- Joined

- Aug 20, 2007

- Messages

- 21,879 (3.41/day)

- Location

- Olympia, WA

| System Name | Pioneer |

|---|---|

| Processor | Ryzen 9 9950X |

| Motherboard | MSI MAG X670E Tomahawk Wifi |

| Cooling | Noctua NH-D15 + A whole lotta Sunon, Phanteks and Corsair Maglev blower fans... |

| Memory | 128GB (4x 32GB) G.Skill Flare X5 @ DDR5-4000(Running 1:1:1 w/ FCLK) |

| Video Card(s) | XFX RX 7900 XTX Speedster Merc 310 |

| Storage | Intel 5800X Optane 800GB boot, +2x Crucial P5 Plus 2TB PCIe 4.0 NVMe SSDs, 1x 2TB Seagate Exos 3.5" |

| Display(s) | 55" LG 55" B9 OLED 4K Display |

| Case | Thermaltake Core X31 |

| Audio Device(s) | TOSLINK->Schiit Modi MB->Asgard 2 DAC Amp->AKG Pro K712 Headphones or HDMI->B9 OLED |

| Power Supply | FSP Hydro Ti Pro 850W |

| Mouse | Logitech G305 Lightspeed Wireless |

| Keyboard | WASD Code v3 with Cherry Green keyswitches + PBT DS keycaps |

| Software | Gentoo Linux x64 |

Welcome back to Confessions of a Crypto Miner… my bi-weekly column about a crypto miner from 2013 trying to get caught up with the latest standards. I'm presently mining and reporting to you from a dual GTX 1080 based rig mining zCash.

In the last entry, I got my hardware & software set up and started mining. If you were monitoring the miner via the stats link, you may have noticed a few offline moments 2-3 days ago. This was due to me installing a nice new power monitoring setup and taking some measurements at different settings, all with the goal of finding the most efficient way to run the miner long term, to maximize profits. We now have all the data on hand and can now draw conclusions from it. There are two things I'd like to investigate with this article: 240 VAC's impact on power draw, and how the graphics card power limit setting affects profit margins.

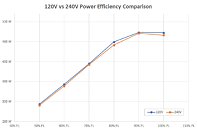

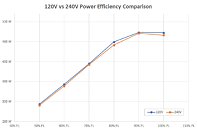

Conventional wisdom with PSUs indicates that a higher line voltage will provide a higher efficiency. Thus, mining with 240 V AC power promises to be more efficient than using the American 120 volts. Conventional wisdom also states that this will probably be a small margin in the range of 2-3%. The 80PLUS standard indicates this, as well as Seasonic's own marketing material (I am using a Seasonic 650 W PRIME Ultra Titanium, for reference). Let's see the actual results, shall we?

Rounded, we have an average of ~1.0%, or honestly, nearly within the margin of error. It would seem these very high efficiency PSUs don't care much what line voltage they are fed. I have both 120 V and 240 V easily available in my house, so I will continue to run on 240 V. If you are considering getting a 220 V line installed, just to save a few percent on efficiency, make sure to do the math on installation cost and how long you will have to be running. For example, assuming profits of $5 per day, $500 to get 220 V installed, providing a 2% efficiency improvement, you'd have to be mining for 5000 days just to break even on the setup cost! However, the bigger your operation is, the more meaningful these small percentages will become, because installation cost is pretty much constant, while profits go up by 2% across your whole setup. Bottom line, always measure, do the math, and as I have said before "always have a plan." I suspect most users in North America to find the 120 V numbers to be more relevant to them, so I will short-term switch over to that for the next set of numbers, which are final earnings vs power limit setting on my two NVIDIA GTX 1080 cards.

