- Joined

- Oct 9, 2007

- Messages

- 47,571 (7.46/day)

- Location

- Dublin, Ireland

| System Name | RBMK-1000 |

|---|---|

| Processor | AMD Ryzen 7 5700G |

| Motherboard | ASUS ROG Strix B450-E Gaming |

| Cooling | DeepCool Gammax L240 V2 |

| Memory | 2x 8GB G.Skill Sniper X |

| Video Card(s) | Palit GeForce RTX 2080 SUPER GameRock |

| Storage | Western Digital Black NVMe 512GB |

| Display(s) | BenQ 1440p 60 Hz 27-inch |

| Case | Corsair Carbide 100R |

| Audio Device(s) | ASUS SupremeFX S1220A |

| Power Supply | Cooler Master MWE Gold 650W |

| Mouse | ASUS ROG Strix Impact |

| Keyboard | Gamdias Hermes E2 |

| Software | Windows 11 Pro |

AMD late Tuesday released its Q2-2020 financial results, which saw the company rake in revenue of $1.93 billion for the quarter, and clock a 26 percent YoY revenue growth. In both its corporate presentation targeted at the financial analysts, and its post-results conference call, AMD revealed a handful interesting bits looking into the near future. Much of the focus of AMD's presentation was in reassuring investors that [unlike Intel] it is promising a stable and predictable roadmap, that nothing has changed on its roadmap, and that it intends to execute everything on time. "Over the past couple of quarters what we've seen is that they see our performance/capability. You can count on us for a consistent roadmap. Milan point important for us, will ensure it ships later this year. Already started engaging people on Zen4/5nm. We feel customers are very open. We feel well positioned," said president and CEO Dr Lisa Su.

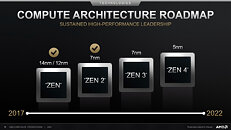

For starters, there was yet another confirmation from the CEO that the company will launch the "Zen 3" CPU microarchitecture across both the consumer and data-center segments before year-end, which means both Ryzen and EPYC "Milan" products based on "Zen 3." Also confirmed was the introduction of the RDNA2 graphics architecture across consumer graphics segments, and the debut of the CDNA scalar compute architecture. The company started shipping semi-custom SoCs to both Microsoft and Sony, so they could manufacture their next-generation Xbox Series X and PlayStation 5 game consoles in volumes for the Holiday shopping season. Semi-custom shipments could contribute big to the company's Q3-2020 earnings. CDNA won't play a big role in 2020 for AMD, but there will be more opportunities for the datacenter GPU lineup in 2021, according to the company. CDNA2 debuts next year.

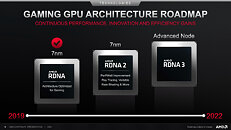

CEO Dr Lisa Su also reiterated that the future-gen "Zen 3" microarchitecture is "in the lab and looking good," and that it will be built on the 5 nm silicon fabrication process. The AMD corporate presentation confirms that "Genoa" will be the codename of the EPYC product based on "Zen 4." The slide suggests a 2021 rollout of "Genoa." The same presentation also points to "Zen 3" based Ryzen products debuting within 2020, and a 2021 debut of the RDNA3 graphics architecture on an "Advanced Node." Consumer graphics continues to be a weak spot for AMD, with revenues on the decline. AMD is betting on RDNA2 and a "full refresh" of the product stack to turn its fortunes around. While semi-custom shipments will drive Q3 revenues, Q4 is expected to be propelled largely by "Zen 3" and RDNA2.

AMD isn't celebrating Intel's fumbles with foundry nodes just yet. As a fabless chip-maker, the company is still at the mercy of TSMC for growth in volumes. Su commented that 7 nm supply situation is "still tight" for AMD. She stated that the company is working with TSMC to ensure it can satisfy customer demand.

AMD appears unfazed by Intel "Tiger Lake." Ryzen 4000 series processors based on the "Renoir" silicon will continue to drive revenues for AMD in the mobile segment, in 2H-2020. In the call, an analyst with JP Morgan and Chase shared findings of the firm's internal survey of CIOs across the industry. According to the survey, CIOs are increasingly receptive to deploying AMD EPYC processors. An analyst also asked AMD if it sees a threat with Arm in the server space, especially in the light of Apple dumping x86. Dr Su said she's quite confident that the PC and server markets remain predominantly x86, and that it's on chipmakers to ensure the x86 remains competitive.

View at TechPowerUp Main Site

For starters, there was yet another confirmation from the CEO that the company will launch the "Zen 3" CPU microarchitecture across both the consumer and data-center segments before year-end, which means both Ryzen and EPYC "Milan" products based on "Zen 3." Also confirmed was the introduction of the RDNA2 graphics architecture across consumer graphics segments, and the debut of the CDNA scalar compute architecture. The company started shipping semi-custom SoCs to both Microsoft and Sony, so they could manufacture their next-generation Xbox Series X and PlayStation 5 game consoles in volumes for the Holiday shopping season. Semi-custom shipments could contribute big to the company's Q3-2020 earnings. CDNA won't play a big role in 2020 for AMD, but there will be more opportunities for the datacenter GPU lineup in 2021, according to the company. CDNA2 debuts next year.

CEO Dr Lisa Su also reiterated that the future-gen "Zen 3" microarchitecture is "in the lab and looking good," and that it will be built on the 5 nm silicon fabrication process. The AMD corporate presentation confirms that "Genoa" will be the codename of the EPYC product based on "Zen 4." The slide suggests a 2021 rollout of "Genoa." The same presentation also points to "Zen 3" based Ryzen products debuting within 2020, and a 2021 debut of the RDNA3 graphics architecture on an "Advanced Node." Consumer graphics continues to be a weak spot for AMD, with revenues on the decline. AMD is betting on RDNA2 and a "full refresh" of the product stack to turn its fortunes around. While semi-custom shipments will drive Q3 revenues, Q4 is expected to be propelled largely by "Zen 3" and RDNA2.

AMD isn't celebrating Intel's fumbles with foundry nodes just yet. As a fabless chip-maker, the company is still at the mercy of TSMC for growth in volumes. Su commented that 7 nm supply situation is "still tight" for AMD. She stated that the company is working with TSMC to ensure it can satisfy customer demand.

AMD appears unfazed by Intel "Tiger Lake." Ryzen 4000 series processors based on the "Renoir" silicon will continue to drive revenues for AMD in the mobile segment, in 2H-2020. In the call, an analyst with JP Morgan and Chase shared findings of the firm's internal survey of CIOs across the industry. According to the survey, CIOs are increasingly receptive to deploying AMD EPYC processors. An analyst also asked AMD if it sees a threat with Arm in the server space, especially in the light of Apple dumping x86. Dr Su said she's quite confident that the PC and server markets remain predominantly x86, and that it's on chipmakers to ensure the x86 remains competitive.

View at TechPowerUp Main Site

You must catch cancer pretty easily. You must be the first case that I ever heard catching cancer from grammar.

You must catch cancer pretty easily. You must be the first case that I ever heard catching cancer from grammar.  Good luck and quick recovery!

Good luck and quick recovery!