- Joined

- Aug 19, 2017

- Messages

- 2,964 (1.06/day)

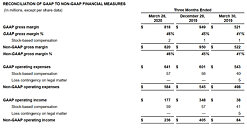

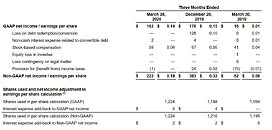

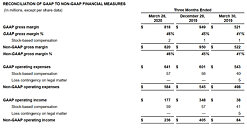

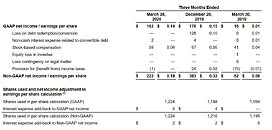

AMD today announced revenue for the first quarter of 2020 of $1.79 billion, operating income of $177 million, net income of $162 million and diluted earnings per share of $0.14. On a non-GAAP* basis, operating income was $236 million, net income was $222 million and diluted earnings per share was $0.18.

"We executed well in the first quarter, navigating the challenging environment to deliver 40 percent year-over-year revenue growth and significant gross margin expansion driven by our Ryzen and EPYC processors," said Dr. Lisa Su, AMD president and CEO. "While we expect some uncertainty in the near-term demand environment, our financial foundation is solid and our strong product portfolio positions us well across a diverse set of resilient end markets. We remain focused on strong business execution while ensuring the safety of our employees and supporting our customers, partners and communities. Our strategy and long-term growth plans are unchanged."

Q1 2020 Results

View at TechPowerUp Main Site

"We executed well in the first quarter, navigating the challenging environment to deliver 40 percent year-over-year revenue growth and significant gross margin expansion driven by our Ryzen and EPYC processors," said Dr. Lisa Su, AMD president and CEO. "While we expect some uncertainty in the near-term demand environment, our financial foundation is solid and our strong product portfolio positions us well across a diverse set of resilient end markets. We remain focused on strong business execution while ensuring the safety of our employees and supporting our customers, partners and communities. Our strategy and long-term growth plans are unchanged."

Q1 2020 Results

- Revenue was $1.79 billion, up 40 percent year-over-year primarily driven by higher Computing and Graphics segment revenue. Revenue was down 16 percent quarter-over-quarter due to lower revenue in both segments.

- Gross margin was 46 percent, up 5 percentage points year-over-year and 1 percentage point quarter-over-quarter, primarily driven by Ryzen and EPYC processor sales.

- Operating income was $177 million compared to operating income of $38 million a year ago and $348 million in the prior quarter. Non-GAAP operating income was $236 million compared to operating income of $84 million a year ago and $405 million in the prior quarter. Operating income improved year-over-year primarily driven by revenue growth and a greater percentage of Ryzen and EPYC processor sales. On a sequential basis, operating income declined due to lower revenue and higher R&D expenses.

- Net income was $162 million compared to net income of $16 million a year ago and $170 million in the prior quarter. Non-GAAP net income was $222 million compared to net income of $62 million a year ago and $383 million in the prior quarter. • Diluted earnings per share was $0.14 compared to diluted earnings per share of $0.01 a year ago and $0.15 in the prior quarter. Non-GAAP diluted earnings per share was $0.18, compared to diluted earnings per share of $0.06 a year ago and $0.32 in the prior quarter.

- Cash, cash equivalents and marketable securities were $1.4 billion at the end of the quarter. Quarterly Financial Segment Summary

- Computing and Graphics segment revenue was $1.44 billion, up 73 percent year-over-year and down 13 percent quarter-over-quarter. Revenue was higher year-over-year driven by strong Ryzen processor and Radeon product channel sales. The quarter-over-quarter decline was primarily due to lower graphics processor sales.

- Client processor average selling price (ASP) was up year-over-year driven by Ryzen processor sales. Client processor ASP was down slightly quarter-over-quarter due to higher notebook sales.

- GPU ASP was lower year-over-year and quarter-over-quarter due to product mix.

- Operating income was $262 million compared to $16 million a year ago and $360 million in the prior quarter. The year-over-year increase was driven by significantly higher revenue. The quarter-over-quarter decline was primarily due to lower revenue.

- Enterprise, Embedded and Semi-Custom segment revenue was $348 million, down 21 percent year-over-year and 25 percent sequentially primarily due to lower semi-custom sales, partially offset by higher EPYC processor sales.

- Operating loss was $26 million compared to operating income of $68 million a year ago, which included a $60 million licensing gain. The decline from operating income of $45 million in the prior quarter was primarily due to lower revenue and higher operating expenses.

- All Other operating loss was $59 million compared to operating losses of $46 million a year ago and $57 million in the prior quarter.

View at TechPowerUp Main Site

))

))

a new chip came out..Just the longevity of the AM4 platform is attest to that.

a new chip came out..Just the longevity of the AM4 platform is attest to that.