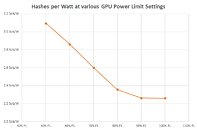

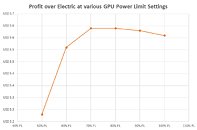

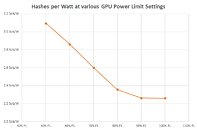

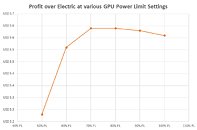

The first chart shows mining efficiency over a range of GPU power limit settings. As expected, when you reduce the maximum power budget available to the GPUs you gain almost 40% in efficiency, due to the lower total cost for electricity. This would make you think that a lower power limit (such as 50%) should yield maximum profits. However, due to how profitable crypto mining presently is, that's not the case, at least for my setup. In fact, plugging my numbers into any online crypto earnings calculator for ZCash (assuming difficulty of 7684.6593, ZEC Price of 454.65 USD, kWh power cost $0.115) shows us that the "sweet spot" is in fact at either power limit 80% or 70%, both tying with a value of $5.59 per day. Very surprising how different that is from the illusion presented by the hashrate vs wattage graph, isn't it? Here again, collect your own data. For example Vega or Polaris have wildly different efficiency curves, so the sweet spot is most certainly different. Also interesting is that at some point, with high profits and low electricity cost, it just makes most sense to mine as many coins as quickly as possible, to get ahead of the difficulty curve. I may actually go this route considering I plan to hold some of my coins for speculation, especially considering the limited profit this whole ordeal actually yielded, which I will discuss now.

In conclusion, I should note that even after tuning for maximum efficiency, the difference in earnings over electric only came to $0.03 more per day moving from 100% to 70% power limit. Was that worth my time? Difficult to say, it took well over three hours to take all those readings and conclude this. In a year that will earn me only $10.95 more than had I just not cared. But it was kind of enjoyable for me… if you find that true, maybe tuning it is worth your time too. There are still things to investigate as well, such as the impact of underclocking and overclocking. Personally, I feel you should definitely pay attention to the risk of getting lost in the tuning side of the equation forever, without ever running a steady solid income.

A word on the PSU used, during all this 120 V vs 220 V discussion I forgot to bring up the small elephant in the room: Graphics card prices are not the only thing that got affected by the mining craze. I remember when an EVGA SuperNOVA 1300G2 could be had for ~$200 online and now it's either nowhere to be seen or goes for $400+. I bought my Seasonic 650 W Prime Ultra Titanium at $160. For context, the 650 W PRIME Platinum and Gold are currently priced at $130 and $100 respectively from Newegg in the present market. Let's say an average 80 PLUS Gold rated PSU is ~86% efficient at mining operating conditions, compared to ~92% and ~94% for the Platinum and Titanium units respectively, all other things being equal. So I would effectively be getting a 2-8% reduction in electricity consumption from the wall but at a $30-60 price hike per mining rig. At my current peak profit over electric of $5.59/day, this ideal situation of an 8% bonus over the gold PSU would have been ~$0.45/day which means it would have taken 134 days to break even and go to the territory where this more efficient PSU starts to finally pay for itself. In the long run, that 4.5 months may not seem bad. However, this is where other facts come into play, as they always do. Large operations, especially those with multiple machines could instead go for cheaper PSUs (e.g. 850 W Seasonic Ultra Gold at $120), and buy more GPUs with the money saved; GPUs which will churn through hashes from day one and generate income immediately. I can't really say with certainty a Titanium PSU makes sense large scale unless there is some evidence of a decrease in failure rate or other cost saving factors at play. Of course, we have no evidence for that to date and as such I can't say this "Titanium Premium" would be a good buy for a larger mining farm vs more GPUs, in my assessment.

View at TechPowerUp Main Site

In the last entry, I got my hardware & software set up and started mining. If you were monitoring the miner via the stats link, you may have noticed a few offline moments 2-3 days ago. This was due to me installing a nice new power monitoring setup and taking some measurements at different settings, all with the goal of finding the most efficient way to run the miner long term, to maximize profits. We now have all the data on hand and can now draw conclusions from it. There are two things I'd like to investigate with this article: 240 VAC's impact on power draw, and how the graphics card power limit setting affects profit margins.

Conventional wisdom with PSUs indicates that a higher line voltage will provide a higher efficiency. Thus, mining with 240 V AC power promises to be more efficient than using the American 120 volts. Conventional wisdom also states that this will probably be a small margin in the range of 2-3%. The 80PLUS standard indicates this, as well as Seasonic's own marketing material (I am using a Seasonic 650 W PRIME Ultra Titanium, for reference). Let's see the actual results, shall we?

