and reducing their power limits; which is bound to hold or increase profitability, while also prolonging the life of the hardware.

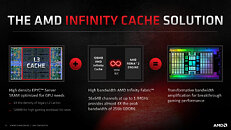

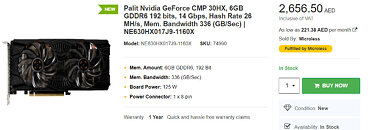

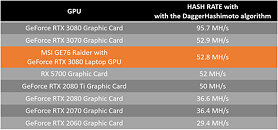

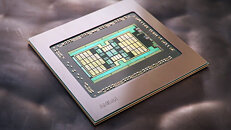

And thus, the inevitable has happened—stocks of the AMD Ryzen 9 7950X have disappeared overnight across online retail. With the market presence of the 7950X3D and the Intel Core i9-14900K, the 7950X was typically found between $550-600, which would have added great value considering its low input costs. CPU-based cryptocurrency miners, including the QBIC miner, appear to be taking advantage of the AVX-512 instruction set. AMD "Zen 4" microarchitecture supports AVX-512 through its dual-pumped 256-bit FPU, and the upcoming "Zen 5" microarchitecture is rumored to double AVX-512 performance over "Zen 4." Meanwhile, Intel has deprecated what few client-relevant AVX-512 instructions its Core processors had since 12th Gen "Alder Lake," as it reportedly affected sales of Xeon processors. What about the 7950X3D? It's pricier, but mining doesn't benefit from the 3D V-cache, and the chip doesn't sustain the kind of CPU clocks the 7950X manages to do across all its 16 cores. It's only a matter of time before the 7950X3D disappears, too; followed by 12-core models such as the 65 W 7900, the 170 W 7900X, and the 7900X3D.

And thus, the inevitable has happened—stocks of the AMD Ryzen 9 7950X have disappeared overnight across online retail. With the market presence of the 7950X3D and the Intel Core i9-14900K, the 7950X was typically found between $550-600, which would have added great value considering its low input costs. CPU-based cryptocurrency miners, including the QBIC miner, appear to be taking advantage of the AVX-512 instruction set. AMD "Zen 4" microarchitecture supports AVX-512 through its dual-pumped 256-bit FPU, and the upcoming "Zen 5" microarchitecture is rumored to double AVX-512 performance over "Zen 4." Meanwhile, Intel has deprecated what few client-relevant AVX-512 instructions its Core processors had since 12th Gen "Alder Lake," as it reportedly affected sales of Xeon processors. What about the 7950X3D? It's pricier, but mining doesn't benefit from the 3D V-cache, and the chip doesn't sustain the kind of CPU clocks the 7950X manages to do across all its 16 cores. It's only a matter of time before the 7950X3D disappears, too; followed by 12-core models such as the 65 W 7900, the 170 W 7900X, and the 7900X3D.