- Joined

- Aug 19, 2017

- Messages

- 2,651 (0.99/day)

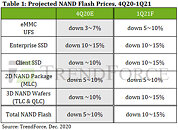

The percentage distribution of 2021 NAND Flash bit demand by application currently shows that client SSD accounts for 31%, enterprise SSD 20%, eMMC/UFS 41%, and NAND wafer 8%, according to TrendForce's latest investigations. TrendForce expects NAND Flash ASP to undergo QoQ declines throughout 2021, since the number of NAND suppliers far exceeds DRAM suppliers, and the bit supply remains high. As Samsung, YMTC, SK Hynix, and Intel actively expand their NAND Flash bit output in 1Q21, the oversupply situation in the industry will become more severe, with a forecasted 6% QoQ increase in NAND Flash bit output and a 10-15% QoQ decline in NAND Flash ASP in 1Q21.

Client SSD prices are expected to decline by 10-15% QoQ as inventory level of PC OEMs remains relatively high

On the matter of demand, client SSD exhibits a similar tendency compared to PC DRAM, as notebook production is expected to decline in 1Q21 due to the cyclical downturn. However, unlike PC DRAM, the client SSD inventory of PC OEMs is still currently at a rather high level, and client SSD prices are expected to continue falling. PC OEMs therefore will not exhibit advance procurement demand for client SSDs, leading to a lack of upward momentum supporting the overall purchasing demand of client SSDs. On the matter of supply, the oversupply of client SSD will unlikely change in 1Q21, since major NAND Flash manufacturers are still proactively sending their latest 128L samples for testing, and the second U.S. supplier is starting to ramp up QLC SSD production. Taking the above into account, client SSD prices are expected to decrease by 10-15% QoQ in 1Q21.

As price competition between PCIe SSD suppliers intensifies, enterprise SSD prices are expected to drop by 10-15% QoQ

With respect to demand, enterprise SSD is likewise quite similar to server DRAM, as they are both affected by the traditional off-season for branded server manufacturers and the continued inventory destocking from data center clients. Before the ramp-up of Intel's next-generation Whitley Gen 2 - Ice Lake platform, the volume of enterprise SSD orders will undergo a further decline in 1Q21 compared to 4Q20. With respect to supply, product testing of 128/144L PCIe G4 SSD samples from Samsung and Intel are currently underway. At the same time, Kioxia is also attempting to obtain additional certifications from data centers with its PCIe G4 products. As more SSD suppliers release their respective PCIe products, the price competition for enterprise SSDs will further intensify going forward. Hence, enterprise SSD prices are expected to decrease by 10-15% QoQ in 1Q21.

eMMC/UFS prices are projected to drop by 5-10% QoQ in 1Q21 given high demand for end-products and tightening supply

Demand-wise, the proactive stock-up activities from OPPO, Vivo, and Xiaomi, as well as the establishment of new Honor, have provided some upward support for the overall demand for eMMC and UFS products. Furthermore, flourishing orders for Chromebooks have also propelled demand for low- and mid-capacity (32/64 GB) eMMC. Despite the oversupply situation of the NAND Flash market, the decline in eMMC/UFS prices will likely be narrower than other product categories. On the other hand, the supply of eMMC products 32 GB and below will continue to diminish, since suppliers have mostly decided to stop updating these products and to continue manufacturing those using older processes. This indicates that prices will be much stabilized in the long run.

Also, there has been insufficient production capacity for controllers manufactured by TSMC and UMC in the upstream eMMC/UFS supply chain. This insufficiency subsequently prompted eMMC/UFS suppliers to shift towards the provision of high-capacity products in order to increase NAND Flash consumption, thereby further reducing the supply of low capacity products. UFS comprises the majority of products that are 64 GB and above, and the supply of 92/96L products are currently sufficient. Suppliers are planning to transition into 1XX L or 1YY L products mostly after 2Q21. Thus, the overall price drop of eMMC/UFS products will be relatively narrow in 1Q21. Their prices are projected to decline by 5-10% QoQ in 1Q21.

As demand for memory cards and UFDs are unlikely to recover in 1Q21, NAND Flash wafer prices are expected to decrease by nearly 15% QoQ

The end demand regarding sales of memory cards and UFD from the retail end will experience difficulties in recovery in 1Q21 with the conclusion of festival demand and e-commerce promotion, the arrival of the traditional off season, and the impact of the pandemic. In terms of supply, as most products are still in a state of oversupply, and certain components, including controllers, are constrained by the production capacity of foundries, various suppliers are experiencing increasing pressure to divert to the wafer market. In terms of manufacturing processes, suppliers such as Samsung and Kioxia have begun selling 92/96L products to module makers, whereas WDC and SK Hynix are even more aggressive by having already provided samples of 112L and 128L products to clients for integration, resulting in a rapid increase in bit supply and a near-15% QoQ price drop for NAND Flash wafers in 1Q21.

