- Joined

- Oct 9, 2007

- Messages

- 47,587 (7.45/day)

- Location

- Dublin, Ireland

| System Name | RBMK-1000 |

|---|---|

| Processor | AMD Ryzen 7 5700G |

| Motherboard | Gigabyte B550 AORUS Elite V2 |

| Cooling | DeepCool Gammax L240 V2 |

| Memory | 2x 16GB DDR4-3200 |

| Video Card(s) | Galax RTX 4070 Ti EX |

| Storage | Samsung 990 1TB |

| Display(s) | BenQ 1440p 60 Hz 27-inch |

| Case | Corsair Carbide 100R |

| Audio Device(s) | ASUS SupremeFX S1220A |

| Power Supply | Cooler Master MWE Gold 650W |

| Mouse | ASUS ROG Strix Impact |

| Keyboard | Gamdias Hermes E2 |

| Software | Windows 11 Pro |

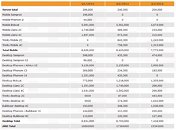

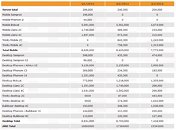

Despite losing in market share to Intel, AMD has reason to cheer as its APU gambit is beginning to pay off. According to the latest architecture- and core count-specific sales figures for AMD given out by Mercury Research detailing Q3-2013 in context of two preceding quarters, APUs make for nearly 75% of AMD's processor sales, and the company's recently-launched "Trinity" line of desktop and mobile APUs are off to a flying start.

The most popular chips in AMD's stable are its "Bobcat" Zacate series low-power APUs, which are being built into entry-level computing devices such as netbooks, nettops, and all-in-one desktops. The chips make up 39 percent of AMD's sales in Q3, followed by another APU line, the A-Series "Trinity", which is available in desktop and mobile variants, offers a combination of a fast integrated graphics processor with up to four CPU cores, and makes up 26.1 percent of AMD's sales. AMD's A-Series "Llano" can still be bought in the market, and makes up 7.4 percent of AMD's sales in Q3.

The picture is rather dull over at AMD's non-APU processor lineup, based on Bulldozer and K10/10.5 architectures. Vishera numebrs are not included in the research, as they are very recently launched. Despite being the older architecture, AMD's K10/K10.5 architecture, which makes up Phenom II series processors, outsold Bulldozer by nearly two times. Non-APU processor make up a little over a fourth of AMD's sales. Given this, it wouldn't be far-fetched to think that AMD is better off consolidating its resources to developing its APU line.

The research even included AMD's sales (in units, not revenue) across the desktop, server, and mobile lines. While the desktop and mobile lines are evenly matched, the server line has an insignificant 1.3 sales percentage. The finer numbers are tabled above.

View at TechPowerUp Main Site

The most popular chips in AMD's stable are its "Bobcat" Zacate series low-power APUs, which are being built into entry-level computing devices such as netbooks, nettops, and all-in-one desktops. The chips make up 39 percent of AMD's sales in Q3, followed by another APU line, the A-Series "Trinity", which is available in desktop and mobile variants, offers a combination of a fast integrated graphics processor with up to four CPU cores, and makes up 26.1 percent of AMD's sales. AMD's A-Series "Llano" can still be bought in the market, and makes up 7.4 percent of AMD's sales in Q3.

The picture is rather dull over at AMD's non-APU processor lineup, based on Bulldozer and K10/10.5 architectures. Vishera numebrs are not included in the research, as they are very recently launched. Despite being the older architecture, AMD's K10/K10.5 architecture, which makes up Phenom II series processors, outsold Bulldozer by nearly two times. Non-APU processor make up a little over a fourth of AMD's sales. Given this, it wouldn't be far-fetched to think that AMD is better off consolidating its resources to developing its APU line.

The research even included AMD's sales (in units, not revenue) across the desktop, server, and mobile lines. While the desktop and mobile lines are evenly matched, the server line has an insignificant 1.3 sales percentage. The finer numbers are tabled above.

View at TechPowerUp Main Site