- Joined

- Dec 6, 2011

- Messages

- 4,784 (0.99/day)

- Location

- Still on the East Side

Jon Peddie Research (JPR), the industry's research and consulting firm for graphics and multimedia, announced estimated graphics add-in-board (AIB) shipments and suppliers' market share for 2014 2Q.

The quarter in general

JPR found that AIB shipments during Q2 2014 behaved according to past years with regard to seasonality, but the decrease was more than the 10-year average. The news was disappointing, quarter-to-quarter, the market dropped 17.5 % (compared to the desktop PC market, which increased 1.3%).

JPR's AIB Report tracks computer add-in graphics boards, which carry discrete graphics chips. AIBs used in desktop PCs, workstations, servers, and other devices such as scientific instruments. They are sold directly to customers as aftermarket products, or are factory installed. In all cases, AIBs represent the higher end of the graphics industry using discrete chips and private high-speed memory, as compared to the integrated GPUs in CPUs that share slower system memory.

On a year-to-year basis, we found that total AIB shipments during the quarter fell 17.6%, which is more than desktop PCs, which declined 1.7%.

However, in spite of the overall decline, which has been caused in part by tablets and embedded graphics, PC gaming momentum continues to build and is the bright spot in the AIB market.

The overall PC desktop market increased quarter-to-quarter including double-attach - the adding of a second (or third) AIB to a system with integrated processor graphics - and to a lesser extent, dual AIBs in performance desktop machines using either AMD's Crossfire or Nvidia's SLI technology.

The attach rate of AIBs to desktop PCs has declined from a high of 63% in Q1 2008 to 36% in 2014 2Q, down from 44% last quarter.

The change from quarter to quarter was significantly greater less than last year, down -17.5% this quarter compared to down -5.5% a year ago.

The AIB market now has just four chip (GPU) suppliers, who also build and sell AIBs. The primary suppliers of GPUs are AMD and Nvidia. There are 50 AIB suppliers, the AIB OEM customers of the GPU suppliers, which they call "partners."

In addition to privately branded AIBs offered worldwide, about a dozen PC suppliers offer AIBs as part of a system, and/or as an option, and some that offer AIBs as separate aftermarket products.

We have been tracking AIB shipments quarterly since 1987 - the volume of those boards peaked in 1999, reaching 114 million units, in 2013 65 million shipped.

View at TechPowerUp Main Site

The quarter in general

JPR found that AIB shipments during Q2 2014 behaved according to past years with regard to seasonality, but the decrease was more than the 10-year average. The news was disappointing, quarter-to-quarter, the market dropped 17.5 % (compared to the desktop PC market, which increased 1.3%).

- Total AIB shipments decreased this quarter to 11.5 million units from last quarter.

- AMD's quarter-to-quarter total desktop AIB unit shipments decreased 10.7%.

- Nvidia's quarter-to-quarter unit shipments decreased 21%.

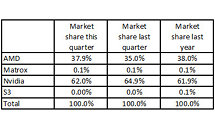

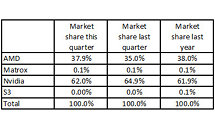

- Nvidia continues to hold a dominant market share position at 62%.

- Figures for the other suppliers were flat to declining.

JPR's AIB Report tracks computer add-in graphics boards, which carry discrete graphics chips. AIBs used in desktop PCs, workstations, servers, and other devices such as scientific instruments. They are sold directly to customers as aftermarket products, or are factory installed. In all cases, AIBs represent the higher end of the graphics industry using discrete chips and private high-speed memory, as compared to the integrated GPUs in CPUs that share slower system memory.

On a year-to-year basis, we found that total AIB shipments during the quarter fell 17.6%, which is more than desktop PCs, which declined 1.7%.

However, in spite of the overall decline, which has been caused in part by tablets and embedded graphics, PC gaming momentum continues to build and is the bright spot in the AIB market.

The overall PC desktop market increased quarter-to-quarter including double-attach - the adding of a second (or third) AIB to a system with integrated processor graphics - and to a lesser extent, dual AIBs in performance desktop machines using either AMD's Crossfire or Nvidia's SLI technology.

The attach rate of AIBs to desktop PCs has declined from a high of 63% in Q1 2008 to 36% in 2014 2Q, down from 44% last quarter.

The change from quarter to quarter was significantly greater less than last year, down -17.5% this quarter compared to down -5.5% a year ago.

The AIB market now has just four chip (GPU) suppliers, who also build and sell AIBs. The primary suppliers of GPUs are AMD and Nvidia. There are 50 AIB suppliers, the AIB OEM customers of the GPU suppliers, which they call "partners."

In addition to privately branded AIBs offered worldwide, about a dozen PC suppliers offer AIBs as part of a system, and/or as an option, and some that offer AIBs as separate aftermarket products.

We have been tracking AIB shipments quarterly since 1987 - the volume of those boards peaked in 1999, reaching 114 million units, in 2013 65 million shipped.

View at TechPowerUp Main Site