Raevenlord

News Editor

- Joined

- Aug 12, 2016

- Messages

- 3,755 (1.16/day)

- Location

- Portugal

| System Name | The Ryzening |

|---|---|

| Processor | AMD Ryzen 9 5900X |

| Motherboard | MSI X570 MAG TOMAHAWK |

| Cooling | Lian Li Galahad 360mm AIO |

| Memory | 32 GB G.Skill Trident Z F4-3733 (4x 8 GB) |

| Video Card(s) | Gigabyte RTX 3070 Ti |

| Storage | Boot: Transcend MTE220S 2TB, Kintson A2000 1TB, Seagate Firewolf Pro 14 TB |

| Display(s) | Acer Nitro VG270UP (1440p 144 Hz IPS) |

| Case | Lian Li O11DX Dynamic White |

| Audio Device(s) | iFi Audio Zen DAC |

| Power Supply | Seasonic Focus+ 750 W |

| Mouse | Cooler Master Masterkeys Lite L |

| Keyboard | Cooler Master Masterkeys Lite L |

| Software | Windows 10 x64 |

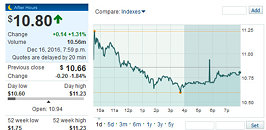

AMD has definitely been on the upswing in recent times, with CEO Lisa Su having seemingly conducted a frail, collapsing company through the muddiest waters in its history. The general sentiment towards the company seems to now be leaning towards the "bullish" side of the equation, which translated into a cool $10.66 per stock at Friday's closing time (having increased, after hours, towards the $10.80 mark. This is great news for a company which has essentially increased their stock value by a factor of four in the last year alone.

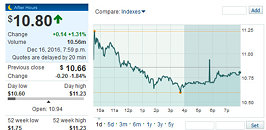

Shares of AMD's rival Nvidia, however, have risen 60% in the past three months and nearly 200% in the past year. NVIDIA's share value closed last Friday at a historic $100.41 (having since declined towards $99.55), over a strong bullish sentiment towards the company, which has recently signed a Warrant Termination Agreement with Goldman Sachs for a $63 million value. This basically shows investors that the company has sufficient cash so as not to allow them to see their share value diluted by the sudden entry in circulation of $63 million of shares, should Goldman Sachs exercise their (now terminated) warrant.

AMD's recent showings of strength in both the CPU (with their recent Ryzen announcement and performance figures against their rival Intel's parts) and GPU space (with the company having increased their market share through an aggressive mid-range push with their RX 480, RX 470, and RX 460 graphics products, as well as ever increasing VEGA showcases) seem to have increased investor confidence in the company's stocks. Expectations are high regarding AMD's ability to deliver, though all of the company's hard-work can potentially be undone by a repeat of their Bulldozer architecture debut.

NVIDIA, on the other hand, has been cementing its position in the AI and compute segments, particularly in the automotive segment, whilst consistently delivering their product line-ups and performance expectations in all market segments. Also, their latest design win with Nintendo's next-generation Switch console (which will make use of a Maxwell-based Tegra chip) and their recent Warrant Termination Agreement with Goldman Sachs have sat well with investors, increasing the company's standing as a bullish investment.

It really does go to show, though, how much of an uphill battle AMD has cut out for itself in the segments it competes on: on the CPU side, the gigantic, black-hole like Intel Corporation, with more funds available for R&D than AMD has in total market value; and on the graphics and computing side of the equation, NVIDIA, with a market capitalization ten times greater than the little, mean, red team. Whether you love or you hate the company, it can't really be denied that AMD has, for the past few years, been the technological manifestation of David, throwing some respectable (if sometimes underwhelming) punches with the Golias' of the tech world.

View at TechPowerUp Main Site

Shares of AMD's rival Nvidia, however, have risen 60% in the past three months and nearly 200% in the past year. NVIDIA's share value closed last Friday at a historic $100.41 (having since declined towards $99.55), over a strong bullish sentiment towards the company, which has recently signed a Warrant Termination Agreement with Goldman Sachs for a $63 million value. This basically shows investors that the company has sufficient cash so as not to allow them to see their share value diluted by the sudden entry in circulation of $63 million of shares, should Goldman Sachs exercise their (now terminated) warrant.

AMD's recent showings of strength in both the CPU (with their recent Ryzen announcement and performance figures against their rival Intel's parts) and GPU space (with the company having increased their market share through an aggressive mid-range push with their RX 480, RX 470, and RX 460 graphics products, as well as ever increasing VEGA showcases) seem to have increased investor confidence in the company's stocks. Expectations are high regarding AMD's ability to deliver, though all of the company's hard-work can potentially be undone by a repeat of their Bulldozer architecture debut.

NVIDIA, on the other hand, has been cementing its position in the AI and compute segments, particularly in the automotive segment, whilst consistently delivering their product line-ups and performance expectations in all market segments. Also, their latest design win with Nintendo's next-generation Switch console (which will make use of a Maxwell-based Tegra chip) and their recent Warrant Termination Agreement with Goldman Sachs have sat well with investors, increasing the company's standing as a bullish investment.

It really does go to show, though, how much of an uphill battle AMD has cut out for itself in the segments it competes on: on the CPU side, the gigantic, black-hole like Intel Corporation, with more funds available for R&D than AMD has in total market value; and on the graphics and computing side of the equation, NVIDIA, with a market capitalization ten times greater than the little, mean, red team. Whether you love or you hate the company, it can't really be denied that AMD has, for the past few years, been the technological manifestation of David, throwing some respectable (if sometimes underwhelming) punches with the Golias' of the tech world.

View at TechPowerUp Main Site