Raevenlord

News Editor

- Joined

- Aug 12, 2016

- Messages

- 3,755 (1.19/day)

- Location

- Portugal

| System Name | The Ryzening |

|---|---|

| Processor | AMD Ryzen 9 5900X |

| Motherboard | MSI X570 MAG TOMAHAWK |

| Cooling | Lian Li Galahad 360mm AIO |

| Memory | 32 GB G.Skill Trident Z F4-3733 (4x 8 GB) |

| Video Card(s) | Gigabyte RTX 3070 Ti |

| Storage | Boot: Transcend MTE220S 2TB, Kintson A2000 1TB, Seagate Firewolf Pro 14 TB |

| Display(s) | Acer Nitro VG270UP (1440p 144 Hz IPS) |

| Case | Lian Li O11DX Dynamic White |

| Audio Device(s) | iFi Audio Zen DAC |

| Power Supply | Seasonic Focus+ 750 W |

| Mouse | Cooler Master Masterkeys Lite L |

| Keyboard | Cooler Master Masterkeys Lite L |

| Software | Windows 10 x64 |

Toshiba may not be dead in the water just yet, but news are dire for the company. After the company confirmed it was looking to spin-off its NAND production business so as to sell a minority, 20% stake for much-needed liquidity in the face of amounting debt and multiple management mistakes, reports now announce a much more aggressive stance from the company. It is now apparently looking to sell a majority stake (60%) on the spin-off, in the face of escalating costs and dwindling prospective chances.

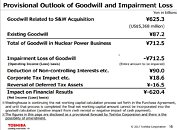

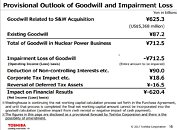

This comes in the wake of recent snags and strategic mistakes for the company, as we've previously reported - such as the $1.2 billion dollar accounting "misstated" earnings, which created difficulties for the company to refinance itself in the Tokyo Stock Exchange, and the gross miscalculation on the amount of debt of the CB&I Stone and Webster company that Toshiba acquired so as to facilitate its U.S.-based Westinghouse Electric nuclear plant subsidiary investment. This "miscalculation", where Toshiba considered the "goodwill" booking charges at $87 million and which were recently restated at a roughly-defined "several billion U.S. dollars." now stand at an eye-watering $6.3 billion.

For Toshiba, NAND flash production is strategically important because it enables the company to produce all types of storage devices in-house, allowing it to keep total production verticality, from product development, inception and design, all the way towards parts manufacturing and assembly - which leads to higher margins on each product sold. And it has to be said: selling of your most profitable business may be a short-term need, but it's surely a long-term risk. And with only a 40% stake in its most profitable business remaining, Toshiba stands to face difficult times.

The company is currently one of the world's largest NAND producers, and there are (as always) sharks hovering around the company. Tsinghua Unigroup, one of the branches of Chinese state-controlled Tsinghua University, has been listed as a possible investor. If successful in this investing effort, this would mean that Tsinghua (and through it, the Chinese government) would be able to achieve in-house semiconductor production. And this investment is looking ever more likely with Toshiba itself admitting to being wary of an investment from its partner WD, whose intervention could spark a long regulatory approval process, prospectively killing the immediacy of Toshiba's predicament.

View at TechPowerUp Main Site

This comes in the wake of recent snags and strategic mistakes for the company, as we've previously reported - such as the $1.2 billion dollar accounting "misstated" earnings, which created difficulties for the company to refinance itself in the Tokyo Stock Exchange, and the gross miscalculation on the amount of debt of the CB&I Stone and Webster company that Toshiba acquired so as to facilitate its U.S.-based Westinghouse Electric nuclear plant subsidiary investment. This "miscalculation", where Toshiba considered the "goodwill" booking charges at $87 million and which were recently restated at a roughly-defined "several billion U.S. dollars." now stand at an eye-watering $6.3 billion.

For Toshiba, NAND flash production is strategically important because it enables the company to produce all types of storage devices in-house, allowing it to keep total production verticality, from product development, inception and design, all the way towards parts manufacturing and assembly - which leads to higher margins on each product sold. And it has to be said: selling of your most profitable business may be a short-term need, but it's surely a long-term risk. And with only a 40% stake in its most profitable business remaining, Toshiba stands to face difficult times.

The company is currently one of the world's largest NAND producers, and there are (as always) sharks hovering around the company. Tsinghua Unigroup, one of the branches of Chinese state-controlled Tsinghua University, has been listed as a possible investor. If successful in this investing effort, this would mean that Tsinghua (and through it, the Chinese government) would be able to achieve in-house semiconductor production. And this investment is looking ever more likely with Toshiba itself admitting to being wary of an investment from its partner WD, whose intervention could spark a long regulatory approval process, prospectively killing the immediacy of Toshiba's predicament.

View at TechPowerUp Main Site