Raevenlord

News Editor

- Joined

- Aug 12, 2016

- Messages

- 3,755 (1.22/day)

- Location

- Portugal

| System Name | The Ryzening |

|---|---|

| Processor | AMD Ryzen 9 5900X |

| Motherboard | MSI X570 MAG TOMAHAWK |

| Cooling | Lian Li Galahad 360mm AIO |

| Memory | 32 GB G.Skill Trident Z F4-3733 (4x 8 GB) |

| Video Card(s) | Gigabyte RTX 3070 Ti |

| Storage | Boot: Transcend MTE220S 2TB, Kintson A2000 1TB, Seagate Firewolf Pro 14 TB |

| Display(s) | Acer Nitro VG270UP (1440p 144 Hz IPS) |

| Case | Lian Li O11DX Dynamic White |

| Audio Device(s) | iFi Audio Zen DAC |

| Power Supply | Seasonic Focus+ 750 W |

| Mouse | Cooler Master Masterkeys Lite L |

| Keyboard | Cooler Master Masterkeys Lite L |

| Software | Windows 10 x64 |

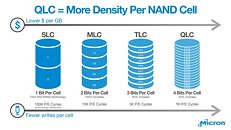

3D QLC (quad-level cell) is the latest, manufacture-ready technology to grace the NAND panorama, with promises of increased density over 3D TLC (triple-level cell), thus bringing pricing per GB even lower. However, as with all wafer-based PC components, yields are an extremely important part of that process. Cost reduction can only be attained if manufacturing allows for a given percentage of a wafer to be fully functional and without defects that compromise its feature-set or performance. However, as cell design becomes more complex in a bid to increase areal density, yields have taken longer to mature.

According to DigiTimes, 3D TLC yields have only gotten off the ground in the beginning of this year - right around the time companies were rolling out their 3D QLC designs. And if TLC took longer than expected to achieve respectable yields, it seems that QLC memory will take even longer - we already knew that the Intel-Micron venture on QLC was facing less than 50% yields, but DigiTimes has now extended this struggle to what seems to be the entire NAND manufacturing industry (Samsung Electronics, SK Hynix, Toshiba/ Western Digital and Micron Technology/Intel). The result? Expected price fluctuations in the beginning of 2019, as predicted production volume fails to meet both projected and actual demand, with 3D TLC supplies having to cope with increased market demands.

View at TechPowerUp Main Site

According to DigiTimes, 3D TLC yields have only gotten off the ground in the beginning of this year - right around the time companies were rolling out their 3D QLC designs. And if TLC took longer than expected to achieve respectable yields, it seems that QLC memory will take even longer - we already knew that the Intel-Micron venture on QLC was facing less than 50% yields, but DigiTimes has now extended this struggle to what seems to be the entire NAND manufacturing industry (Samsung Electronics, SK Hynix, Toshiba/ Western Digital and Micron Technology/Intel). The result? Expected price fluctuations in the beginning of 2019, as predicted production volume fails to meet both projected and actual demand, with 3D TLC supplies having to cope with increased market demands.

View at TechPowerUp Main Site