Raevenlord

News Editor

- Joined

- Aug 12, 2016

- Messages

- 3,755 (1.23/day)

- Location

- Portugal

| System Name | The Ryzening |

|---|---|

| Processor | AMD Ryzen 9 5900X |

| Motherboard | MSI X570 MAG TOMAHAWK |

| Cooling | Lian Li Galahad 360mm AIO |

| Memory | 32 GB G.Skill Trident Z F4-3733 (4x 8 GB) |

| Video Card(s) | Gigabyte RTX 3070 Ti |

| Storage | Boot: Transcend MTE220S 2TB, Kintson A2000 1TB, Seagate Firewolf Pro 14 TB |

| Display(s) | Acer Nitro VG270UP (1440p 144 Hz IPS) |

| Case | Lian Li O11DX Dynamic White |

| Audio Device(s) | iFi Audio Zen DAC |

| Power Supply | Seasonic Focus+ 750 W |

| Mouse | Cooler Master Masterkeys Lite L |

| Keyboard | Cooler Master Masterkeys Lite L |

| Software | Windows 10 x64 |

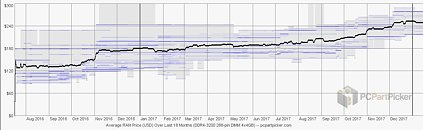

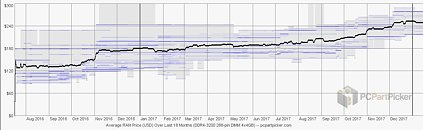

Reuters reports that a sudden (if ridiculous) 5% drop in memory chip prices in Q4 2017 has brought revenue expectations and investors' profit measurements to a teetering halt. 5% may not look like much - it certainly isn't much when we look at the historic price increases that almost doubled the cost of DDR4 memory kits, as you can see in the PC Part Picker chart below. This memory module price chart doesn't include the 5% drop yet, probably because it takes time for memory chip pricing to materialize in end-user module pricing. But for investors, it's like a spark in a paper archive - it could signal an impending price decrease that would push all profit estimates out the window.

This 5% drop in pricing has prompted industry analysts to review their profit estimates for 2018, and expect that the memory industry's growth rate will fall by more than half this year to 30 percent. You read that right - investors are scared because growth rates will be 30 percent instead of 60 percent. Oh the joys of inflated pricing, and slower-than-usual ramp-up to keep demand higher than supply. The joys of economic capitalism, where prices for consumers go up, and an industries' value skyrockets by more than 70$ in a single year (2017).

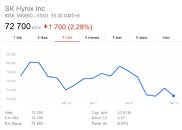

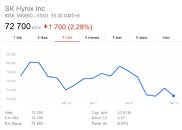

This news led to a knee-jerk reaction from investors and the stock market for memory manufacturers as a whole, though; Samsung shares dipped 7.5 percent last week, while SK Hynix's fell 6.2 percent (January 6th seems to be the tipping point). But analysts say that there is unlikely to be a sudden crash, and that 2018 should still be a relatively stable year for chipmakers. This is due to the ever increasing memory demands of smartphones - average DRAM memory of new smartphone models launched last quarter increased by 38 percent from the second quarter of 2016, while NAND content measured by gigabyte jumped a staggering 84 percent, according to an analysis by BNP Paribas, as reported by Reuters.

Analyst firm Macquarie estimates Samsung's chip division's operating profit margin jumped to 47 percent last year from 26.5 percent in 2016, and will rise further to 55.5 percent this year. DRAM manufacturers' rush to ramp up production - quadrupling manufacturing investment for 2017 and 2018 combined to $38 billion from 2016's $10 billion - prices may decline as much as 18 percent next year, according to brokerage firm Nomura.

Such solid demand will keep the industry's margin healthy this year, and chipmakers' investment in more advanced technology will help them cut production costs and stay profitable even as prices ease, analysts say.

View at TechPowerUp Main Site

This 5% drop in pricing has prompted industry analysts to review their profit estimates for 2018, and expect that the memory industry's growth rate will fall by more than half this year to 30 percent. You read that right - investors are scared because growth rates will be 30 percent instead of 60 percent. Oh the joys of inflated pricing, and slower-than-usual ramp-up to keep demand higher than supply. The joys of economic capitalism, where prices for consumers go up, and an industries' value skyrockets by more than 70$ in a single year (2017).

This news led to a knee-jerk reaction from investors and the stock market for memory manufacturers as a whole, though; Samsung shares dipped 7.5 percent last week, while SK Hynix's fell 6.2 percent (January 6th seems to be the tipping point). But analysts say that there is unlikely to be a sudden crash, and that 2018 should still be a relatively stable year for chipmakers. This is due to the ever increasing memory demands of smartphones - average DRAM memory of new smartphone models launched last quarter increased by 38 percent from the second quarter of 2016, while NAND content measured by gigabyte jumped a staggering 84 percent, according to an analysis by BNP Paribas, as reported by Reuters.

Analyst firm Macquarie estimates Samsung's chip division's operating profit margin jumped to 47 percent last year from 26.5 percent in 2016, and will rise further to 55.5 percent this year. DRAM manufacturers' rush to ramp up production - quadrupling manufacturing investment for 2017 and 2018 combined to $38 billion from 2016's $10 billion - prices may decline as much as 18 percent next year, according to brokerage firm Nomura.

Such solid demand will keep the industry's margin healthy this year, and chipmakers' investment in more advanced technology will help them cut production costs and stay profitable even as prices ease, analysts say.

View at TechPowerUp Main Site