TheLostSwede

News Editor

- Joined

- Nov 11, 2004

- Messages

- 18,056 (2.44/day)

- Location

- Sweden

| System Name | Overlord Mk MLI |

|---|---|

| Processor | AMD Ryzen 7 7800X3D |

| Motherboard | Gigabyte X670E Aorus Master |

| Cooling | Noctua NH-D15 SE with offsets |

| Memory | 32GB Team T-Create Expert DDR5 6000 MHz @ CL30-34-34-68 |

| Video Card(s) | Gainward GeForce RTX 4080 Phantom GS |

| Storage | 1TB Solidigm P44 Pro, 2 TB Corsair MP600 Pro, 2TB Kingston KC3000 |

| Display(s) | Acer XV272K LVbmiipruzx 4K@160Hz |

| Case | Fractal Design Torrent Compact |

| Audio Device(s) | Corsair Virtuoso SE |

| Power Supply | be quiet! Pure Power 12 M 850 W |

| Mouse | Logitech G502 Lightspeed |

| Keyboard | Corsair K70 Max |

| Software | Windows 10 Pro |

| Benchmark Scores | https://valid.x86.fr/yfsd9w |

Samsung is by far Samsung's largest foundry customers and this is no secret, but now it seems like the company wants to gain more customers to help pay for the costs of operating a cutting edge foundry. A little over a decade ago, Samsung was part of the Common Platform technology alliance together with GlobalFoundries and IBM, which allowed companies to almost pick either foundry based on a common design kit and common process technologies. It made Samsung an attractive foundry option, but the alliance didn't last.

As we know, Nvidia gave Samsung a try with Ampere and there were a lot of reports of yield issues and what not early on. This seems to have persuaded Nvidia to move back to TSMC for Lovelace and Hopper, which is a big loss for Samsung. However, it seems this was also something of a wakeup call for Samsung, as the company is apparently looking at making some internal changes to its customer structure so it can handle third party customers in a better way.

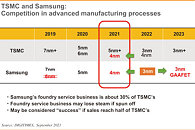

Samsung is ready to start producing chips on its 4 nm node this year, with its 3 nm GAAFET node expected to live in 2023, something that was revealed earlier this year. This is at least six months to a year behind TSMC's 3 nm node which is expected to go into production in the second half of 2022. According to DigiTimes, TSMC already has 60 EUV tools for its 3 nm node in its possession, whereas Samsung in comparison is only expected to have 20 at the most and isn't expected to have more than 30 by the end of this year.

Maybe the biggest issue for Samsung is that its foundry business isn't making money, as the second quarter profits were only US$268 million, with TSMC raking in over US$13 billion at the same time. Even SMIC and UMC are more profitable than Samsung and it's likely that some of this is down to the fact that third parties are wary about using Samsung's foundries due to a wide range of reasons, least not that Samsung is often a direct competitor. Samsung has considered spinning off its foundry business in the past and this might still come to pass, but it's apparently not something the company is considering at the moment.

Samsung has a lot of work ahead of itself to not only stay competitive with TSMC, but also to convince potential customers to choose them over its competitors, even more so now maybe, as Intel is also vying for a slice of the foundry business cake. With TSMC having announced that it'll be investing US$100 billion between 2021 and 2023, in capacity expansion, or roughly twice that of Samsung's sales from its foundry business, it's going to be tough for Samsung to stay competitive without more business. Rumours are that Tesla might be moving from TSMC to Samsung and we also know that Google is working with Samsung on its Tensor SoC. However these are still fairly small business opportunities and Samsung needs some high-volume customers to be able to keep up with TSMC long term.

View at TechPowerUp Main Site

As we know, Nvidia gave Samsung a try with Ampere and there were a lot of reports of yield issues and what not early on. This seems to have persuaded Nvidia to move back to TSMC for Lovelace and Hopper, which is a big loss for Samsung. However, it seems this was also something of a wakeup call for Samsung, as the company is apparently looking at making some internal changes to its customer structure so it can handle third party customers in a better way.

Samsung is ready to start producing chips on its 4 nm node this year, with its 3 nm GAAFET node expected to live in 2023, something that was revealed earlier this year. This is at least six months to a year behind TSMC's 3 nm node which is expected to go into production in the second half of 2022. According to DigiTimes, TSMC already has 60 EUV tools for its 3 nm node in its possession, whereas Samsung in comparison is only expected to have 20 at the most and isn't expected to have more than 30 by the end of this year.

Maybe the biggest issue for Samsung is that its foundry business isn't making money, as the second quarter profits were only US$268 million, with TSMC raking in over US$13 billion at the same time. Even SMIC and UMC are more profitable than Samsung and it's likely that some of this is down to the fact that third parties are wary about using Samsung's foundries due to a wide range of reasons, least not that Samsung is often a direct competitor. Samsung has considered spinning off its foundry business in the past and this might still come to pass, but it's apparently not something the company is considering at the moment.

Samsung has a lot of work ahead of itself to not only stay competitive with TSMC, but also to convince potential customers to choose them over its competitors, even more so now maybe, as Intel is also vying for a slice of the foundry business cake. With TSMC having announced that it'll be investing US$100 billion between 2021 and 2023, in capacity expansion, or roughly twice that of Samsung's sales from its foundry business, it's going to be tough for Samsung to stay competitive without more business. Rumours are that Tesla might be moving from TSMC to Samsung and we also know that Google is working with Samsung on its Tensor SoC. However these are still fairly small business opportunities and Samsung needs some high-volume customers to be able to keep up with TSMC long term.

View at TechPowerUp Main Site