- Joined

- Oct 9, 2007

- Messages

- 47,402 (7.52/day)

- Location

- Hyderabad, India

| System Name | RBMK-1000 |

|---|---|

| Processor | AMD Ryzen 7 5700G |

| Motherboard | ASUS ROG Strix B450-E Gaming |

| Cooling | DeepCool Gammax L240 V2 |

| Memory | 2x 8GB G.Skill Sniper X |

| Video Card(s) | Palit GeForce RTX 2080 SUPER GameRock |

| Storage | Western Digital Black NVMe 512GB |

| Display(s) | BenQ 1440p 60 Hz 27-inch |

| Case | Corsair Carbide 100R |

| Audio Device(s) | ASUS SupremeFX S1220A |

| Power Supply | Cooler Master MWE Gold 650W |

| Mouse | ASUS ROG Strix Impact |

| Keyboard | Gamdias Hermes E2 |

| Software | Windows 11 Pro |

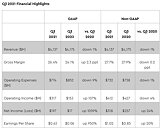

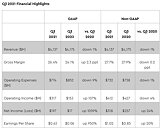

Western Digital Corp. (Nasdaq: WDC) today reported fiscal third quarter 2021 financial results. "We reported solid results above the guidance range, driven by increasing momentum of our energy-assisted drives and our second-generation NVMe enterprise SSDs, improving NAND flash pricing trends, along with the continued accelerated digital transformation across end markets," said David Goeckeler, Western Digital CEO.

"Western Digital's strengths in technology and cost leadership, expansive product portfolio and broad routes to market are providing a foundation upon which we are solidifying our position as an essential building block of the digital economy. These strengths, combined with our increased operational and strategic focus enabled by our new business unit structure, are driving results. As we continue to face a dynamic environment, we are seeing the benefits of the synergistic value in the breadth of Western Digital's portfolio, and our unique ability to deliver both hard drive and flash solutions to our diverse end-markets and customer base."

The company generated $116 million in cash flow from operations, made a total debt repayment of $212 million, and ended the quarter with $2.7 billion of total cash and cash equivalents. There were 313 million ordinary shares outstanding at the end of the quarter.

Additional details can be found within the company's earnings presentation, which is accessible online at investor.wdc.com.

In the fiscal third quarter of 2021, Western Digital's revenue decreased 1% year-over-year to $4.1 billion, driven by a decline in Data Center Devices & Solutions offset by strong performance in gaming and consumer markets.

In Client Devices, continued strength in notebook and desktop PC demand, along with new game console ramps, drove solid revenue growth.

In Data Center Devices and Solutions, while revenue was down 19% from the prior year, Western Digital experienced significant sequential growth with its second generation, NVMe enterprise SSD at a cloud titan. In addition, many cloud customers also utilize NAND flash for their consumer product lines, creating additional end market opportunities for Western Digital as the company continues to diversify and balance the end markets served. Qualifications of Western Digital's energy-assisted hard drives have also been completed with nearly all cloud and enterprise customers, including all cloud titans.

In Client Solutions, revenue increased due to strength in retail, which remains a high performing end market, as Western Digital's brand recognition, broad product portfolio, and extensive distribution channels continue to distinguish Western Digital from its competitors.

View at TechPowerUp Main Site

"Western Digital's strengths in technology and cost leadership, expansive product portfolio and broad routes to market are providing a foundation upon which we are solidifying our position as an essential building block of the digital economy. These strengths, combined with our increased operational and strategic focus enabled by our new business unit structure, are driving results. As we continue to face a dynamic environment, we are seeing the benefits of the synergistic value in the breadth of Western Digital's portfolio, and our unique ability to deliver both hard drive and flash solutions to our diverse end-markets and customer base."

The company generated $116 million in cash flow from operations, made a total debt repayment of $212 million, and ended the quarter with $2.7 billion of total cash and cash equivalents. There were 313 million ordinary shares outstanding at the end of the quarter.

Additional details can be found within the company's earnings presentation, which is accessible online at investor.wdc.com.

In the fiscal third quarter of 2021, Western Digital's revenue decreased 1% year-over-year to $4.1 billion, driven by a decline in Data Center Devices & Solutions offset by strong performance in gaming and consumer markets.

In Client Devices, continued strength in notebook and desktop PC demand, along with new game console ramps, drove solid revenue growth.

In Data Center Devices and Solutions, while revenue was down 19% from the prior year, Western Digital experienced significant sequential growth with its second generation, NVMe enterprise SSD at a cloud titan. In addition, many cloud customers also utilize NAND flash for their consumer product lines, creating additional end market opportunities for Western Digital as the company continues to diversify and balance the end markets served. Qualifications of Western Digital's energy-assisted hard drives have also been completed with nearly all cloud and enterprise customers, including all cloud titans.

In Client Solutions, revenue increased due to strength in retail, which remains a high performing end market, as Western Digital's brand recognition, broad product portfolio, and extensive distribution channels continue to distinguish Western Digital from its competitors.

View at TechPowerUp Main Site