- Joined

- Oct 9, 2007

- Messages

- 47,291 (7.53/day)

- Location

- Hyderabad, India

| System Name | RBMK-1000 |

|---|---|

| Processor | AMD Ryzen 7 5700G |

| Motherboard | ASUS ROG Strix B450-E Gaming |

| Cooling | DeepCool Gammax L240 V2 |

| Memory | 2x 8GB G.Skill Sniper X |

| Video Card(s) | Palit GeForce RTX 2080 SUPER GameRock |

| Storage | Western Digital Black NVMe 512GB |

| Display(s) | BenQ 1440p 60 Hz 27-inch |

| Case | Corsair Carbide 100R |

| Audio Device(s) | ASUS SupremeFX S1220A |

| Power Supply | Cooler Master MWE Gold 650W |

| Mouse | ASUS ROG Strix Impact |

| Keyboard | Gamdias Hermes E2 |

| Software | Windows 11 Pro |

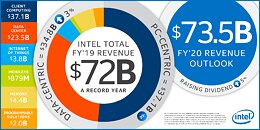

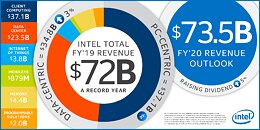

Intel Corporation today reported fourth-quarter and full-year 2019 financial results. The company also announced that its board of directors approved a five percent cash dividend increase to $1.32 per share on an annual basis. The board declared a quarterly dividend of $0.33 per share on the company's common stock, which will be payable on March 1 to shareholders of record on February 7.

"In 2019, we gained share in an expanded addressable market that demands more performance to process, move and store data," said Bob Swan, Intel CEO. "One year into our long-term financial plan, we have outperformed our revenue and EPS expectations. Looking ahead, we are investing to win the technology inflections of the future, play a bigger role in the success of our customers and increase shareholder returns."

Intel's collection of data-centric businesses achieved record revenue in the fourth quarter, led by record Data Center Group (DCG) revenue. DCG revenue grew 19 percent YoY in the fourth quarter, driven by robust demand from cloud service provider customers and a continued strong mix of high-performance 2nd-Generation Intel Xeon Scalable processors. Intel acquired Habana Labs in the fourth quarter, strengthening its artificial intelligence portfolio for the data center. Internet of Things Group (IOTG) revenue was up 13 percent on strength in retail and transportation. Mobileye achieved record revenue, up 31 percent YoY on increasing ADAS adoption. Intel's memory business (NSG) was up 10 percent YoY on continued NAND and Intel Optane bit growth. PSG fourth-quarter revenue was down 17 percent YoY.

In the fourth quarter, the PC-centric business (CCG) was up 2 percent on higher modem sales and desktop platform volumes. Major PC manufacturers have introduced 44 systems featuring the new, 10 nm-based 10th Gen Intel Core processors (previously referred to as "Ice Lake"), and momentum continues to build for Project Athena. Project Athena-verified devices have been tuned, tested and verified to deliver fantastic system-level innovation and benefits spanning battery life, consistent responsiveness, instant wake, application compatibility and more. Intel has verified 26 Project Athena designs to date.

View at TechPowerUp Main Site

"In 2019, we gained share in an expanded addressable market that demands more performance to process, move and store data," said Bob Swan, Intel CEO. "One year into our long-term financial plan, we have outperformed our revenue and EPS expectations. Looking ahead, we are investing to win the technology inflections of the future, play a bigger role in the success of our customers and increase shareholder returns."

Intel's collection of data-centric businesses achieved record revenue in the fourth quarter, led by record Data Center Group (DCG) revenue. DCG revenue grew 19 percent YoY in the fourth quarter, driven by robust demand from cloud service provider customers and a continued strong mix of high-performance 2nd-Generation Intel Xeon Scalable processors. Intel acquired Habana Labs in the fourth quarter, strengthening its artificial intelligence portfolio for the data center. Internet of Things Group (IOTG) revenue was up 13 percent on strength in retail and transportation. Mobileye achieved record revenue, up 31 percent YoY on increasing ADAS adoption. Intel's memory business (NSG) was up 10 percent YoY on continued NAND and Intel Optane bit growth. PSG fourth-quarter revenue was down 17 percent YoY.

In the fourth quarter, the PC-centric business (CCG) was up 2 percent on higher modem sales and desktop platform volumes. Major PC manufacturers have introduced 44 systems featuring the new, 10 nm-based 10th Gen Intel Core processors (previously referred to as "Ice Lake"), and momentum continues to build for Project Athena. Project Athena-verified devices have been tuned, tested and verified to deliver fantastic system-level innovation and benefits spanning battery life, consistent responsiveness, instant wake, application compatibility and more. Intel has verified 26 Project Athena designs to date.

View at TechPowerUp Main Site