Raevenlord

News Editor

- Joined

- Aug 12, 2016

- Messages

- 3,755 (1.22/day)

- Location

- Portugal

| System Name | The Ryzening |

|---|---|

| Processor | AMD Ryzen 9 5900X |

| Motherboard | MSI X570 MAG TOMAHAWK |

| Cooling | Lian Li Galahad 360mm AIO |

| Memory | 32 GB G.Skill Trident Z F4-3733 (4x 8 GB) |

| Video Card(s) | Gigabyte RTX 3070 Ti |

| Storage | Boot: Transcend MTE220S 2TB, Kintson A2000 1TB, Seagate Firewolf Pro 14 TB |

| Display(s) | Acer Nitro VG270UP (1440p 144 Hz IPS) |

| Case | Lian Li O11DX Dynamic White |

| Audio Device(s) | iFi Audio Zen DAC |

| Power Supply | Seasonic Focus+ 750 W |

| Mouse | Cooler Master Masterkeys Lite L |

| Keyboard | Cooler Master Masterkeys Lite L |

| Software | Windows 10 x64 |

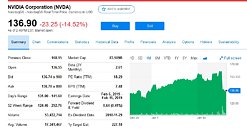

NVIDIA's stock value has been falling precipitously in the last several months. We reported in December that the company lost some 48.8% in value between October and December, moving from an all-time peak of $289.36 on October 1st, to just under $149 on December 14th. At the time, excess inventories were the cause, alongside a less than glamorous reception to their new RTX series of graphics cards. Now? NVIDIA cites "deteriorating macroeconomic conditions, particularly in China" as harming demand for their gaming GPUs. But this now comes alongside a its datacenter business also falling short of expectations - that's two of NVIDIA's most lucrative markets being put towards the red, or at least, with lower than expected income revenues.

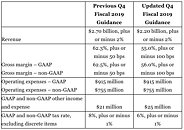

This led the company to revise its financial outlook for the year, lowering revenue estimates by $500 million, down to $2.2 billion from its initial $2.7 billion forecast. Gross margins have been lowered by some 7%, which means lowered earnings for investors. Since the December plunge, NVIDIA's stock had recovered up to around $160 per share, but has now dived 14.52%, down to $136.90 - even lower than before. The company has seen its market valuation shrink by more than 50% inside of four months - while the company is still well in the green side of the limbo, so to speak, these certainly don't serve to improve the company's spirit.

View at TechPowerUp Main Site

This led the company to revise its financial outlook for the year, lowering revenue estimates by $500 million, down to $2.2 billion from its initial $2.7 billion forecast. Gross margins have been lowered by some 7%, which means lowered earnings for investors. Since the December plunge, NVIDIA's stock had recovered up to around $160 per share, but has now dived 14.52%, down to $136.90 - even lower than before. The company has seen its market valuation shrink by more than 50% inside of four months - while the company is still well in the green side of the limbo, so to speak, these certainly don't serve to improve the company's spirit.

View at TechPowerUp Main Site