It won't be easy to see an AMD counterpart to NVIDIA GeForce RTX 2080 Ti in the short time. Heck, it will be difficult to see any real competitors to the RTX 2000 Series anytime soon. But maybe AMD doesn't need to compete on that front. Not yet. The reason is sound and clear: RTX prices are NVIDIA's weakness, and that weakness, my fellow readers, could become AMD's biggest strength.

The prices NVIDIA and its partners are asking for RTX 2080 and RTX 2080 Ti have been a clear discussion topic since we learnt about them. Most users have criticized those price points, even after NVIDIA explained the reasoning behind them. Those chips are bigger, more complex and more powerful than ever, so yes, costs have increased and that has to be taken into account.

None of that matters. It even doesn't matter what ray-tracing can bring to the game, and it doesn't matter if those Tensor Cores will provide benefits beyond DLSS. I'm not even counting on the fact that DLSS is a proprietary technology that will lock us (and developers, for that matter) a little bit more in another walled garden. Even if you realize that the market perception is clear: who has the fastest graphics card is perceived as the tech/market leader.

There's certainly a chance that RTX takes off and NVIDIA sets again the bar in this segment: the reception of the new cards hasn't been overwhelming, but developers could begin to take advantage of all the benefits Turing brings. If they do, we will have a different discussion, one in which future cards such as RTX 2070/2060 and its derivatives could bring a bright future for NVIDIA... and a dimmer one for AMD.

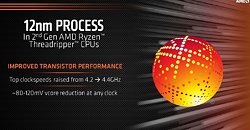

But the thing that matters now for a lot of users is pricing, and AMD could leverage that crucial element of the equation. In fact, the company could do that very soon. Some indications reveal that AMD could launch a new Polaris revision in the near future. This new silicon is allegedly being built on TSMC's 12 nm process, something AMD did successfully with its Ryzen 2000 Series of CPUs.

AMD must have learnt a good lesson there: its CPU portfolio is easily the best in its history, and the latest woes at Intel are helping and causing forecast revisions that estimate a 30% market share globally for AMD in Q4 2018. See? Intel's weakness is AMD's strength on this front.

2018 started with the worst news for Intel -Spectre and Meltdown- and it hasn't gone much better later on: the jump to the 10 nm process never seems to come, and Intel's messages about those delays have not helped to reinforce confidence in this manufacturer. The company would be three generations further than they are now without those big problems, and the situation for AMD would be quite different too.

Everything seems to make sense here: customers are upset with that RTX 2000 Series for the elite, and that Polaris revision could arrive at the right time and the right place. With a smaller node AMD could gain higher yields, decrease cost, increase clock frequencies and provide that 15% performance increase some publications are pointing to. Those are a lot of "coulds", and in fact there's no reason to believe that Polaris 30 is more than just a die shrink, so we would have the same unit counts and higher clocks.

That won't probably be enough to make the hypothetical RX 680 catch up with a GTX 1070: performance of the latter is +34% the one we found in the RX 580 on average according to our tests, so even with that refresh we will have a more competitive Radeon RX family that could win the price/performance battle, and that is no small feat.

The new cards would also not target just existing GTX 7/9 Series users, but also those older AMD Radeon users that were expecting a nice upgrade on performance without having to sell their souls. And for the undecided users, the ones that are thinking about getting a GTX 1050/Ti or a GTX 1060, AMD's offer could be quite attractive if price/performance ratio hits NVIDIA where it hurts more.

That would put that new family of graphic cards (Radeon RX 600?) on a pretty good position to compete with GeForce GTX 1000. NVIDIA presumably could still be king in the power consumption area, but besides that, AMD could position itself on that $300-$500 range (and even below that) with a really compelling suite of products.

So yes, AMD could have a winning hand here. Your move, AMD.

View at TechPowerUp Main Site

The prices NVIDIA and its partners are asking for RTX 2080 and RTX 2080 Ti have been a clear discussion topic since we learnt about them. Most users have criticized those price points, even after NVIDIA explained the reasoning behind them. Those chips are bigger, more complex and more powerful than ever, so yes, costs have increased and that has to be taken into account.

None of that matters. It even doesn't matter what ray-tracing can bring to the game, and it doesn't matter if those Tensor Cores will provide benefits beyond DLSS. I'm not even counting on the fact that DLSS is a proprietary technology that will lock us (and developers, for that matter) a little bit more in another walled garden. Even if you realize that the market perception is clear: who has the fastest graphics card is perceived as the tech/market leader.

There's certainly a chance that RTX takes off and NVIDIA sets again the bar in this segment: the reception of the new cards hasn't been overwhelming, but developers could begin to take advantage of all the benefits Turing brings. If they do, we will have a different discussion, one in which future cards such as RTX 2070/2060 and its derivatives could bring a bright future for NVIDIA... and a dimmer one for AMD.

But the thing that matters now for a lot of users is pricing, and AMD could leverage that crucial element of the equation. In fact, the company could do that very soon. Some indications reveal that AMD could launch a new Polaris revision in the near future. This new silicon is allegedly being built on TSMC's 12 nm process, something AMD did successfully with its Ryzen 2000 Series of CPUs.

AMD must have learnt a good lesson there: its CPU portfolio is easily the best in its history, and the latest woes at Intel are helping and causing forecast revisions that estimate a 30% market share globally for AMD in Q4 2018. See? Intel's weakness is AMD's strength on this front.

2018 started with the worst news for Intel -Spectre and Meltdown- and it hasn't gone much better later on: the jump to the 10 nm process never seems to come, and Intel's messages about those delays have not helped to reinforce confidence in this manufacturer. The company would be three generations further than they are now without those big problems, and the situation for AMD would be quite different too.

Everything seems to make sense here: customers are upset with that RTX 2000 Series for the elite, and that Polaris revision could arrive at the right time and the right place. With a smaller node AMD could gain higher yields, decrease cost, increase clock frequencies and provide that 15% performance increase some publications are pointing to. Those are a lot of "coulds", and in fact there's no reason to believe that Polaris 30 is more than just a die shrink, so we would have the same unit counts and higher clocks.

That won't probably be enough to make the hypothetical RX 680 catch up with a GTX 1070: performance of the latter is +34% the one we found in the RX 580 on average according to our tests, so even with that refresh we will have a more competitive Radeon RX family that could win the price/performance battle, and that is no small feat.

The new cards would also not target just existing GTX 7/9 Series users, but also those older AMD Radeon users that were expecting a nice upgrade on performance without having to sell their souls. And for the undecided users, the ones that are thinking about getting a GTX 1050/Ti or a GTX 1060, AMD's offer could be quite attractive if price/performance ratio hits NVIDIA where it hurts more.

That would put that new family of graphic cards (Radeon RX 600?) on a pretty good position to compete with GeForce GTX 1000. NVIDIA presumably could still be king in the power consumption area, but besides that, AMD could position itself on that $300-$500 range (and even below that) with a really compelling suite of products.

So yes, AMD could have a winning hand here. Your move, AMD.

View at TechPowerUp Main Site