View at TechPowerUp Main Site

Client SSD prices are expected to decline by 10-15% QoQ as inventory level of PC OEMs remains relatively high

On the matter of demand, client SSD exhibits a similar tendency compared to PC DRAM, as notebook production is expected to decline in 1Q21 due to the cyclical downturn. However, unlike PC DRAM, the client SSD inventory of PC OEMs is still currently at a rather high level, and client SSD prices are expected to continue falling. PC OEMs therefore will not exhibit advance procurement demand for client SSDs, leading to a lack of upward momentum supporting the overall purchasing demand of client SSDs. On the matter of supply, the oversupply of client SSD will unlikely change in 1Q21, since major NAND Flash manufacturers are still proactively sending their latest 128L samples for testing, and the second U.S. supplier is starting to ramp up QLC SSD production. Taking the above into account, client SSD prices are expected to decrease by 10-15% QoQ in 1Q21.

As price competition between PCIe SSD suppliers intensifies, enterprise SSD prices are expected to drop by 10-15% QoQ

With respect to demand, enterprise SSD is likewise quite similar to server DRAM, as they are both affected by the traditional off-season for branded server manufacturers and the continued inventory destocking from data center clients. Before the ramp-up of Intel's next-generation Whitley Gen 2 - Ice Lake platform, the volume of enterprise SSD orders will undergo a further decline in 1Q21 compared to 4Q20. With respect to supply, product testing of 128/144L PCIe G4 SSD samples from Samsung and Intel are currently underway. At the same time, Kioxia is also attempting to obtain additional certifications from data centers with its PCIe G4 products. As more SSD suppliers release their respective PCIe products, the price competition for enterprise SSDs will further intensify going forward. Hence, enterprise SSD prices are expected to decrease by 10-15% QoQ in 1Q21.

eMMC/UFS prices are projected to drop by 5-10% QoQ in 1Q21 given high demand for end-products and tightening supply

Demand-wise, the proactive stock-up activities from OPPO, Vivo, and Xiaomi, as well as the establishment of new Honor, have provided some upward support for the overall demand for eMMC and UFS products. Furthermore, flourishing orders for Chromebooks have also propelled demand for low- and mid-capacity (32/64 GB) eMMC. Despite the oversupply situation of the NAND Flash market, the decline in eMMC/UFS prices will likely be narrower than other product categories. On the other hand, the supply of eMMC products 32 GB and below will continue to diminish, since suppliers have mostly decided to stop updating these products and to continue manufacturing those using older processes. This indicates that prices will be much stabilized in the long run.

Also, there has been insufficient production capacity for controllers manufactured by TSMC and UMC in the upstream eMMC/UFS supply chain. This insufficiency subsequently prompted eMMC/UFS suppliers to shift towards the provision of high-capacity products in order to increase NAND Flash consumption, thereby further reducing the supply of low capacity products. UFS comprises the majority of products that are 64 GB and above, and the supply of 92/96L products are currently sufficient. Suppliers are planning to transition into 1XX L or 1YY L products mostly after 2Q21. Thus, the overall price drop of eMMC/UFS products will be relatively narrow in 1Q21. Their prices are projected to decline by 5-10% QoQ in 1Q21.

As demand for memory cards and UFDs are unlikely to recover in 1Q21, NAND Flash wafer prices are expected to decrease by nearly 15% QoQ

The end demand regarding sales of memory cards and UFD from the retail end will experience difficulties in recovery in 1Q21 with the conclusion of festival demand and e-commerce promotion, the arrival of the traditional off season, and the impact of the pandemic. In terms of supply, as most products are still in a state of oversupply, and certain components, including controllers, are constrained by the production capacity of foundries, various suppliers are experiencing increasing pressure to divert to the wafer market. In terms of manufacturing processes, suppliers such as Samsung and Kioxia have begun selling 92/96L products to module makers, whereas WDC and SK Hynix are even more aggressive by having already provided samples of 112L and 128L products to clients for integration, resulting in a rapid increase in bit supply and a near-15% QoQ price drop for NAND Flash wafers in 1Q21.

View at TechPowerUp Main Site