Rounded, we have an average of ~1.0%, or honestly, nearly within the margin of error. It would seem these very high efficiency PSUs don't care much what line voltage they are fed. I have both 120 V and 240 V easily available in my house, so I will continue to run on 240 V. If you are considering getting a 220 V line installed, just to save a few percent on efficiency, make sure to do the math on installation cost and how long you will have to be running. For example, assuming profits of $5 per day, $500 to get 220 V installed, providing a 2% efficiency improvement, you'd have to be mining for 5000 days just to break even on the setup cost! However, the bigger your operation is, the more meaningful these small percentages will become, because installation cost is pretty much constant, while profits go up by 2% across your whole setup. Bottom line, always measure, do the math, and as I have said before "always have a plan." I suspect most users in North America to find the 120 V numbers to be more relevant to them, so I will short-term switch over to that for the next set of numbers, which are final earnings vs power limit setting on my two NVIDIA GTX 1080 cards.

The first chart shows mining efficiency over a range of GPU power limit settings. As expected, when you reduce the maximum power budget available to the GPUs you gain almost 40% in efficiency, due to the lower total cost for electricity. This would make you think that a lower power limit (such as 50%) should yield maximum profits. However, due to how profitable crypto mining presently is, that's not the case, at least for my setup. In fact, plugging my numbers into any online crypto earnings calculator for ZCash (assuming difficulty of 7684.6593, ZEC Price of 454.65 USD, kWh power cost $0.115) shows us that the "sweet spot" is in fact at either power limit 80% or 70%, both tying with a value of $5.59 per day. Very surprising how different that is from the illusion presented by the hashrate vs wattage graph, isn't it? Here again, collect your own data. For example Vega or Polaris have wildly different efficiency curves, so the sweet spot is most certainly different. Also interesting is that at some point, with high profits and low electricity cost, it just makes most sense to mine as many coins as quickly as possible, to get ahead of the difficulty curve. I may actually go this route considering I plan to hold some of my coins for speculation, especially considering the limited profit this whole ordeal actually yielded, which I will discuss now.

In conclusion, I should note that even after tuning for maximum efficiency, the difference in earnings over electric only came to $0.03 more per day moving from 100% to 70% power limit. Was that worth my time? Difficult to say, it took well over three hours to take all those readings and conclude this. In a year that will earn me only $10.95 more than had I just not cared. But it was kind of enjoyable for me… if you find that true, maybe tuning it is worth your time too. There are still things to investigate as well, such as the impact of underclocking and overclocking. Personally, I feel you should definitely pay attention to the risk of getting lost in the tuning side of the equation forever, without ever running a steady solid income.

A word on the PSU used, during all this 120 V vs 220 V discussion I forgot to bring up the small elephant in the room: Graphics card prices are not the only thing that got affected by the mining craze. I remember when an EVGA SuperNOVA 1300G2 could be had for ~$200 online and now it's either nowhere to be seen or goes for $400+. I bought my Seasonic 650 W Prime Ultra Titanium at $160. For context, the 650 W PRIME Platinum and Gold are currently priced at $130 and $100 respectively from Newegg in the present market. Let's say an average 80 PLUS Gold rated PSU is ~86% efficient at mining operating conditions, compared to ~92% and ~94% for the Platinum and Titanium units respectively, all other things being equal. So I would effectively be getting a 2-8% reduction in electricity consumption from the wall but at a $30-60 price hike per mining rig. At my current peak profit over electric of $5.59/day, this ideal situation of an 8% bonus over the gold PSU would have been ~$0.45/day which means it would have taken 134 days to break even and go to the territory where this more efficient PSU starts to finally pay for itself. In the long run, that 4.5 months may not seem bad. However, this is where other facts come into play, as they always do. Large operations, especially those with multiple machines could instead go for cheaper PSUs (e.g. 850 W Seasonic Ultra Gold at $120), and buy more GPUs with the money saved; GPUs which will churn through hashes from day one and generate income immediately. I can't really say with certainty a Titanium PSU makes sense large scale unless there is some evidence of a decrease in failure rate or other cost saving factors at play. Of course, we have no evidence for that to date and as such I can't say this "Titanium Premium" would be a good buy for a larger mining farm vs more GPUs, in my assessment.

View at TechPowerUp Main Site