Global Top Ten IC Design House Revenue Spikes 32% in 2Q22, Ability to Destock Inventory to be Tested in 2H22, Says TrendForce

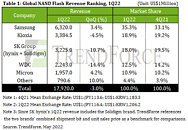

According to the latest TrendForce statistics, revenue of the top ten global IC design houses reached US$39.56 billion in 2Q22, growing 32% YoY. Growth was primarily driven by demand for data centers, networking, IoT, and high-end product portfolios. AMD achieved synergy through mergers and acquisitions. In addition to climbing to third place, the company also posted the highest annual revenue growth rate in 2Q22 at 70%.

Qualcomm continues in the No. 1 position worldwide, exhibiting growth in the mobile phone, RF front-end, automotive, and IoT sectors. Sales of mid/low-end mobile phone APs were weak but demand for high-end mobile phone APs was relatively stable. Company revenue reached US$9.38 billion, or 45% growth YoY. NVIDIA benefitted from expanded application of GPUs in data centers to expand this product category's revenue share past the 50% mark to 53.5%, making up for the 13% YoY slump in its game application business, bringing total revenue to US$7.09 billion, though annual growth rate slowed to 21%. AMD reorganized its business after the addition of Xilinx and Pensando. The company's embedded division revenue increased by 2,228% YoY. In addition, its data center department also made a considerable contribution. AMD posted revenue of US$6.55 billion, achieving 70% growth YoY, highest amongst the top ten. Broadcom's sales performance in semiconductor solutions remained solid and demand for cloud services, data centers, and networking is quite strong. The company's purchase order backlog is still increasing with 2Q22 revenue reaching US$6.49 billion, an annual growth rate of 31%.

Qualcomm continues in the No. 1 position worldwide, exhibiting growth in the mobile phone, RF front-end, automotive, and IoT sectors. Sales of mid/low-end mobile phone APs were weak but demand for high-end mobile phone APs was relatively stable. Company revenue reached US$9.38 billion, or 45% growth YoY. NVIDIA benefitted from expanded application of GPUs in data centers to expand this product category's revenue share past the 50% mark to 53.5%, making up for the 13% YoY slump in its game application business, bringing total revenue to US$7.09 billion, though annual growth rate slowed to 21%. AMD reorganized its business after the addition of Xilinx and Pensando. The company's embedded division revenue increased by 2,228% YoY. In addition, its data center department also made a considerable contribution. AMD posted revenue of US$6.55 billion, achieving 70% growth YoY, highest amongst the top ten. Broadcom's sales performance in semiconductor solutions remained solid and demand for cloud services, data centers, and networking is quite strong. The company's purchase order backlog is still increasing with 2Q22 revenue reaching US$6.49 billion, an annual growth rate of 31%.