- Joined

- Dec 6, 2011

- Messages

- 4,784 (0.98/day)

- Location

- Still on the East Side

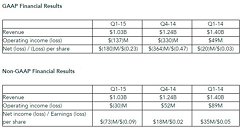

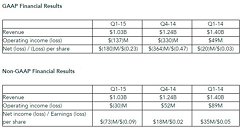

AMD today announced revenue for the first quarter of 2015 of $1.03 billion, operating loss of $137 million and net loss of $180 million, or $0.23 per share. Non-GAAP operating loss was $30 million and non-GAAP net loss was $73 million, or $0.09 per share.

"Building great products, driving deeper customer relationships and simplifying our business remain the right long-term steps to strengthen AMD and improve our financial performance," said Dr. Lisa Su, AMD president and CEO. "Under the backdrop of a challenging PC environment, we are focused on improving our near-term financial results and delivering a stronger second half of the year based on completing our work to rebalance channel inventories and shipping strong new products."

Q1 2015 Results

Other Corporate Events

Financial Segment Summary

Recent Highlights

Current Outlook

For Q2 2015, AMD expects revenue to decrease 3 percent, plus or minus 3 percent, sequentially.

View at TechPowerUp Main Site

"Building great products, driving deeper customer relationships and simplifying our business remain the right long-term steps to strengthen AMD and improve our financial performance," said Dr. Lisa Su, AMD president and CEO. "Under the backdrop of a challenging PC environment, we are focused on improving our near-term financial results and delivering a stronger second half of the year based on completing our work to rebalance channel inventories and shipping strong new products."

Q1 2015 Results

- Revenue of $1.03 billion, down 17 percent sequentially and 26 percent year-over-year.

- Gross margin of 32 percent, up 3 percentage points sequentially, primarily due to a lower of cost or market inventory adjustment in Q4 2014. Non-GAAP gross margin of 32 percent, decreased 2 percentage points sequentially due to product mix and lower game console royalties in the first quarter.

- Operating loss of $137 million, compared to an operating loss of $330 million for the prior quarter, which included a goodwill impairment and a lower of cost or market inventory adjustment in Q4 2014. Non-GAAP operating loss of $30 million, compared to non-GAAP operating income of $52 million in Q4 2014, primarily due to lower revenue and gross margin.

- Net loss of $180 million, loss per share of $0.23, and non-GAAP net loss of $73 million, non-GAAP loss per share of $0.09, compared to a net loss of $364 million, loss per share of $0.47 and non-GAAP net income of $18 million, non-GAAP earnings per share of $0.02 in Q4 2014.

- Cash, cash equivalents and marketable securities were $906 million at the end of the quarter, down $134 million from the end of the prior quarter.

- Total debt at the end of the quarter was $2.27 billion, up $56 million from the prior quarter.

Other Corporate Events

- As a part of the strategy to simplify and sharpen the company's investment focus, AMD is exiting the dense server systems business, formerly SeaMicro, effective immediately.

AMD recorded $75 million of special charges in Q1 2015 primarily related to impairment of previously acquired intangible assets. - AMD entered into a fifth amendment to our Wafer Supply Agreement with GLOBALFOUNDRIES. AMD expects to purchase approximately $1 billion in wafers in 2015, in line with the company's current market expectations.

Financial Segment Summary

- Computing and Graphics segment revenue decreased 20 percent sequentially and 38 percent from Q1 2014. The sequential decrease was primarily due to lower desktop and notebook processor sales and the annual decrease was driven by lower desktop processor sales and GPU channel sales.

Operating loss was $75 million, compared with an operating loss of $56 million in Q4 2014 and operating income of $3 million in Q1 2014. The sequential decrease was primarily driven by lower desktop and notebook processor sales, partially offset by lower operating expenses. The year-over-year decrease was primarily driven by lower desktop processor sales.

Client average selling price (ASP) decreased sequentially and increased year-over-year primarily driven by processor product sales mix.

GPU ASP increased sequentially primarily due to higher channel GPU and Professional Graphics ASPs and decreased year-over-year primarily due to a lower channel ASP. - Enterprise, Embedded and Semi-Custom segment revenue decreased 14 percent sequentially, primarily driven by seasonally lower sales of semi-custom SoCs. The year-over-year decrease of 7 percent was primarily driven by lower server processor sales.

Operating income was $45 million compared with $109 million in Q4 2014 and $85 million in Q1 2014, primarily due to lower game console royalties, product mix and higher R&D spending. - All Other category operating loss was $107 million compared with losses of $383 million in Q4 2014 and $39 million in Q1 2014. The sequential decrease was primarily due to the absence of the Q4 2014 goodwill impairment of $233 million and the lower of cost or market inventory adjustment of $58 million. The year-over-year increase was primarily due to $87 million restructuring and other special charges, consisting primarily of $75 million related to the exiting of the dense server systems business.

Recent Highlights

- AMD provided details of the energy efficiency and design advances in the upcoming A-Series APU (codenamed "Carrizo") which is expected to deliver double digit percentage increases in both performance and battery life compared to the previous generation.

- AMD joined other HSA Foundation members including ARM, LG Electronics, MediaTek, Qualcomm, and Samsung to release the HSA 1.0 specification, bringing the industry one step closer to delivering true heterogeneous computing across the billons of modern SoCs powering mobile devices, desktop PCs, high-performance computing (HPC) systems, and servers.

- Adoption of AMD's high-performance APUs in key embedded markets continued with new product introductions from Samsung Electronics, GE Intelligent Platforms and Fujitsu.

- AMD continued to secure new design wins and expand ecosystem support for the AMD FirePro professional graphics cards and server GPUs.

With the addition of the second-generation HP ZBook 14 G2 and 15u G2 Mobile Workstations, AMD FirePro professional graphics are now available in high-end to entry-level HP ZBook solutions.

The AMD FirePro server GPU is now available on the HP ProLiant DL380 Gen9, the world's best-selling server, targeting a variety of specialized applications including Academic and Government clusters, Oil and Gas research, and Deep Neural Networks. - Acer, BenQ and LG Electronics began offering displays supporting AMD FreeSync technology, designed to enable fluid gaming and video playback at virtually any frame. Asus, Nixeus, Samsung and Viewsonic have also announced plans to introduce new monitors supporting the technology in the first half of 2015.

- AMD announced the LiquidVR initiative in close collaboration with key technology partners to deliver the next-generation of Virtual Reality capable of delivering immersive awareness where situations, objects, or characters within the virtual world seem "real."

- AMD continued fostering the development of the 64-bit ARM-based server and embedded ecosystem with announcements that a growing base of operating systems and hypervisors will support AMD's forthcoming 64-bit ARM processor. In addition to OpenSUSE13.2, the Linux 3.19 kernel, Fedora 21 and Xen 4.5 will all support the AMD Opteron A1100 Series processor.

Current Outlook

For Q2 2015, AMD expects revenue to decrease 3 percent, plus or minus 3 percent, sequentially.

View at TechPowerUp Main Site