TheLostSwede

News Editor

- Joined

- Nov 11, 2004

- Messages

- 18,374 (2.46/day)

- Location

- Sweden

| System Name | Overlord Mk MLI |

|---|---|

| Processor | AMD Ryzen 7 7800X3D |

| Motherboard | Gigabyte X670E Aorus Master |

| Cooling | Noctua NH-D15 SE with offsets |

| Memory | 32GB Team T-Create Expert DDR5 6000 MHz @ CL30-34-34-68 |

| Video Card(s) | Gainward GeForce RTX 4080 Phantom GS |

| Storage | 1TB Solidigm P44 Pro, 2 TB Corsair MP600 Pro, 2TB Kingston KC3000 |

| Display(s) | Acer XV272K LVbmiipruzx 4K@160Hz |

| Case | Fractal Design Torrent Compact |

| Audio Device(s) | Corsair Virtuoso SE |

| Power Supply | be quiet! Pure Power 12 M 850 W |

| Mouse | Logitech G502 Lightspeed |

| Keyboard | Corsair K70 Max |

| Software | Windows 10 Pro |

| Benchmark Scores | https://valid.x86.fr/yfsd9w |

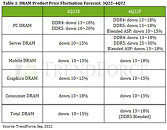

According to TrendForce research, rising inflation has weakened demand for consumer products, flattening the peak of peak season. In 3Q22, memory bit consumption and shipments continued to exhibit quarterly decline. Due to a significant decline in memory demand, terminal buyers also delayed purchases, leading to further escalation of supplier inventory pressure. At the same time, the strategies of various DRAM suppliers to increase their market share remain unchanged. There have been cases of "consolidated Q3/Q4 price negotiations" or "negotiating quantity before pricing" in the market, which are the reasons leading to a ballooning of declining DRAM prices to 13~18% in 4Q22.

In terms of PC DRAM, due to weak demand for notebooks, PC OEMs will remain focused on destocking DRAM inventory. While the DRAM supply side has not actually reduced production since operating profit remains favorable, bit output continues to rise and pressure on suppliers' inventory becomes increasingly obvious. From the perspective of DDR4 and DDR5, the price drop forecast in 4Q22 is 13~18% with DDR5 declining more than DDR4. However, as the penetration rate of DDR5 continues to rise, coupled with a higher unit price, the penetration rate of DDR5 in the PC DRAM sector will increase 13~15% in 4Q22, which will buoy the average unit price of overall PC DRAM (combined DDR5 and DDR4) marginally and PC DRAM pricing in 4Q22 is estimated to drop by approximately 10~15%.

In terms of server DRAM, server terminals have reduced server DRAM bit purchases due to a delay in their new platform and shipments of whole servers is expected to decline in 4Q22. Client server DRAM inventory will be at a high watermark for approximately 9-12 weeks. At the same time, as OEMs and Chinese cloud service providers have slowed their purchasing momentum, manufacturers have shifted focus to negotiating pricing and volume with North American cloud service providers. However, output cannot be effectively digested, compounding manufacturers' inventory pressure. In addition, barring the binding two-quarter consolidated price schemes originally negotiated in 3Q22, it cannot be ruled out that at the end of this year, sellers will offer buyers lower pricing to make advanced purchases for 1Q23. Therefore, the quarterly decline in DDR4 pricing in 4Q22 is likely to be as severe as 13~18%. DDR5 will officially enter mass production in 4Q22 with sample pricing dropping by 25~30% compared with sample pricing in the previous quarter. However, the initial penetration rate of mass production is only around 5%. Therefore, the impact on overall server DRAM (combined DDR5 and DDR4) pricing is limited and server DRAM prices are estimated to drop by approximately 13~18% in 4Q22.

