- Joined

- Oct 9, 2007

- Messages

- 47,241 (7.55/day)

- Location

- Hyderabad, India

| System Name | RBMK-1000 |

|---|---|

| Processor | AMD Ryzen 7 5700G |

| Motherboard | ASUS ROG Strix B450-E Gaming |

| Cooling | DeepCool Gammax L240 V2 |

| Memory | 2x 8GB G.Skill Sniper X |

| Video Card(s) | Palit GeForce RTX 2080 SUPER GameRock |

| Storage | Western Digital Black NVMe 512GB |

| Display(s) | BenQ 1440p 60 Hz 27-inch |

| Case | Corsair Carbide 100R |

| Audio Device(s) | ASUS SupremeFX S1220A |

| Power Supply | Cooler Master MWE Gold 650W |

| Mouse | ASUS ROG Strix Impact |

| Keyboard | Gamdias Hermes E2 |

| Software | Windows 11 Pro |

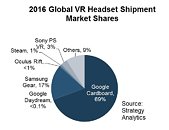

2016 saw the launch of multiple new VR platforms vying for consumer, developer and enterprise attention. The Strategy Analytics report "VR Headset Platform Market Share Year End 2016" estimates that over 30 million VR headsets shipped, split between 6 major competing VR platforms in an increasingly fragmented landscape.

David MacQueen, Executive Director of Strategy Analytics' Virtual Reality Ecosystem research program, noted, "2016 certainly was a busy year in VR. Appearing alongside Google Cardboard were new platforms Google Daydream, Samsung Gear VR, Oculus Rift, PlayStation VR and SteamVR, currently served by the HTC Vive device, although more vendors will join this platform in 2017."

"Our data shows that Google has a commanding lead in terms of shipments and installed base for its ultra-low cost Cardboard VR platform, and the size of the audience is already attracting marketers and brands looking to use VR as a promotional tool. However, it accounted for merely 12% revenue share. The higher-spec smartphone VR platform, Samsung Gear VR, took top spot by revenues with a 35% revenue share. Sony's successful PS VR launch sees that platform take second place by revenues, and between them Sony and Samsung captured more than half of VR hardware revenues in 2016".

Cliff Raskind, Senior Director at Strategy Analytics, added, "The successful push of VR hardware to consumers through direct sales, bundling and even giving devices away, is seeding the market and creating the audience required for successful ecosystems to grow. However, 6 competing ecosystems makes for a market which is crowded and fragmented. 2017 is sure to be an interesting year and we expect some shakedown as the competing ecosystems either cement their position or fall by the wayside. Hardware revenues or audience alone will not be enough to win, and we will continue to track the ecosystem evolution as new use cases, apps, and industries beyond gaming and media grow the market for VR and AR."

Strategy Analytics analysts will present our latest insights into the smart connected device ecosystem at MWC Barcelona.

View at TechPowerUp Main Site

David MacQueen, Executive Director of Strategy Analytics' Virtual Reality Ecosystem research program, noted, "2016 certainly was a busy year in VR. Appearing alongside Google Cardboard were new platforms Google Daydream, Samsung Gear VR, Oculus Rift, PlayStation VR and SteamVR, currently served by the HTC Vive device, although more vendors will join this platform in 2017."

"Our data shows that Google has a commanding lead in terms of shipments and installed base for its ultra-low cost Cardboard VR platform, and the size of the audience is already attracting marketers and brands looking to use VR as a promotional tool. However, it accounted for merely 12% revenue share. The higher-spec smartphone VR platform, Samsung Gear VR, took top spot by revenues with a 35% revenue share. Sony's successful PS VR launch sees that platform take second place by revenues, and between them Sony and Samsung captured more than half of VR hardware revenues in 2016".

Cliff Raskind, Senior Director at Strategy Analytics, added, "The successful push of VR hardware to consumers through direct sales, bundling and even giving devices away, is seeding the market and creating the audience required for successful ecosystems to grow. However, 6 competing ecosystems makes for a market which is crowded and fragmented. 2017 is sure to be an interesting year and we expect some shakedown as the competing ecosystems either cement their position or fall by the wayside. Hardware revenues or audience alone will not be enough to win, and we will continue to track the ecosystem evolution as new use cases, apps, and industries beyond gaming and media grow the market for VR and AR."

Strategy Analytics analysts will present our latest insights into the smart connected device ecosystem at MWC Barcelona.

View at TechPowerUp Main Site