- Joined

- May 14, 2004

- Messages

- 29,014 (3.74/day)

| Processor | Ryzen 7 5700X |

|---|---|

| Memory | 48 GB |

| Video Card(s) | RTX 4080 |

| Storage | 2x HDD RAID 1, 3x M.2 NVMe |

| Display(s) | 30" 2560x1600 + 19" 1280x1024 |

| Software | Windows 10 64-bit |

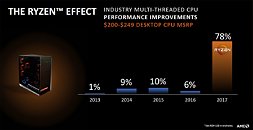

Yesterday AMD held their "One Year Ryzen Anniversary" call which reiterated the company's success introducing Ryzen products and also provided insight into what's planned for 2018 and beyond.

When asked about market share status and goals, Jim Anderson, SVP and GM of Computing and Graphics at AMD, mentioned that their near-term goal is reaching levels that the company enjoyed during their early-2000s market-leadership that they had thanks to the Athlon64 processors, which were strong competitors to what Intel offered at the time. Specifically, Jim said "I don't see any reason we can't get back to historical share levels that AMD has enjoyed in the past." Back in the 2000s the company boomed on a market share above 20% for desktop and slightly below 20% for notebook, also thanks to Intel's weakness in driving technology forward.

AMD hopes that they can repeat that success, by providing more cores for less money with Ryzen, while also gaining technology leadership, like the integrated Vega graphics in the new APUs. While 2017 was more focused on introducing Ryzen to the desktop space, 2018 will be the year AMD makes a push for Ryzen-based notebooks. Over the course of 2017, Ryzen desktop increased AMD's desktop CPU market share by 50% year-over-year; from 8% to 12% (Q4 2016 vs Q4 2017). In Q1 2018, 50% of the company's client compute revenue came from Ryzen, a solid increase over 40% in Q4 2017. At some (enthusiast focused) retailers the company is even seeing 40-50% CPU sales share.

The company expects 60 new Ryzen-based platforms from OEMs in 2018, with the majority being mobile designs across the whole size and performance spectrum: from ultra-portable to gaming. This will open up a $10 billion market for the company to grow in, in addition to the $9 billion desktop CPU market. Additional focus is put on Ryzen Pro (both desktop and mobile), which is targeted at enterprise and government customers through additional security and management features.

View at TechPowerUp Main Site

When asked about market share status and goals, Jim Anderson, SVP and GM of Computing and Graphics at AMD, mentioned that their near-term goal is reaching levels that the company enjoyed during their early-2000s market-leadership that they had thanks to the Athlon64 processors, which were strong competitors to what Intel offered at the time. Specifically, Jim said "I don't see any reason we can't get back to historical share levels that AMD has enjoyed in the past." Back in the 2000s the company boomed on a market share above 20% for desktop and slightly below 20% for notebook, also thanks to Intel's weakness in driving technology forward.

AMD hopes that they can repeat that success, by providing more cores for less money with Ryzen, while also gaining technology leadership, like the integrated Vega graphics in the new APUs. While 2017 was more focused on introducing Ryzen to the desktop space, 2018 will be the year AMD makes a push for Ryzen-based notebooks. Over the course of 2017, Ryzen desktop increased AMD's desktop CPU market share by 50% year-over-year; from 8% to 12% (Q4 2016 vs Q4 2017). In Q1 2018, 50% of the company's client compute revenue came from Ryzen, a solid increase over 40% in Q4 2017. At some (enthusiast focused) retailers the company is even seeing 40-50% CPU sales share.

The company expects 60 new Ryzen-based platforms from OEMs in 2018, with the majority being mobile designs across the whole size and performance spectrum: from ultra-portable to gaming. This will open up a $10 billion market for the company to grow in, in addition to the $9 billion desktop CPU market. Additional focus is put on Ryzen Pro (both desktop and mobile), which is targeted at enterprise and government customers through additional security and management features.

View at TechPowerUp Main Site