- Joined

- Oct 9, 2007

- Messages

- 47,351 (7.51/day)

- Location

- Hyderabad, India

| System Name | RBMK-1000 |

|---|---|

| Processor | AMD Ryzen 7 5700G |

| Motherboard | ASUS ROG Strix B450-E Gaming |

| Cooling | DeepCool Gammax L240 V2 |

| Memory | 2x 8GB G.Skill Sniper X |

| Video Card(s) | Palit GeForce RTX 2080 SUPER GameRock |

| Storage | Western Digital Black NVMe 512GB |

| Display(s) | BenQ 1440p 60 Hz 27-inch |

| Case | Corsair Carbide 100R |

| Audio Device(s) | ASUS SupremeFX S1220A |

| Power Supply | Cooler Master MWE Gold 650W |

| Mouse | ASUS ROG Strix Impact |

| Keyboard | Gamdias Hermes E2 |

| Software | Windows 11 Pro |

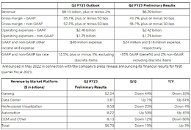

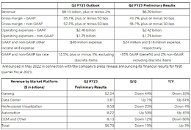

NVIDIA (NASDAQ: NVDA) today announced selected preliminary financial results for the second quarter ended July 31, 2022. Second quarter revenue is expected to be approximately $6.70 billion, down 19% sequentially and up 3% from the prior year, primarily reflecting weaker than forecasted Gaming revenue. Gaming revenue was $2.04 billion, down 44% sequentially and down 33% from the prior year. Data Center revenue was $3.81 billion, up 1% sequentially and up 61% from the prior year.

The shortfall relative to the May revenue outlook of $8.10 billion was primarily attributable to lower sell-in of Gaming products reflecting a reduction in channel partner sales likely due to macroeconomic headwinds. In addition to reducing sell-in, the company implemented pricing programs with channel partners to reflect challenging market conditions that are expected to persist into the third quarter.

Data Center revenue, though a record, was somewhat short of the company's expectations, as it was impacted by supply chain disruptions. Second quarter results are expected to include approximately $1.32 billion of charges, primarily for inventory and related reserves, based on revised expectations of future demand.

"Our gaming product sell-through projections declined significantly as the quarter progressed," said Jensen Huang, founder and CEO of NVIDIA. "As we expect the macroeconomic conditions affecting sell-through to continue, we took actions with our Gaming partners to adjust channel prices and inventory.

"NVIDIA has excellent products and position driving large and growing markets. As we navigate these challenges, we remain focused on the once-in-a-generation opportunity to reinvent computing for the era of AI," he said.

"The significant charges incurred in the quarter reflect previous long-term purchase commitments we made during a time of severe component shortages and our current expectation of ongoing macroeconomic uncertainty," said Colette Kress, EVP and CFO of NVIDIA.

"We believe our long-term gross margin profile is intact. We have slowed operating expense growth, balancing investments for long-term growth while managing near-term profitability. We plan to continue stock buybacks as we foresee strong cash generation and future growth," she said.

The preliminary results for the second quarter ended July 31, 2022, are an estimate, based on information available to management as of the date of this release, and are subject to further changes upon completion of the company's standard quarter and year-end closing procedures. This update does not present all necessary information for an understanding of NVIDIA's financial condition as of the date of this release, or its results of operations for the second quarter. As NVIDIA completes its quarter-end financial close process and finalizes its financial statements for the quarter, it will be required to make significant judgments in a number of areas. It is possible that NVIDIA may identify items that require it to make adjustments to the preliminary financial information set forth above and those changes could be material. NVIDIA does not intend to update such financial information prior to release of its final second quarter financial statement information, which is currently scheduled for Aug. 24, 2022.

View at TechPowerUp Main Site

The shortfall relative to the May revenue outlook of $8.10 billion was primarily attributable to lower sell-in of Gaming products reflecting a reduction in channel partner sales likely due to macroeconomic headwinds. In addition to reducing sell-in, the company implemented pricing programs with channel partners to reflect challenging market conditions that are expected to persist into the third quarter.

Data Center revenue, though a record, was somewhat short of the company's expectations, as it was impacted by supply chain disruptions. Second quarter results are expected to include approximately $1.32 billion of charges, primarily for inventory and related reserves, based on revised expectations of future demand.

"Our gaming product sell-through projections declined significantly as the quarter progressed," said Jensen Huang, founder and CEO of NVIDIA. "As we expect the macroeconomic conditions affecting sell-through to continue, we took actions with our Gaming partners to adjust channel prices and inventory.

"NVIDIA has excellent products and position driving large and growing markets. As we navigate these challenges, we remain focused on the once-in-a-generation opportunity to reinvent computing for the era of AI," he said.

"The significant charges incurred in the quarter reflect previous long-term purchase commitments we made during a time of severe component shortages and our current expectation of ongoing macroeconomic uncertainty," said Colette Kress, EVP and CFO of NVIDIA.

"We believe our long-term gross margin profile is intact. We have slowed operating expense growth, balancing investments for long-term growth while managing near-term profitability. We plan to continue stock buybacks as we foresee strong cash generation and future growth," she said.

The preliminary results for the second quarter ended July 31, 2022, are an estimate, based on information available to management as of the date of this release, and are subject to further changes upon completion of the company's standard quarter and year-end closing procedures. This update does not present all necessary information for an understanding of NVIDIA's financial condition as of the date of this release, or its results of operations for the second quarter. As NVIDIA completes its quarter-end financial close process and finalizes its financial statements for the quarter, it will be required to make significant judgments in a number of areas. It is possible that NVIDIA may identify items that require it to make adjustments to the preliminary financial information set forth above and those changes could be material. NVIDIA does not intend to update such financial information prior to release of its final second quarter financial statement information, which is currently scheduled for Aug. 24, 2022.

View at TechPowerUp Main Site