- Joined

- Oct 9, 2007

- Messages

- 47,244 (7.54/day)

- Location

- Hyderabad, India

| System Name | RBMK-1000 |

|---|---|

| Processor | AMD Ryzen 7 5700G |

| Motherboard | ASUS ROG Strix B450-E Gaming |

| Cooling | DeepCool Gammax L240 V2 |

| Memory | 2x 8GB G.Skill Sniper X |

| Video Card(s) | Palit GeForce RTX 2080 SUPER GameRock |

| Storage | Western Digital Black NVMe 512GB |

| Display(s) | BenQ 1440p 60 Hz 27-inch |

| Case | Corsair Carbide 100R |

| Audio Device(s) | ASUS SupremeFX S1220A |

| Power Supply | Cooler Master MWE Gold 650W |

| Mouse | ASUS ROG Strix Impact |

| Keyboard | Gamdias Hermes E2 |

| Software | Windows 11 Pro |

Intel Corporation today reported second-quarter 2022 financial results. "This quarter's results were below the standards we have set for the company and our shareholders. We must and will do better. The sudden and rapid decline in economic activity was the largest driver, but the shortfall also reflects our own execution issues," said Pat Gelsinger, Intel CEO. "We are being responsive to changing business conditions, working closely with our customers while remaining laser-focused on our strategy and long-term opportunities. We are embracing this challenging environment to accelerate our transformation."

"We are taking necessary actions to manage through the current environment, including accelerating the deployment of our smart capital strategy, while reiterating our prior full-year adjusted free cash flow guidance and returning gross margins to our target range by the fourth quarter," said David Zinsner, Intel CFO. "We remain fully committed to our business strategy, the long-term financial model communicated at our investor meeting and a strong and growing dividend."

Business Unit Summary

Intel previously announced several organizational changes to accelerate its execution and innovation by allowing it to capture growth in both large traditional markets and high-growth emerging markets. This includes the reorganization of Intel's business units to capture this growth and provide increased transparency, focus and accountability. As a result, the company modified its segment reporting to align to the previously announced business reorganization. All prior-period segment data has been retrospectively adjusted to reflect the way the company internally manages and monitors operating segment performance starting in fiscal year 2022.

Business Highlights

Intel's guidance for the third quarter and full year includes both GAAP and non-GAAP estimates. Reconciliations between GAAP and non-GAAP financial measures are included below.

View at TechPowerUp Main Site

"We are taking necessary actions to manage through the current environment, including accelerating the deployment of our smart capital strategy, while reiterating our prior full-year adjusted free cash flow guidance and returning gross margins to our target range by the fourth quarter," said David Zinsner, Intel CFO. "We remain fully committed to our business strategy, the long-term financial model communicated at our investor meeting and a strong and growing dividend."

Business Unit Summary

Intel previously announced several organizational changes to accelerate its execution and innovation by allowing it to capture growth in both large traditional markets and high-growth emerging markets. This includes the reorganization of Intel's business units to capture this growth and provide increased transparency, focus and accountability. As a result, the company modified its segment reporting to align to the previously announced business reorganization. All prior-period segment data has been retrospectively adjusted to reflect the way the company internally manages and monitors operating segment performance starting in fiscal year 2022.

Business Highlights

- Intel made significant progress during the quarter on the ramp of Intel 7, now shipping in aggregate over 35 million units. The company expects Intel 4 to be ready for volume production in the second half of this year and is at or ahead of schedule for Intel 3, 20A and 18A.

- IFS recently announced a strategic partnership with MediaTek to manufacture chips for a range of smart edge devices using Intel process technologies. During the quarter, Intel also launched the IFS Cloud Alliance, the next phase of its accelerator ecosystem program that will enable secure design environments in the cloud.

- In the second quarter, CCG launched the 12th generation Intel Core HX processors, the final products in Intel's Alder Lake family, which is now powering more than 525 designs.

