- Joined

- Oct 9, 2007

- Messages

- 47,579 (7.46/day)

- Location

- Dublin, Ireland

| System Name | RBMK-1000 |

|---|---|

| Processor | AMD Ryzen 7 5700G |

| Motherboard | ASUS ROG Strix B450-E Gaming |

| Cooling | DeepCool Gammax L240 V2 |

| Memory | 2x 8GB G.Skill Sniper X |

| Video Card(s) | Palit GeForce RTX 2080 SUPER GameRock |

| Storage | Western Digital Black NVMe 512GB |

| Display(s) | BenQ 1440p 60 Hz 27-inch |

| Case | Corsair Carbide 100R |

| Audio Device(s) | ASUS SupremeFX S1220A |

| Power Supply | Cooler Master MWE Gold 650W |

| Mouse | ASUS ROG Strix Impact |

| Keyboard | Gamdias Hermes E2 |

| Software | Windows 11 Pro |

Jon Peddie Research reports the growth of the global PC-based graphics processor unit (GPU) market reached 84 million units in Q2'22 and PC CPU shipments decreased by -34% year over year. Overall, GPUs will have a compound annual growth rate of 3.8% during 2022-2026 and reach an installed base of 3,103 million units at the end of the forecast period. Over the next five years, the penetration of discrete GPUs (dGPUs) in the PC will grow to reach a level of 30%.

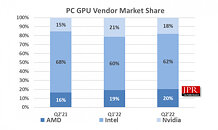

AMD's overall market share percentage from last quarter increased by 1.1%, Intel's market share increased by 2.0%, and NVIDIA's market share decreased by -3.15%, as indicated in the following chart. Overall GPU unit shipments decreased by -14.9% from last quarter. AMD's shipments decreased by -7.6%, Intel's shipments decreased by -9.8%, and NVIDIA's shipments decreased by -25.7%.

Quick highlights

GPUs have been a leading indicator of the market because a GPU goes into a system before the suppliers ship the PC. Most of the semiconductor vendors are guiding down for the next quarter an average of -2.81%. Last quarter they guided 1.98%, which was too high.

Jon Peddie, president of JPR, noted, "This quarter had overall negative results for the GPU vendors, compared to the last quarter. Global events such as the continued war in Ukraine, Russia's manipulation of gas supplies to Western Europe, and the subsequent nervousness those events create have put a dampener on Europe's economy; the UK is in recession with high inflation."

The US was able to get some significant legislation passed, such as student loan relief, a stronger climate control bill with big provisions for alternative energy sources, and the long-sought CHIPs bill. All of that stimulus and infrastructure investment will position the US in a much stronger position for the flowing decade and longer.

"Forecasting has never been more challenging, and as a result, our forecast and others' will get revised frequently as new data appears," Peddie said.

JPR also publishes a series of reports on the graphics add-in board market and PC gaming hardware market, which covers the total market, including systems and accessories, and looks at 31 countries.

Pricing and availability

JPR's Market Watch is available and sells for $2,750. This report includes an Excel workbook with the data used to create the charts, the charts themselves, and supplemental information. The annual subscription price for JPR's Market Watch is $5,500 and includes four quarterly issues. Full subscribers to JPR services receive TechWatch (the company's bi-weekly report) and a copy of Market Watch as part of their subscription.

View at TechPowerUp Main Site

AMD's overall market share percentage from last quarter increased by 1.1%, Intel's market share increased by 2.0%, and NVIDIA's market share decreased by -3.15%, as indicated in the following chart. Overall GPU unit shipments decreased by -14.9% from last quarter. AMD's shipments decreased by -7.6%, Intel's shipments decreased by -9.8%, and NVIDIA's shipments decreased by -25.7%.

Quick highlights

- The GPU's overall attach rate (which includes integrated and discrete GPUs, desktop, notebook, and workstation) to PCs for the quarter was 121%, down -7.9% from last quarter.

- The overall PC CPU market decreased by -7.0% quarter to quarter and decreased -33.7% year to year.

- Desktop graphics add-in boards (AIBs that use discrete GPUs) decreased by -22.6% from the last quarter.

- Tablet shipments remained flat from last quarter

GPUs have been a leading indicator of the market because a GPU goes into a system before the suppliers ship the PC. Most of the semiconductor vendors are guiding down for the next quarter an average of -2.81%. Last quarter they guided 1.98%, which was too high.

Jon Peddie, president of JPR, noted, "This quarter had overall negative results for the GPU vendors, compared to the last quarter. Global events such as the continued war in Ukraine, Russia's manipulation of gas supplies to Western Europe, and the subsequent nervousness those events create have put a dampener on Europe's economy; the UK is in recession with high inflation."

The US was able to get some significant legislation passed, such as student loan relief, a stronger climate control bill with big provisions for alternative energy sources, and the long-sought CHIPs bill. All of that stimulus and infrastructure investment will position the US in a much stronger position for the flowing decade and longer.

"Forecasting has never been more challenging, and as a result, our forecast and others' will get revised frequently as new data appears," Peddie said.

JPR also publishes a series of reports on the graphics add-in board market and PC gaming hardware market, which covers the total market, including systems and accessories, and looks at 31 countries.

Pricing and availability

JPR's Market Watch is available and sells for $2,750. This report includes an Excel workbook with the data used to create the charts, the charts themselves, and supplemental information. The annual subscription price for JPR's Market Watch is $5,500 and includes four quarterly issues. Full subscribers to JPR services receive TechWatch (the company's bi-weekly report) and a copy of Market Watch as part of their subscription.

View at TechPowerUp Main Site