- Joined

- Dec 6, 2011

- Messages

- 4,784 (1.00/day)

- Location

- Still on the East Side

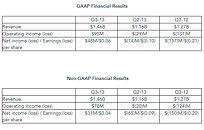

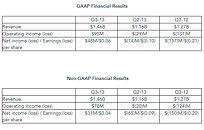

AMD today announced revenue for the third quarter of 2013 of $1.46 billion, operating income of $95 million and net income of $48 million, or $0.06 per share. The company reported non-GAAP operating income of $78 million and non-GAAP net income of $31 million, or $0.04 per share.

"AMD returned to profitability and generated free cash flow in the third quarter as we continued to successfully execute the strategic transformation plan we outlined a year ago," said Rory Read, AMD president and CEO. "We achieved 26 percent sequential revenue growth driven by our semi-custom business and remain committed to generating approximately 50 percent of revenue from high-growth markets over the next two years. Developing industry-leading technology remains at our core, and we are in the middle of a multi-year journey to redefine AMD as a leader across a more diverse set of growth markets."

Quarterly Financial Summary

Recent Highlights

Current Outlook

For the fourth quarter of 2013, AMD expects revenue to increase 5 percent, plus or minus 3 percent, sequentially.

View at TechPowerUp Main Site

"AMD returned to profitability and generated free cash flow in the third quarter as we continued to successfully execute the strategic transformation plan we outlined a year ago," said Rory Read, AMD president and CEO. "We achieved 26 percent sequential revenue growth driven by our semi-custom business and remain committed to generating approximately 50 percent of revenue from high-growth markets over the next two years. Developing industry-leading technology remains at our core, and we are in the middle of a multi-year journey to redefine AMD as a leader across a more diverse set of growth markets."

Quarterly Financial Summary

- Gross margin was 36 percent in Q3 2013.

Gross margin decreased sequentially. Q3 2013 gross margin included a $19 million benefit, approximately 1 percentage point, from the sale of inventory that had been previously reserved in Q3 2012 as compared to a similar $11 million benefit, approximately 1 percentage point, in Q2 2013. - Cash, cash equivalents and marketable securities balance, including long-term marketable securities, was $1.2 billion at the end of the quarter, slightly above our targeted optimal level of $1.1 billion.

- Computing Solutions segment revenue decreased 6 percent sequentially and decreased 15 percent year-over-year. The sequential and year-over-year declines were due to decreased notebook and chipset unit shipments, partially offset by an increase in desktop unit shipments.

Operating income was $22 million, compared with operating income of $2 million in Q2 2013 and an operating loss of $114 million in Q3 2012. The Q3 2012 operating loss included an inventory write-down of approximately $100 million primarily consisting of first generation A-Series accelerated processing units (APUs).

Microprocessor Average Selling Price (ASP) was flat sequentially and decreased year-over-year. - Graphics and Visual Solutions (GVS) is comprised of graphics processing units (GPUs), including professional graphics, as well as semi-custom products and development and game console royalties.

GVS segment revenue increased 110 percent sequentially and increased 96 percent year-over-year driven largely by our semi-custom business. GPU revenue declined sequentially and year-over-year. In the third quarter customers began transitioning to our new products late in the quarter.

Operating income was $79 million compared with breakeven in Q2 2013 and $18 million in Q3 2012.

GPU ASP decreased sequentially and year-over-year.

Recent Highlights

- AMD announced the AMD Radeon R7 and R9 Series graphics cards. Based on the award-winning Graphics Core Next (GCN) architecture, the AMD Radeon R7 Series graphics cards support AMD's "Mantle" technology which enables game developers to more easily harness the full capabilities of the GCN cores across both PCs and consoles to offer an unmatched level of hardware optimization, revolutionary performance and image quality. AMD's newest graphics chips also include AMD TrueAudio Technology, the world's first fully programmable audio pipeline on a graphics card.

- Verizon announced that its high-performance public cloud with best-in-class reliability is powered by AMD's SeaMicro SM15000 servers.

- As a part of driving the company's growth in embedded markets, AMD extended its embedded System-on-a-Chip (SoC) product portfolio with the launch of a new low-power AMD Embedded G-Series SOC for fanless designs at approximately 3-watts average power. AMD also detailed its plans to become the first and only company to offer both 64-bit ARM and x86 embedded solutions starting in 2014.

- Toshiba and HP announced new 2-in-1 PCs based on the 2013 AMD Elite Mobility APU. These innovative designs offer the full Windows 8 touch PC experience in a notebook that performs equally well as a tablet when desired.

- HP announced the new thin and light HP ZBook 14 mobile workstations that rely on AMD FirePro professional graphics.

- AMD selected SAPPHIRE Technology to be the exclusive global distribution partner for AMD FirePro professional graphics, driving stronger support for AMD FirePro professional graphics by delivering new distribution resources to AMD's channel ecosystem companies worldwide.

- AMD and Mixamo introduced the world's first real-time facial capture technology for the Unity game development platform, enabling developers to capture their facial expressions through standard webcams and transfer them in real time onto a 3D character.

- AMD announced senior leaders from ARM, DICE/Electronic Arts, Imagination Technologies, Mediatek USA, Oracle, Sony and Unity Technologies will keynote APU13, the company's third annual developer conference.

- Adobe announced further enhancements to its Adobe Creative Cloud suite to accelerate the performance and improve the quality of its applications when running on AMD APUs and discrete GPUs.

- AMD was recognized for its excellence in corporate responsibility, making the Dow Jones Sustainability Index for the ninth consecutive year.

Current Outlook

For the fourth quarter of 2013, AMD expects revenue to increase 5 percent, plus or minus 3 percent, sequentially.

View at TechPowerUp Main Site

. That might be exaggerating, but it's non the less a world I wouldn't like to be in.

. That might be exaggerating, but it's non the less a world I wouldn't like to be in.