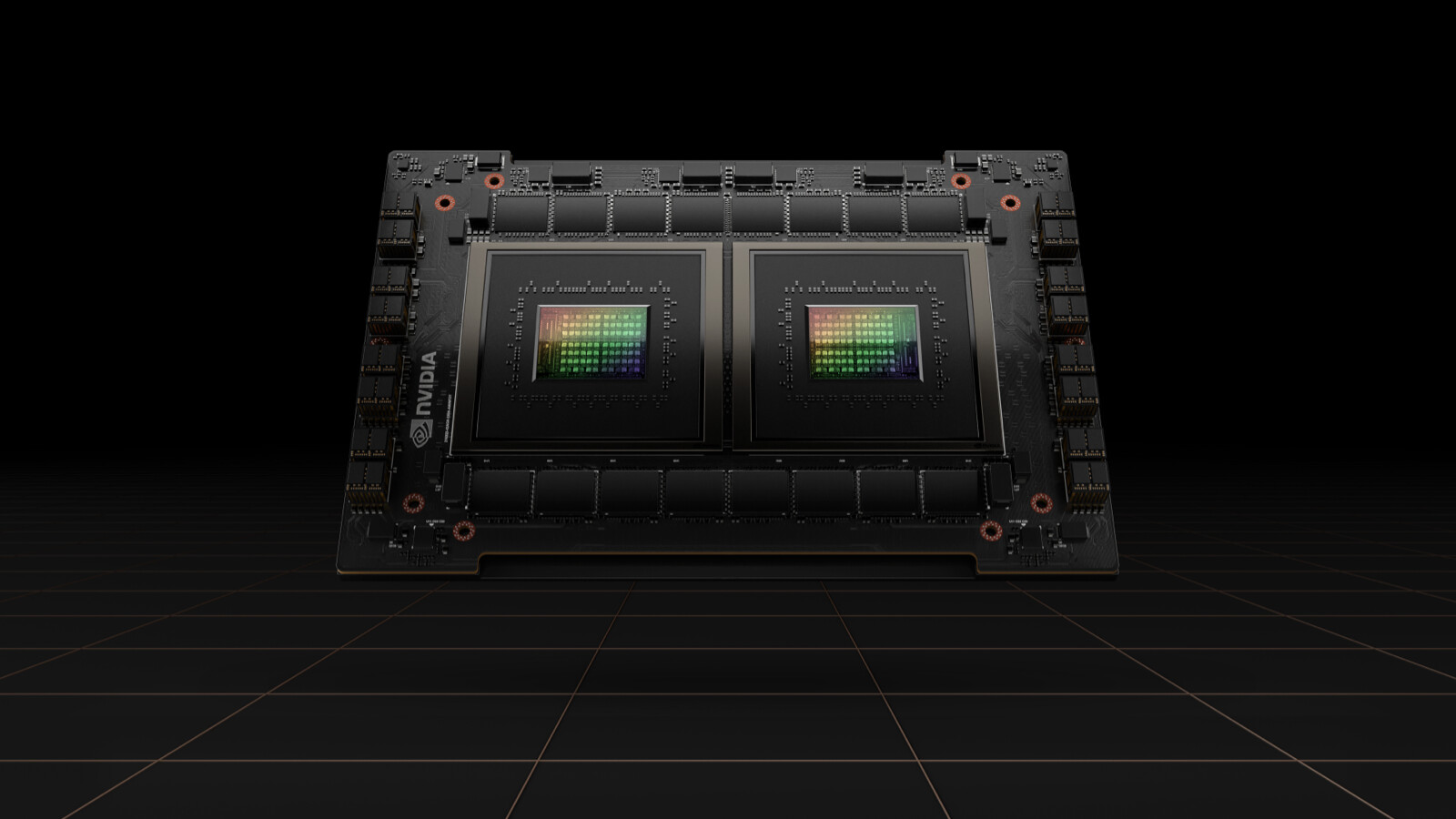

- In DCAI, Intel expanded its supply agreement with Meta, leveraging its IDM advantage so that Meta can meet its expanding compute needs. In the quarter, Intel agreed to expand its partnership with AWS to include the co-development of multi-generational data center solutions optimized for AWS infrastructure, and Intel as a strategic customer for internal workloads, including EDA. Intel expects these custom Intel Xeon solutions will bring greater levels of differentiation and a durable TCO advantage to AWS and its customers, including Intel. In addition, NVIDIA announced its selection of Sapphire Rapids for use in its new DGX-H100, which will couple Sapphire Rapids with NVIDIA's Hopper GPUs to deliver unprecedented AI performance.

- NEX achieved record revenue and began shipping Mount Evans, a 200G ASIC IPU, which was co-developed and is beginning to ramp with a large hyperscaler. In addition, the Intel Xeon D processor is ramping with leading companies across industries.

- AXG shipped Intel's first Intel Blockscale ASIC, and the Intel Arc A-series GPUs for laptops began shipping with OEMs, including Samsung, Lenovo, Acer, HP and ASUS.

- Mobileye achieved record revenue in the quarter with first half 2022 design wins generating 37 million units of projected future business.

Intel's guidance for the third quarter and full year includes both GAAP and non-GAAP estimates. Reconciliations between GAAP and non-GAAP financial measures are included below.

View at TechPowerUp Main Site