- Joined

- Oct 9, 2007

- Messages

- 47,538 (7.47/day)

- Location

- Hyderabad, India

| System Name | RBMK-1000 |

|---|---|

| Processor | AMD Ryzen 7 5700G |

| Motherboard | ASUS ROG Strix B450-E Gaming |

| Cooling | DeepCool Gammax L240 V2 |

| Memory | 2x 8GB G.Skill Sniper X |

| Video Card(s) | Palit GeForce RTX 2080 SUPER GameRock |

| Storage | Western Digital Black NVMe 512GB |

| Display(s) | BenQ 1440p 60 Hz 27-inch |

| Case | Corsair Carbide 100R |

| Audio Device(s) | ASUS SupremeFX S1220A |

| Power Supply | Cooler Master MWE Gold 650W |

| Mouse | ASUS ROG Strix Impact |

| Keyboard | Gamdias Hermes E2 |

| Software | Windows 11 Pro |

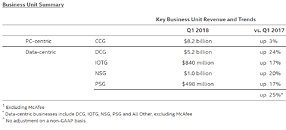

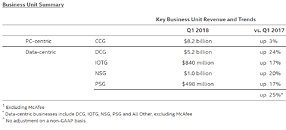

Intel Corporation today reported first-quarter 2018 financial results. "Coming off a record 2017, 2018 is off to a strong start. Our PC business continued to execute well and our data-centric businesses grew 25 percent, accounting for nearly half of first-quarter revenue," said Brian Krzanich, Intel CEO. "The strength of Intel's business underscores my confidence in our strategy and the unrelenting demand for compute performance fueled by the growth of data."

"Compared to the first-quarter expectations we set in January, revenue was higher, operating margins were stronger and EPS was better," said Bob Swan, Intel CFO. "Our data-centric strategy is accelerating Intel's transformation, and we're raising our earnings and cash flow expectations for the year." In the first quarter, the company generated approximately $6.3 billion in cash from operations, paid dividends of $1.4 billion and used $1.9 billion to repurchase 41 million shares of stock.

In the first quarter, Intel saw strong performance from data-centric businesses, which accounted for approximately half (49%) of Intel's revenue, an all-time high. The Data Center Group (DCG) achieved growth in all market segments and saw increasing adoption of Intel Xeon Scalable processors, including for artificial intelligence workloads. Non-Volatile Memory Solutions Group (NSG) revenue grew 20 percent as strong demand for storage continued. The Programmable Solutions Group (PSG) won new designs with server OEMs adding Intel's field programmable gate array (FPGA) acceleration to their data center offerings, and strong demand from retail and video customers drove first-quarter growth in the Internet of Things Group (IOTG).

The Client Computing Group (CCG) continued its strong execution and introduced a new lineup of high-performance mobile products including the 8th Gen Intel Core i9 processor and a new Intel Core platform extension that brings together the benefits of 8th Gen Intel Core processors with Intel Optane memory. We continue to make 14 nm process optimizations and architectural innovations in both data center and client products that will be coming this year. Intel is currently shipping low-volume 10 nm product and now expects 10 nm volume production to shift to 2019.

In autonomous driving, Mobileye continued momentum with automotive customers and recently won a high-volume design for EyeQ*5. The company also began operating autonomous vehicle test cars in Israel with plans to expand the fleet to other geographies.

Business Outlook

Intel's guidance for the second-quarter and full-year 2018 includes both GAAP and non-GAAP estimates. Reconciliations between these GAAP and non-GAAP financial measures are included below.

Intel's Business Outlook does not include the potential impact of any business combinations, asset acquisitions, divestitures (except as noted below), strategic investments and other significant transactions that may be completed after April 26, 2018. Actual results may differ materially from Intel's Business Outlook as a result of, among other things, the factors described under "Forward-Looking Statements" below. Our guidance above reflects the divestiture of Wind River, which we expect to close during the second quarter of 2018.

View at TechPowerUp Main Site

"Compared to the first-quarter expectations we set in January, revenue was higher, operating margins were stronger and EPS was better," said Bob Swan, Intel CFO. "Our data-centric strategy is accelerating Intel's transformation, and we're raising our earnings and cash flow expectations for the year." In the first quarter, the company generated approximately $6.3 billion in cash from operations, paid dividends of $1.4 billion and used $1.9 billion to repurchase 41 million shares of stock.

In the first quarter, Intel saw strong performance from data-centric businesses, which accounted for approximately half (49%) of Intel's revenue, an all-time high. The Data Center Group (DCG) achieved growth in all market segments and saw increasing adoption of Intel Xeon Scalable processors, including for artificial intelligence workloads. Non-Volatile Memory Solutions Group (NSG) revenue grew 20 percent as strong demand for storage continued. The Programmable Solutions Group (PSG) won new designs with server OEMs adding Intel's field programmable gate array (FPGA) acceleration to their data center offerings, and strong demand from retail and video customers drove first-quarter growth in the Internet of Things Group (IOTG).

The Client Computing Group (CCG) continued its strong execution and introduced a new lineup of high-performance mobile products including the 8th Gen Intel Core i9 processor and a new Intel Core platform extension that brings together the benefits of 8th Gen Intel Core processors with Intel Optane memory. We continue to make 14 nm process optimizations and architectural innovations in both data center and client products that will be coming this year. Intel is currently shipping low-volume 10 nm product and now expects 10 nm volume production to shift to 2019.

In autonomous driving, Mobileye continued momentum with automotive customers and recently won a high-volume design for EyeQ*5. The company also began operating autonomous vehicle test cars in Israel with plans to expand the fleet to other geographies.

Business Outlook

Intel's guidance for the second-quarter and full-year 2018 includes both GAAP and non-GAAP estimates. Reconciliations between these GAAP and non-GAAP financial measures are included below.

Intel's Business Outlook does not include the potential impact of any business combinations, asset acquisitions, divestitures (except as noted below), strategic investments and other significant transactions that may be completed after April 26, 2018. Actual results may differ materially from Intel's Business Outlook as a result of, among other things, the factors described under "Forward-Looking Statements" below. Our guidance above reflects the divestiture of Wind River, which we expect to close during the second quarter of 2018.

View at TechPowerUp Main Site

you see where I'm going ... there is always an angle: more could have been done with different budget/allocation. I can't really argue how much of a deciding factor it was.

you see where I'm going ... there is always an angle: more could have been done with different budget/allocation. I can't really argue how much of a deciding factor it was.