- Joined

- Oct 9, 2007

- Messages

- 47,244 (7.54/day)

- Location

- Hyderabad, India

| System Name | RBMK-1000 |

|---|---|

| Processor | AMD Ryzen 7 5700G |

| Motherboard | ASUS ROG Strix B450-E Gaming |

| Cooling | DeepCool Gammax L240 V2 |

| Memory | 2x 8GB G.Skill Sniper X |

| Video Card(s) | Palit GeForce RTX 2080 SUPER GameRock |

| Storage | Western Digital Black NVMe 512GB |

| Display(s) | BenQ 1440p 60 Hz 27-inch |

| Case | Corsair Carbide 100R |

| Audio Device(s) | ASUS SupremeFX S1220A |

| Power Supply | Cooler Master MWE Gold 650W |

| Mouse | ASUS ROG Strix Impact |

| Keyboard | Gamdias Hermes E2 |

| Software | Windows 11 Pro |

Activision Blizzard, Inc. today announced second-quarter 2019 results. "Our second quarter results exceeded our prior outlook for both revenue and earnings per share," said Bobby Kotick, Chief Executive Officer of Activision Blizzard. "In the first half of 2019 we have prioritized investments in our key franchises and, beginning in the second half of this year our audiences will have a chance to see and experience the initial results of these efforts."

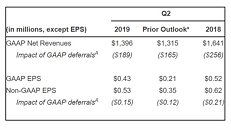

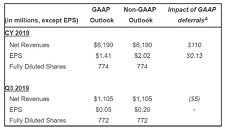

For the quarter ended June 30, 2019, Activision Blizzard's net revenues presented in accordance with GAAP were $1.40 billion, as compared with $1.64 billion for the second quarter of 2018. GAAP net revenues from digital channels were $1.09 billion. GAAP operating margin was 24%. GAAP earnings per diluted share were $0.43, as compared with $0.52 for the second quarter of 2018. For the quarter ended June 30, 2019, on a non-GAAP basis, Activision Blizzard's operating margin was 32% and earnings per diluted share were $0.53, as compared with $0.62 for the second quarter of 2018.

For the quarter ended June 30, 2019, operating cash flow was $154 million. For the trailing twelve-month period, operating cash flow was $1.86 billion.

Please refer to the tables at the back of this press release for a reconciliation of the company's GAAP and non-GAAP results.

Operating Metrics

For the quarter ended June 30, 2019, Activision Blizzard's net bookingsB were $1.21 billion, compared with $1.38 billion for the second quarter of 2018. Net bookingsB from digital channels were $1.01 billion, as compared with $1.20 billion for the second quarter of 2018.

Selected Business Highlights

Activision Blizzard outperformed our second quarter outlook, reflecting strong creative and commercial execution as we continued to reposition the business for future growth. Across Call of Duty, Candy Crush, Warcraft, Hearthstone, Overwatch, and Diablo, we are expanding our development teams so that we can accelerate the delivery of content in our pipeline, pursue new business models, broaden our communities, and delight our players.

Audience Reach

Currency Assumptions for 2019 Outlook:

The company paid a cash dividend of $0.37 per common share, up 9% year-over-year, in May 2019 to shareholders as of record at the close of business on March 28, 2019. Cash payments totaled $283 million.

View at TechPowerUp Main Site

For the quarter ended June 30, 2019, Activision Blizzard's net revenues presented in accordance with GAAP were $1.40 billion, as compared with $1.64 billion for the second quarter of 2018. GAAP net revenues from digital channels were $1.09 billion. GAAP operating margin was 24%. GAAP earnings per diluted share were $0.43, as compared with $0.52 for the second quarter of 2018. For the quarter ended June 30, 2019, on a non-GAAP basis, Activision Blizzard's operating margin was 32% and earnings per diluted share were $0.53, as compared with $0.62 for the second quarter of 2018.

For the quarter ended June 30, 2019, operating cash flow was $154 million. For the trailing twelve-month period, operating cash flow was $1.86 billion.

Please refer to the tables at the back of this press release for a reconciliation of the company's GAAP and non-GAAP results.

Operating Metrics

For the quarter ended June 30, 2019, Activision Blizzard's net bookingsB were $1.21 billion, compared with $1.38 billion for the second quarter of 2018. Net bookingsB from digital channels were $1.01 billion, as compared with $1.20 billion for the second quarter of 2018.

Selected Business Highlights

Activision Blizzard outperformed our second quarter outlook, reflecting strong creative and commercial execution as we continued to reposition the business for future growth. Across Call of Duty, Candy Crush, Warcraft, Hearthstone, Overwatch, and Diablo, we are expanding our development teams so that we can accelerate the delivery of content in our pipeline, pursue new business models, broaden our communities, and delight our players.

Audience Reach

- Activision Blizzard had 327 million Monthly Active Users (MAUs)C in the quarter.

- King had 258 million MAUsC. Candy Crush franchise MAUsC grew year-over-year, driven by growth in Candy Crush Saga and the addition of Candy Crush Friends Saga.

- Activision had 37 million MAUsC. Call of Duty: Black Ops 4 MAUsC grew year-over-year versus Call of Duty: WWII, and hours played increased by more than 50%. Crash Team Racing: Nitro-Fueled enjoyed positive critical reviews and strong sales, particularly through digital channels.

- Blizzard had 32 million MAUsC. Hearthstone MAUsC grew quarter-over-quarter following the release of the Rise of Shadows expansion and The Dalaran Heist single-player Adventure. Overwatch MAUsC were relatively stable quarter-over-quarter, with engagement increasing following the release of the Workshop. Subscribers in World of Warcraft increased since mid-May, following the release date announcement and beta for World of Warcraft Classic and the Rise of Azshara content update.

- Total time spent in King's Candy Crush franchise grew strongly year-over-year.

- Total hours played in Activision's Call of Duty franchise rose double-digits year-over-year.

- Daily time spent per player in Blizzard's franchises again increased year-over-year.

- Overwatch League hours viewed continued to grow robustly year-over-year in the two stages held during the second quarter. Season-to-date, viewership and average minute audience have grown double-digits year-over-year.

- Activision Blizzard delivered approximately $800 million of in-game net bookingsB in the second quarter.

- King's Candy Crush was the top-grossing franchise in the U.S. mobile app stores, a lead position it has held for the last two years1.

- Advertising in the King network continued to ramp, with net bookingsB growing sequentially and doubling year-over-year.

- For Call of Duty: Black Ops 4, net bookingsB from in-game items grew year-over-year versus Call of Duty: WWII and are ahead of WWII on a comparable life-to-date basis.

- Hearthstone net bookingsB grew sequentially in Q2 following the release of Rise of Shadows and the introduction of the paid single-player Adventure, with the expansion also outperforming last Q4's Rastakhan's Rumble

Currency Assumptions for 2019 Outlook:

- $1.15 USD/Euro for current outlook (vs. average of $1.12 for 2018, $1.12 for 2017, and $1.11 for 2016); and

- $1.24 USD/British Pound Sterling for current outlook (vs. average of $1.30 for 2018, $1.30 for 2017 and $1.36 for 2016).

- Note: Our financial guidance includes the forecasted impact of our FX hedging program.

The company paid a cash dividend of $0.37 per common share, up 9% year-over-year, in May 2019 to shareholders as of record at the close of business on March 28, 2019. Cash payments totaled $283 million.

View at TechPowerUp Main Site