Raevenlord

News Editor

- Joined

- Aug 12, 2016

- Messages

- 3,755 (1.23/day)

- Location

- Portugal

| System Name | The Ryzening |

|---|---|

| Processor | AMD Ryzen 9 5900X |

| Motherboard | MSI X570 MAG TOMAHAWK |

| Cooling | Lian Li Galahad 360mm AIO |

| Memory | 32 GB G.Skill Trident Z F4-3733 (4x 8 GB) |

| Video Card(s) | Gigabyte RTX 3070 Ti |

| Storage | Boot: Transcend MTE220S 2TB, Kintson A2000 1TB, Seagate Firewolf Pro 14 TB |

| Display(s) | Acer Nitro VG270UP (1440p 144 Hz IPS) |

| Case | Lian Li O11DX Dynamic White |

| Audio Device(s) | iFi Audio Zen DAC |

| Power Supply | Seasonic Focus+ 750 W |

| Mouse | Cooler Master Masterkeys Lite L |

| Keyboard | Cooler Master Masterkeys Lite L |

| Software | Windows 10 x64 |

AMD's stock on Monday took a relatively steep dive in value, following a report by Morgan Stanley that pegs cryptocurrency-fueled graphics shipments to decline by 50% next year (a $250 million decline in revenue). "We believe that AMD's graphics surge has been caused by a sharp increase in sales of graphics chips to cryptocurrency miners. We expect this to meaningfully decelerate next year," Morgan Stanley analyst Joseph Moore said. At the same time, the report expects video game console demand to decline by 5.5% in 2018, which led Moore towards lowering his price target for AMD shares to $8 from $11, a 32% decline from Friday's close.

As a consequence of the report, Morgan Stanley reduced its rating on AMD shares from equal-weight to underweight, which reduced confidence in the market, and triggered a sell-off - and following the mechanism of availability and demand, a descent in stock pricing was already painted on the wall. A 9% fall isn't something to scoff at - especially when the economics surrounding it are attributed to a single - as of yet - report. AMD stock fluctuations aren't new; the company's stock has been particularly volatile in recent times - especially when compared to its peers (and competitors) Intel and NVIDIA.

"We expect cryptocurrency to gradually fade from here, consoles to decline, and graphics to be flattish," Moore wrote. "To be clear, we admire what the company has accomplished on a fraction of its competitors' budgets in both microprocessors and graphics - our cautious view is based entirely on the current stock price, and the limited potential for upside in 2018 and beyond."

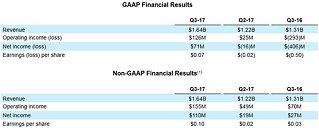

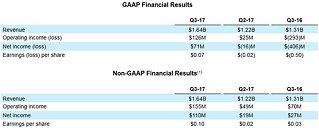

To put things in perspective, though, AMD's stock is up 64% in the past 12 months through last Friday, compared with S&P 500's 21% gain in the same time-frame. This new decline comes in the wake of AMD's last week stock plunge after the announcement of the latest Q3 results, proving that more than the fact that AMD returned to profitability after years in the red, expectation is the main driver of stock market pricing.

View at TechPowerUp Main Site

As a consequence of the report, Morgan Stanley reduced its rating on AMD shares from equal-weight to underweight, which reduced confidence in the market, and triggered a sell-off - and following the mechanism of availability and demand, a descent in stock pricing was already painted on the wall. A 9% fall isn't something to scoff at - especially when the economics surrounding it are attributed to a single - as of yet - report. AMD stock fluctuations aren't new; the company's stock has been particularly volatile in recent times - especially when compared to its peers (and competitors) Intel and NVIDIA.

"We expect cryptocurrency to gradually fade from here, consoles to decline, and graphics to be flattish," Moore wrote. "To be clear, we admire what the company has accomplished on a fraction of its competitors' budgets in both microprocessors and graphics - our cautious view is based entirely on the current stock price, and the limited potential for upside in 2018 and beyond."

To put things in perspective, though, AMD's stock is up 64% in the past 12 months through last Friday, compared with S&P 500's 21% gain in the same time-frame. This new decline comes in the wake of AMD's last week stock plunge after the announcement of the latest Q3 results, proving that more than the fact that AMD returned to profitability after years in the red, expectation is the main driver of stock market pricing.

View at TechPowerUp Main Site