- Joined

- Aug 19, 2017

- Messages

- 2,929 (1.05/day)

Contract prices of NAND Flash products are expected to undergo a marginal drop of 0-5% QoQ in 4Q21 as demand slows, according to TrendForce's latest investigations. Hence, the current cyclical upturn in NAND Flash prices will have lasted for only two consecutive quarters. Looking ahead, NAND Flash suppliers' capacity expansion plans will be affected by the outlook on future trends and the supply of other non-memory components. At the same time, attention will have to be paid to the demand projection. At the moment, NAND Flash suppliers appear likely to downsize their capacity expansion activities for 2022, resulting in a 31.8% YoY increase in NAND Flash bit supply next year. Annual bit demand, on the other hand, is projected to increase by 30.8% YoY. With demand being outpaced by supply and competition intensifying among suppliers for higher-layer products, the NAND Flash market will likely experience a cyclical downturn in prices in 2022.

YoY Growth of bit supply for 2022 is projected to reach 31.8% as competition for higher-layer NAND Flash remains fierce

With demand surging for a significant part of this year, customers have accelerated their adoption of higher-layer NAND technologies. Suppliers have also revised their production plans several times so as to raise output, reaching a YoY growth of nearly 40% in total NAND Flash bit supply in 2021. In light of the somewhat high base for comparison and the relatively weak demand outlook next year, TrendForce expects annual NAND Flash bit supply to increase by only about 31.8% YoY in 2022.

NAND Flash bit demand will grow by just 30.8% due to high base for comparison and factors related to arrival of post-pandemic era

The analysis of the demand side of the NAND Flash market finds that the shipment volumes of smartphones, notebook computers, and servers have been undergoing robust growths in 2021, resulting in a relatively high base period for comparison against next year's figures. Hence, substantial YoY increases in device production or shipment in 2022 will be difficult. In addition, the procurement side still suffers from mismatched availability of components. With NAND Flash supply being relatively healthy and device manufacturers carrying a growing NAND Flash inventory, NAND Flash procurement for the upcoming period will likely be limited. TrendForce expects NAND Flash bit demand to increase by 30.8% YoY in 2022, which represents a slower growth compared with the increase in NAND Flash bit supply.

Regarding the smartphone market, the persistent shortage of components, including chipsets and driver ICs, is expected to exacerbate the decline in smartphone shipment during the traditional off-season of the first quarter. As for the average storage capacity of handsets, one driver of growth is the iPhone series, which is adopting a 1 TB solution for the first time with this year's line-up (i.e., iPhone 13 Pro/Pro Max). This will encourage brands in the Android camp to follow suit and have a 1 TB solution featured in the future flagship models that are released in 2022, thus slightly increasing the shipment share of high-density solutions. Furthermore, brands in the Android camp will be focusing on pushing models with 256 GB or 512 GB in response to Apple's storage upgrade for this year's iPhone lineup. TrendForce forecasts that the NAND Flash bit demand related to smartphones will rise by around 28.5% YoY in 2022, which is noticeably lower than the growth rates that approached almost 30% for the years prior to 2021.

Regarding the notebook market, orders for notebook computers will enter a period of downward correction in 2022 compared to the peak growth that took place in 2021 as increasingly widespread vaccinations lead to a gradual easing of border restrictions. Although the workforce's return to physical offices has now generated some upside demand for commercial notebooks, the demand for consumer notebooks and Chromebooks, which are highly contingent on the education sector, will undergo a sharp decline. Taking these factors into account, TrendForce forecasts a modest 23.2% YoY growth in client SSD bit demand in 2022, which falls short of the growth in 2021 by a considerable margin.

Regarding the server market, CSPs' continued procurement of servers in 2022 is expected to drive up annual server shipment by about 4.5% YoY. In particular, the average storage capacity of enterprise SSDs is expected to experience a more significant growth next year compared to previous years due to the gradual release of new server CPU platforms with PCIe Gen 4 support, which features more PCIe lanes allocated to SSD data transfer. These new CPUs will also come with substantial upgrades in terms of both core count and processing power. Adoption of large-capacity enterprise SSDs enables servers equipped with such CPUs to achieve improved computing performance and in turn allows CSPs to cut down on the number of server nodes required, thereby optimizing the cost of data center build-out. In terms of applications, computing demand from AI and big data will continue growing, and this growth will also contribute to the increase in the average storage capacity of enterprise SSDs next year. In addition to the aforementioned developments, the release of Intel's Sapphire Rapids platform, which supports PCIe Gen 5, will bring about a further bump in enterprise SSD data transfer speed, as well as average storage capacity, which is expected to increase by 33.5% YoY in 2022.

