- Joined

- Dec 6, 2011

- Messages

- 4,784 (1.00/day)

- Location

- Still on the East Side

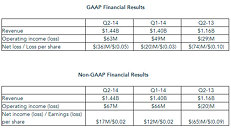

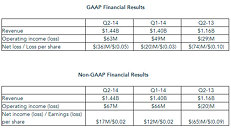

AMD today announced revenue for the second quarter of 2014 of $1.44 billion, operating income of $63 million and net loss of $36 million, or $0.05 per share. Non-GAAP operating income was $67 million and non-GAAP net income, which primarily excludes $49 million of loss from debt redemption in the quarter, was $17 million, or $0.02 per share.

"The second quarter capped off a solid first half of the year for AMD with strong revenue growth and improved financial performance," said Rory Read, AMD president and CEO. "Our transformation strategy is on track and we expect to deliver full year non-GAAP profitability and year-over-year revenue growth. We continue to strengthen our business model and shape AMD into a more agile company offering differentiated solutions for a diverse set of markets."

Quarterly Financial Summary

Recent Highlights

Current Outlook

For the third quarter of 2014, AMD expects revenue to increase 2 percent, plus or minus 3 percent, sequentially.

View at TechPowerUp Main Site

"The second quarter capped off a solid first half of the year for AMD with strong revenue growth and improved financial performance," said Rory Read, AMD president and CEO. "Our transformation strategy is on track and we expect to deliver full year non-GAAP profitability and year-over-year revenue growth. We continue to strengthen our business model and shape AMD into a more agile company offering differentiated solutions for a diverse set of markets."

Quarterly Financial Summary

- Gross margin was 35 percent in Q2 2014.

Gross margin was flat sequentially. - Cash, cash equivalents and marketable securities were $948 million at the end of the quarter, significantly higher than the target minimum of $600 million and close to the optimal zone of $1 billion.

- Total debt at the end of the quarter was $2.21 billion, an increase from $2.14 billion at the end of Q1 2014.

During Q2 2014, the company continued re-profiling its near-term debt maturities, issuing $500 million in aggregate principal amount of 7.00% Senior Notes due 2024 and repurchasing all $452 million aggregate principal amount of the company's outstanding 8.125% Senior Notes due 2017. - Computing Solutions segment revenue increased 1 percent sequentially and decreased 20 percent year-over-year. The year-over-year decline was due to decreased microprocessor unit shipments.

Operating income was $9 million, an improvement from an operating loss of $3 million in Q1 2014 and operating income of $2 million in Q2 2013. The sequential increase was primarily driven by improved gross margin due to a richer mix of notebook products while the year-over-year increase was primarily driven by lower operating expenses.

Microprocessor average selling price (ASP) increased sequentially and year-over-year. - Graphics and Visual Solutions segment revenue increased 5 percent sequentially and 141 percent year-over-year driven largely by increased semi-custom SoC shipments. Graphics processor unit (GPU) revenue decreased sequentially and year-over-year, primarily due to a decrease in AIB channel sales, partially offset by increased sales of professional graphics and desktop OEM GPUs.

Operating income was $82 million compared with $91 million in Q1 2014 and breakeven in Q2 2013. The sequential decline was primarily due to lower GPU revenue, while the year-over-year increase was driven by increased sales of semi-custom SoCs.

GPU ASP decreased sequentially and year-over-year, primarily driven by lower AIB channel sales.

Recent Highlights

- AMD unveiled further details on its ambidextrous computing roadmap, including a 64-bit ARM architecture license and plans to develop custom high-performance ARM and x86 processor cores for 2016. The company's differentiated x86 and ARM strategy is designed to deliver unmatched computing and graphics performance using a shared, flexible infrastructure to drive new innovations.

- AMD appointed Dr. Lisa Su to Chief Operating Officer, responsible for overseeing the company's previously separate global operations, operating segments and sales organization to drive growth in both traditional PC and adjacent markets.

- AMD realigned its organization structure to deliver unmatched customer value in both traditional PC markets and adjacent high-growth markets. Effective July 1, 2014, AMD's two new reportable segments are as follows:

Computing and Graphics segment, which will primarily include desktop and notebook processors and chipsets, discrete GPUs and professional graphics;

Enterprise, Embedded and Semi-Custom segment, which will primarily include server and embedded processors, dense servers, semi-custom SoC products, development services and technology for game consoles.

AMD's Quarterly Report on Form 10-Q for the quarter ended September 27, 2014 will reflect this new segment reporting structure. - AMD detailed its plans to accelerate the energy efficiency of its accelerated processing units (APUs) delivering 25x efficiency improvements by 2020 through design optimizations, intelligent power management and Heterogeneous System Architecture advances that are expected to enable AMD to outpace the industry's historical energy efficiency trend by at least 70 percent.

- AMD continued to gain momentum with its embedded products in the second quarter.

The company introduced the 2nd-generation embedded R-Series APU as well as the AMD embedded G-Series SoC and CPU solutions, which will power HP thin clients and Advantech's new embedded industrial solution and are ideally suited for ATMs, kiosks and medical equipment applications.

AMD embedded Radeon graphics were selected by Boeing for its next-generation advanced cockpit display systems. - AMD publicly demonstrated for the first time its 64-bit ARM-based AMD Opteron A-Series processor, codenamed "Seattle," a significant step forward in expanding the footprint of ultra-efficient 64-bit ARM solutions for cloud computing and the Internet of Things.

- AMD expanded its mobile APU offerings in the quarter:

Acer, Dell, HP and Lenovo have all introduced notebooks powered by AMD's newest 3rd-generation mainstream mobile APUs, which combine category-leading compute performance with unique features and rich user interactions.

AMD also launched its most advanced mobile APUs for consumer and commercial notebooks. The new 2014 performance mobile APUs include AMD's first FX-branded enthusiast class APU for notebooks as well as AMD Pro A-Series APUs. HP is offering the AMD PRO A-Series APUs across its Elite 700-Series notebooks, desktops and all-in-ones, with additional OEMs expected to introduce systems later this year. - AMD expanded its 2nd-generation Graphics Core Next-based professional graphics solutions with the introduction of the AMD FirePro W8100 professional graphics card, which delivers 38x more performance than the closest competitive offerings based on double precision testing. Dell, HP and more than 10 workstation system integrators have all announced systems featuring the new card.

- AMD's groundbreaking Mantle API, which creates more immersive experiences that take fuller advantage of modern APUs and GPUs to deliver console-like experiences, will be used by Electronic Arts in the upcoming Battlefield Hardline, Dragon Age: Inquisition and Plants vs. Zombies: Garden Warfare games. More than 40 game titles supporting Mantle are in development with more than 50 developers actively working with the API for future titles.

Current Outlook

For the third quarter of 2014, AMD expects revenue to increase 2 percent, plus or minus 3 percent, sequentially.

View at TechPowerUp Main Site

The details of Georgia's state legislation is open to anyone who can parse the information. Georgia's state tax incentive/credit legislation isn't particularly different from any other economically depressed area that is looking to attract investment.

The details of Georgia's state legislation is open to anyone who can parse the information. Georgia's state tax incentive/credit legislation isn't particularly different from any other economically depressed area that is looking to attract investment. The fact that

The fact that