- Joined

- Oct 9, 2007

- Messages

- 47,435 (7.51/day)

- Location

- Hyderabad, India

| System Name | RBMK-1000 |

|---|---|

| Processor | AMD Ryzen 7 5700G |

| Motherboard | ASUS ROG Strix B450-E Gaming |

| Cooling | DeepCool Gammax L240 V2 |

| Memory | 2x 8GB G.Skill Sniper X |

| Video Card(s) | Palit GeForce RTX 2080 SUPER GameRock |

| Storage | Western Digital Black NVMe 512GB |

| Display(s) | BenQ 1440p 60 Hz 27-inch |

| Case | Corsair Carbide 100R |

| Audio Device(s) | ASUS SupremeFX S1220A |

| Power Supply | Cooler Master MWE Gold 650W |

| Mouse | ASUS ROG Strix Impact |

| Keyboard | Gamdias Hermes E2 |

| Software | Windows 11 Pro |

AMD (NASDAQ:AMD) today announced revenue for the first quarter of 2017 of $984 million, operating loss of $29 million, and net loss of $73 million, or $0.08 per share. On a non-GAAP basis, operating loss was $6 million, net loss was $38 million, and loss per share was $0.04. "We achieved 18 percent year-over-year revenue growth driven by strong demand for our high performance Ryzen CPUs as well as graphics processors," said Dr. Lisa Su, AMD president and CEO. "We are positioned for solid revenue growth and margin expansion opportunities across the business in the year ahead as we bring innovation, performance, and choice to an expanding set of markets."

Q1 2017 Results

AMD's outlook statements are based on current expectations. The following statements are forward-looking, and actual results could differ materially depending on market conditions and the factors set forth under "Cautionary Statement" below.

For the second quarter of 2017, AMD expects revenue to increase approximately 17 percent sequentially, plus or minus 3 percent. The midpoint of guidance would result in second quarter 2017 revenue increasing approximately 12 percent year-over-year. For additional details regarding AMD's results and outlook please see the CFO commentary posted at quarterlyearnings.amd.com.

View at TechPowerUp Main Site

Q1 2017 Results

- Revenue of $984 million was up 18 percent year-over-year, driven by higher revenue in both the Computing and Graphics and Enterprise, Embedded, and Semi-Custom business segments. Revenue was down 11 percent sequentially, due primarily to seasonality in both segments. However, Computing and Graphics segment revenue decline was better than seasonal due to the initial sales from high performance Ryzen desktop processors.

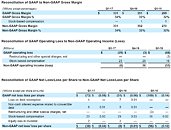

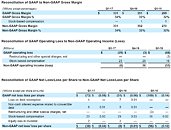

- On a GAAP basis, gross margin was 34 percent, up 2 percentage points year-over-year and sequentially due to a higher percentage of revenue from the Computing and Graphics segment, as well as a richer product mix within that segment. Operating loss of $29 million compared to operating losses of $68 million a year ago and $3 million in the prior quarter. Net loss of $73 million compared to net losses of $109 million a year ago and $51 million in the prior quarter. Loss per share of $0.08 compared to a loss per share of $0.14 a year ago and a loss per share of $0.06 in the prior quarter.

- On a non-GAAP basis, gross margin was 34 percent, up 2 percentage points year-over-year and sequentially. Operating loss of $6 million compared to an operating loss of $55 million a year ago and operating income of $26 million in the prior quarter. Net loss of $38 million compared to net losses of $96 million a year ago and $8 million in the prior quarter. Loss per share of $0.04 compared to a loss per share of $0.12 a year ago and a loss per share of $0.01 in the prior quarter.

- Cash, cash equivalents, and marketable securities were $943 million at the end of the quarter, down $321 million from the end of the prior quarter primarily due to the timing of sales and cash collections, debt interest payments, and increased inventory.

- Computing and Graphics segment revenue was $593 million, up 29 percent year-over-year and down 1 percent sequentially. The year-over-year increase was driven primarily by higher desktop and graphics processor sales. The sequential decrease was primarily due to a decrease in mobile and graphics processor sales largely offset by initial revenue from high performance Ryzen desktop processors.

o Operating loss was $15 million, compared to operating losses of $70 million in Q1 2016 and $21 million in Q4 2016. The year-over-year improvement was driven primarily by higher revenue. The sequential improvement was driven primarily by lower operating expenses.

o Client average selling price (ASP) increased year-over-year and sequentially driven by desktop processor ASP.

o GPU ASP increased year-over-year and sequentially due primarily to higher desktop GPU ASP. - Enterprise, Embedded, and Semi-Custom segment revenue was $391 million, up 5 percent year over-year driven primarily by higher semi-custom SoC sales. Sequentially, revenue decreased 23 percent primarily due to seasonally lower sales of semi-custom SoCs.

o Operating income was $9 million, compared to an operating income of $16 million in Q1 2016 and an operating income of $47 million in Q4 2016. The year-over-year decrease was primarily due to higher server related R&D investments, partially offset by an increase in the THATIC JV licensing gain. The sequential decrease was primarily due to seasonally lower sales of semi-custom SoCs. - All Other operating loss was $23 million compared with operating losses of $14 million in Q1 2016 and $29 million in Q4 2016. The year-over-year and sequential differences in operating loss were related to stock-based compensation charges.

