- Joined

- Aug 19, 2017

- Messages

- 2,651 (0.99/day)

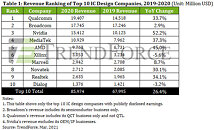

The emergence of the COVID-19 pandemic in 1H20 seemed at first poised to devastate the IC design industry. However, as WFH and distance education became the norm, TrendForce finds that the demand for notebook computers and networking products also spiked in response, in turn driving manufacturers to massively ramp up their procurement activities for components. Fabless IC design companies that supply such components therefore benefitted greatly from manufacturers' procurement demand, and the IC design industry underwent tremendous growth in 2020. In particular, the top three IC design companies (Qualcomm, Broadcom, and Nvidia) all posted YoY increases in their revenues, with Nvidia registering the most impressive growth, at a staggering 52.2% increase YoY, the highest among the top 10 companies.

According to TrendForce's latest investigations, Qualcomm was able to overtake Broadcom for the leading position in the top 10 list primarily due to two reasons: First, the sudden demand surge for network devices; and second, Apple's decision to once again adopt Qualcomm's baseband processors. Incidentally, US sanctions against Huawei also prompted other smartphone brands to ramp up their production volumes in an attempt to seize additional market shares. Taken together, these factors collectively drove up Qualcomm's revenue last year. Likewise, although the US-China trade war hampered Broadcom's performances in 1H20, its smartphone RF front-end became a crucial part of Apple's supply chain in 2H20. Even so, Broadcom fell to second place in the rankings, since its revenue growth was relatively minor. The Mellanox acquisition substantially bolstered the depth and breadth of Nvidia's data center solutions, which generated nearly US$6.4 billion in revenue, a 121.2% increase YoY. Owing to its data center solutions and gaming graphics cards, which performed well in the market, Nvidia posted the highest YoY revenue growth among the top 10 companies, at 52.2% as previously mentioned.

The three Taiwanese companies delivered remarkable performances as well. In particular, MediaTek's revenue underwent a 37.3% YoY increase in 2020, an overwhelming improvement over the 1% YoY increase in 2019. MediaTek's growth last year took place due to several reasons, including the skyrocketing demand for notebooks and networking products, the success of MediaTek's 5G smartphone processors, and improved specs as well as cost optimizations for MediaTek's networking products. Novatek's revenue grew by 30.1% YoY, as the US-China trade war and the stay-at-home economy brought about by the pandemic resulted in strong sales of its driver ICs and TV SoCs. Finally, Realtek benefitted from the high demand for its various offerings, most notably networking products and notebooks, although sales of its audio products and Bluetooth chips were also respectable. Realtek's revenue increased by 34.1% YoY.

Capitalizing on the capacity limitations of Intel's 10 nm process, AMD made significant inroads in the notebook, desktop, and server CPU markets, resulting in a $9.7 billion revenue, a remarkable 45% increase YoY. Although Xilinx's revenue declined by 5.6% YoY in the wake of the US-China trade war, recent QoQ changes in Xilinx's revenue show that the company is well on its way to recovery going forward.

Although vaccines are being administered across the globe at the moment, the pandemic has yet to show any signs of slowdown in 1Q21. While device manufacturers remain active in procuring components, the shortage of foundry capacities is expected to persist throughout the year. IC design companies are likely to raise IC quotes given the need to ensure sufficient foundry capacities allocated to IC products, in turn propelling IC design revenue to new heights in 2021.

View at TechPowerUp Main Site

According to TrendForce's latest investigations, Qualcomm was able to overtake Broadcom for the leading position in the top 10 list primarily due to two reasons: First, the sudden demand surge for network devices; and second, Apple's decision to once again adopt Qualcomm's baseband processors. Incidentally, US sanctions against Huawei also prompted other smartphone brands to ramp up their production volumes in an attempt to seize additional market shares. Taken together, these factors collectively drove up Qualcomm's revenue last year. Likewise, although the US-China trade war hampered Broadcom's performances in 1H20, its smartphone RF front-end became a crucial part of Apple's supply chain in 2H20. Even so, Broadcom fell to second place in the rankings, since its revenue growth was relatively minor. The Mellanox acquisition substantially bolstered the depth and breadth of Nvidia's data center solutions, which generated nearly US$6.4 billion in revenue, a 121.2% increase YoY. Owing to its data center solutions and gaming graphics cards, which performed well in the market, Nvidia posted the highest YoY revenue growth among the top 10 companies, at 52.2% as previously mentioned.

The three Taiwanese companies delivered remarkable performances as well. In particular, MediaTek's revenue underwent a 37.3% YoY increase in 2020, an overwhelming improvement over the 1% YoY increase in 2019. MediaTek's growth last year took place due to several reasons, including the skyrocketing demand for notebooks and networking products, the success of MediaTek's 5G smartphone processors, and improved specs as well as cost optimizations for MediaTek's networking products. Novatek's revenue grew by 30.1% YoY, as the US-China trade war and the stay-at-home economy brought about by the pandemic resulted in strong sales of its driver ICs and TV SoCs. Finally, Realtek benefitted from the high demand for its various offerings, most notably networking products and notebooks, although sales of its audio products and Bluetooth chips were also respectable. Realtek's revenue increased by 34.1% YoY.

Capitalizing on the capacity limitations of Intel's 10 nm process, AMD made significant inroads in the notebook, desktop, and server CPU markets, resulting in a $9.7 billion revenue, a remarkable 45% increase YoY. Although Xilinx's revenue declined by 5.6% YoY in the wake of the US-China trade war, recent QoQ changes in Xilinx's revenue show that the company is well on its way to recovery going forward.

Although vaccines are being administered across the globe at the moment, the pandemic has yet to show any signs of slowdown in 1Q21. While device manufacturers remain active in procuring components, the shortage of foundry capacities is expected to persist throughout the year. IC design companies are likely to raise IC quotes given the need to ensure sufficient foundry capacities allocated to IC products, in turn propelling IC design revenue to new heights in 2021.

View at TechPowerUp Main Site