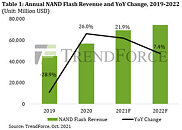

Annual NAND Flash revenue is projected to increase by merely 7% YoY in 2022 while falling quotes offset growth in bit shipment

NAND Flash ASPs have not shown significant downturns for two consecutive years since 2020. At the same time, as the COVID-19 pandemic drives up the demand for electronic products and cloud services, the overall growth in NAND Flash bit demand has been remarkable, resulting in an annual NAND Flash revenue growth of more than 20% YoY in both 2020 and 2021. Looking ahead to 2022, the YoY increase in NAND Flash bit demand will diminish due to the high base for comparison this year. The NAND Flash market is projected to enter a period of price downturn, with an over 18% decline in NAND Flash ASP. While such a decline offsets the rise in bit shipment, annual NAND Flash revenue will likely increase by merely 7% in 2022, the lowest YoY growth in three years.

View at TechPowerUp Main Site

YoY Growth of bit supply for 2022 is projected to reach 31.8% as competition for higher-layer NAND Flash remains fierce

With demand surging for a significant part of this year, customers have accelerated their adoption of higher-layer NAND technologies. Suppliers have also revised their production plans several times so as to raise output, reaching a YoY growth of nearly 40% in total NAND Flash bit supply in 2021. In light of the somewhat high base for comparison and the relatively weak demand outlook next year, TrendForce expects annual NAND Flash bit supply to increase by only about 31.8% YoY in 2022.

NAND Flash bit demand will grow by just 30.8% due to high base for comparison and factors related to arrival of post-pandemic era

The analysis of the demand side of the NAND Flash market finds that the shipment volumes of smartphones, notebook computers, and servers have been undergoing robust growths in 2021, resulting in a relatively high base period for comparison against next year's figures. Hence, substantial YoY increases in device production or shipment in 2022 will be difficult. In addition, the procurement side still suffers from mismatched availability of components. With NAND Flash supply being relatively healthy and device manufacturers carrying a growing NAND Flash inventory, NAND Flash procurement for the upcoming period will likely be limited. TrendForce expects NAND Flash bit demand to increase by 30.8% YoY in 2022, which represents a slower growth compared with the increase in NAND Flash bit supply.

Regarding the smartphone market, the persistent shortage of components, including chipsets and driver ICs, is expected to exacerbate the decline in smartphone shipment during the traditional off-season of the first quarter. As for the average storage capacity of handsets, one driver of growth is the iPhone series, which is adopting a 1 TB solution for the first time with this year's line-up (i.e., iPhone 13 Pro/Pro Max). This will encourage brands in the Android camp to follow suit and have a 1 TB solution featured in the future flagship models that are released in 2022, thus slightly increasing the shipment share of high-density solutions. Furthermore, brands in the Android camp will be focusing on pushing models with 256 GB or 512 GB in response to Apple's storage upgrade for this year's iPhone lineup. TrendForce forecasts that the NAND Flash bit demand related to smartphones will rise by around 28.5% YoY in 2022, which is noticeably lower than the growth rates that approached almost 30% for the years prior to 2021.

Regarding the notebook market, orders for notebook computers will enter a period of downward correction in 2022 compared to the peak growth that took place in 2021 as increasingly widespread vaccinations lead to a gradual easing of border restrictions. Although the workforce's return to physical offices has now generated some upside demand for commercial notebooks, the demand for consumer notebooks and Chromebooks, which are highly contingent on the education sector, will undergo a sharp decline. Taking these factors into account, TrendForce forecasts a modest 23.2% YoY growth in client SSD bit demand in 2022, which falls short of the growth in 2021 by a considerable margin.

Regarding the server market, CSPs' continued procurement of servers in 2022 is expected to drive up annual server shipment by about 4.5% YoY. In particular, the average storage capacity of enterprise SSDs is expected to experience a more significant growth next year compared to previous years due to the gradual release of new server CPU platforms with PCIe Gen 4 support, which features more PCIe lanes allocated to SSD data transfer. These new CPUs will also come with substantial upgrades in terms of both core count and processing power. Adoption of large-capacity enterprise SSDs enables servers equipped with such CPUs to achieve improved computing performance and in turn allows CSPs to cut down on the number of server nodes required, thereby optimizing the cost of data center build-out. In terms of applications, computing demand from AI and big data will continue growing, and this growth will also contribute to the increase in the average storage capacity of enterprise SSDs next year. In addition to the aforementioned developments, the release of Intel's Sapphire Rapids platform, which supports PCIe Gen 5, will bring about a further bump in enterprise SSD data transfer speed, as well as average storage capacity, which is expected to increase by 33.5% YoY in 2022.

Annual NAND Flash revenue is projected to increase by merely 7% YoY in 2022 while falling quotes offset growth in bit shipment

NAND Flash ASPs have not shown significant downturns for two consecutive years since 2020. At the same time, as the COVID-19 pandemic drives up the demand for electronic products and cloud services, the overall growth in NAND Flash bit demand has been remarkable, resulting in an annual NAND Flash revenue growth of more than 20% YoY in both 2020 and 2021. Looking ahead to 2022, the YoY increase in NAND Flash bit demand will diminish due to the high base for comparison this year. The NAND Flash market is projected to enter a period of price downturn, with an over 18% decline in NAND Flash ASP. While such a decline offsets the rise in bit shipment, annual NAND Flash revenue will likely increase by merely 7% in 2022, the lowest YoY growth in three years.

View at TechPowerUp Main Site