Raevenlord

News Editor

- Joined

- Aug 12, 2016

- Messages

- 3,755 (1.21/day)

- Location

- Portugal

| System Name | The Ryzening |

|---|---|

| Processor | AMD Ryzen 9 5900X |

| Motherboard | MSI X570 MAG TOMAHAWK |

| Cooling | Lian Li Galahad 360mm AIO |

| Memory | 32 GB G.Skill Trident Z F4-3733 (4x 8 GB) |

| Video Card(s) | Gigabyte RTX 3070 Ti |

| Storage | Boot: Transcend MTE220S 2TB, Kintson A2000 1TB, Seagate Firewolf Pro 14 TB |

| Display(s) | Acer Nitro VG270UP (1440p 144 Hz IPS) |

| Case | Lian Li O11DX Dynamic White |

| Audio Device(s) | iFi Audio Zen DAC |

| Power Supply | Seasonic Focus+ 750 W |

| Mouse | Cooler Master Masterkeys Lite L |

| Keyboard | Cooler Master Masterkeys Lite L |

| Software | Windows 10 x64 |

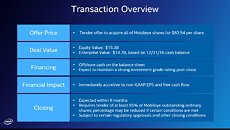

Intel and Mobileye announced on March 13 that they have entered into a definitive agreement pursuant to which Intel will acquire Mobileye. Under the terms of the agreement, a subsidiary of Intel will commence a tender offer to acquire all of the issued and outstanding ordinary shares of Mobileye for $63.54 per share in cash, representing a fully-diluted equity value of approximately $15.3 billion and an enterprise value of $14.7 billion.

The acquisition will couple the best-in-class technologies from both companies, including Intel's high-performance computing and connectivity expertise and Mobileye's leading computer vision expertise to create automated driving solutions from the cloud through the network to the car.

Intel pegs the combination as "expected to accelerate innovation for the automotive industry and position Intel as a leading technology provider in the fast-growing market for highly and fully autonomous vehicles." Intel estimates the vehicle systems, data and services market opportunity to be up to $70 billion by 2030. The transaction extends Intel's strategy to invest in data-intensive market opportunities that build on the company's strengths in computing and connectivity from the cloud, through the network, to the device.

"This acquisition is a great step forward for our shareholders, the automotive industry and consumers," said Brian Krzanich, Intel CEO. "Intel provides critical foundational technologies for autonomous driving including plotting the car's path and making real-time driving decisions. Mobileye brings the industry's best automotive-grade computer vision and strong momentum with automakers and suppliers. Together, we can accelerate the future of autonomous driving with improved performance in a cloud-to-car solution at a lower cost for automakers."

Intel is funding the acquisition with cash straight form its balance sheet, with the transaction being expected to close within 9 months.

View at TechPowerUp Main Site

The acquisition will couple the best-in-class technologies from both companies, including Intel's high-performance computing and connectivity expertise and Mobileye's leading computer vision expertise to create automated driving solutions from the cloud through the network to the car.

Intel pegs the combination as "expected to accelerate innovation for the automotive industry and position Intel as a leading technology provider in the fast-growing market for highly and fully autonomous vehicles." Intel estimates the vehicle systems, data and services market opportunity to be up to $70 billion by 2030. The transaction extends Intel's strategy to invest in data-intensive market opportunities that build on the company's strengths in computing and connectivity from the cloud, through the network, to the device.

"This acquisition is a great step forward for our shareholders, the automotive industry and consumers," said Brian Krzanich, Intel CEO. "Intel provides critical foundational technologies for autonomous driving including plotting the car's path and making real-time driving decisions. Mobileye brings the industry's best automotive-grade computer vision and strong momentum with automakers and suppliers. Together, we can accelerate the future of autonomous driving with improved performance in a cloud-to-car solution at a lower cost for automakers."

Intel is funding the acquisition with cash straight form its balance sheet, with the transaction being expected to close within 9 months.

View at TechPowerUp Main Site