- AMD launched its first high-performance x86 Ryzen desktop processor based on the entirely new "Zen" core microarchitecture, bringing leadership multi-core performance to PC gamers, creators, and hardware enthusiasts worldwide.

o AMD Ryzen 7: These 8-core, 16-thread processors bring innovation and choice back to the enthusiast PC market and include the world's highest performing, and lowest powered 8-core desktop PC processors.

o AMD Ryzen 5: Mainstream processors designed to bring innovation to the high-volume, sub-$300 CPU market with a disruptive price-to-performance ratio for gamers and creators. - AMD shared new details about its upcoming server and high-end graphics solutions:

o Launching in Q2 2017, AMD's high-performance x86 server CPU, codenamed "Naples", exceeds today's top competitive offering on critical parameters, with 45 percent more cores, 60 percent more input / output capacity (I/O), and 122 percent more memory bandwidth. AMD also announced a collaboration with Microsoft to incorporate the cloud delivery features of "Naples" with Microsoft's "Project Olympus" server platform.

o AMD's "Vega" GPU architecture is on track to launch in Q2, and has been designed from scratch to address the most data- and visually-intensive next-generation workloads with key architecture advancements including: a differentiated memory subsystem, next-generation geometry pipeline, new compute engine, and a new pixel engine. - AMD further strengthened its consumer and professional graphics offerings with new hardware and software solutions for gamers and creators:

o Introduced the Radeon RX 500 series line of GPUs based on a refined, second-generation "Polaris" architecture to deliver an up to 57 percent performance improvement and higher clock speeds for modern games, smooth VR experiences, and the latest display technologies.

o Announced the Radeon Pro Duo, the first "Polaris" architecture based dual-GPU graphics card, designed to excel at media and entertainment, broadcast, design, and manufacturing workflows. Slated for availability in late May 2017, the Radeon Pro Duo delivers up to 2 times faster performance than the closest competing professional graphics card on select professional applications and increased VR performance over single GPU solutions by up to 50%. - Demonstrated its continued focus on ensuring consumers and enterprise users have the software tools they need to get the most from their Radeon and Radeon Pro GPUs with regular updates to its Radeon Software Crimson ReLive Edition and Radeon Pro Software Enterprise Edition drivers, incorporating new features, performance and stability improvements.

- AMD continued its close collaboration with game developers to help them leverage the full potential of AMD compute and graphics solutions and deliver breakthrough experiences for gamers.

o AMD announced, in conjunction with game developers Stardock and Oxide Games, the completion of initial optimization of "Ashes of the Singularity" for AMD Ryzen desktop processors resulting in enhanced game play and an up to 30 percent increase in "Average Frames Per Second All Batches" in-game benchmark performance, placing the AMD Ryzen 7 1800X in elite performance levels for the game.

o AMD and Bethesda Softworks formed a multi-title strategic partnership to rapidly advance game technology development, including harnessing the full potential of low-level APIs and maximizing the capabilities of the computing and graphics power of AMD's multicore Ryzen CPUs, Radeon GPUs, and AMD server solutions across Bethesda's existing franchises.

o AMD unveiled that its "Vega"-architecture based GPUs have been selected to power LiquidSky's cloud gaming platform, enabling gamers to enjoy the power of "Vega" from virtually anywhere, and affordably through LiquidSky's low-cost and free subscription models. - Microsoft disclosed new information about its AMD-based "Project Scorpio" console. The new premium game console is expected to be available for holiday 2017 and will be powered by a highly-customized AMD SoC.

AMD's outlook statements are based on current expectations. The following statements are forward-looking, and actual results could differ materially depending on market conditions and the factors set forth under "Cautionary Statement" below.

For the second quarter of 2017, AMD expects revenue to increase approximately 17 percent sequentially, plus or minus 3 percent. The midpoint of guidance would result in second quarter 2017 revenue increasing approximately 12 percent year-over-year. For additional details regarding AMD's results and outlook please see the CFO commentary posted at quarterlyearnings.amd.com.

View at TechPowerUp Main Site