In terms of Mobile DRAM, smartphone brands continue to adjust their mobile DRAM inventory. Inventory levels are expected to be maintained at 7-9 weeks by the end of 3Q22 and variables remain in the seller's market. Therefore, smartphone brands continue to revise their annual production targets downward which increases the difficulty of destocking mobile DRAM. As the proportion of advanced processes utilized by manufacturers continues to grow, their contribution to mobile DRAM bit output has increased. These factories' consolidated price negotiation strategy in 2H22 has yet to bear fruit, so demand from client brands did not increase. Although new Apple products are bound to boost market demand in 4Q22, due to the pressure exerted by previously accumulated inventory and increased 4Q22 supply, pressure on factory inventory will worsen. The price of mobile DRAM is estimated to drop by approximately 13~18% in 4Q22 and it may continue to deteriorate.

In terms of Graphics DRAM, TrendForce expects another round of price cuts for graphics cards. However, various types of terminal promotions can only eliminate preexisting inventory, which possesses limited value in driving new demand. Demand for GDDR6 8 Gb and 16Gb has weakened simultaneously due to buyer inventory adjustment. Buyers' purchasing volume was not stimulated even though DRAM suppliers slashed prices in 3Q22. Therefore, preexisting graphics DRAM inventory continues to pile up, creating greater pressure coupled with the gradual production of previous wafer starts. From the perspective of 4Q22, although there are only two GDDR6 8 Gb suppliers, Samsung and SK hynix, due to huge inventory pressure, the two parties will inevitably compete for orders by undercutting the other's pricing. Therefore, the decline of GDDR6 8 Gb in 4Q22 may be higher than GDDR6 16Gb, lowering prices by approximately 10~15%.

In terms of consumer DRAM, although networking benefited from an alleviation of materials shortages and infrastructure upgrades in Europe and the United States stabilizing consumer DRAM shipments, offsetting declining demand for other end products proved difficult. In a down price cycle, customers have kept their inventories at healthy levels and are not actively stocking. Demand for consumer DRAM is expected to remain weak. Affected by downward revisions in smartphone production throughout the year, demand for image sensors (CIS) has also declined. Therefore, Korean manufacturers have slowed the pace of migrating old processes (DDR3/DDR4) to CIS, resulting in continuous output of heavy consumer DRAM bit volume and inventory pressure that has become difficult to reduce. As oversupply has not eased, DDR3 and DDR4 prices are expected to drop by 10-15% in 4Q22 and overall consumer prices will drop by 10-15%.

View at TechPowerUp Main Site | Source

In terms of PC DRAM, due to weak demand for notebooks, PC OEMs will remain focused on destocking DRAM inventory. While the DRAM supply side has not actually reduced production since operating profit remains favorable, bit output continues to rise and pressure on suppliers' inventory becomes increasingly obvious. From the perspective of DDR4 and DDR5, the price drop forecast in 4Q22 is 13~18% with DDR5 declining more than DDR4. However, as the penetration rate of DDR5 continues to rise, coupled with a higher unit price, the penetration rate of DDR5 in the PC DRAM sector will increase 13~15% in 4Q22, which will buoy the average unit price of overall PC DRAM (combined DDR5 and DDR4) marginally and PC DRAM pricing in 4Q22 is estimated to drop by approximately 10~15%.

In terms of server DRAM, server terminals have reduced server DRAM bit purchases due to a delay in their new platform and shipments of whole servers is expected to decline in 4Q22. Client server DRAM inventory will be at a high watermark for approximately 9-12 weeks. At the same time, as OEMs and Chinese cloud service providers have slowed their purchasing momentum, manufacturers have shifted focus to negotiating pricing and volume with North American cloud service providers. However, output cannot be effectively digested, compounding manufacturers' inventory pressure. In addition, barring the binding two-quarter consolidated price schemes originally negotiated in 3Q22, it cannot be ruled out that at the end of this year, sellers will offer buyers lower pricing to make advanced purchases for 1Q23. Therefore, the quarterly decline in DDR4 pricing in 4Q22 is likely to be as severe as 13~18%. DDR5 will officially enter mass production in 4Q22 with sample pricing dropping by 25~30% compared with sample pricing in the previous quarter. However, the initial penetration rate of mass production is only around 5%. Therefore, the impact on overall server DRAM (combined DDR5 and DDR4) pricing is limited and server DRAM prices are estimated to drop by approximately 13~18% in 4Q22.

In terms of Mobile DRAM, smartphone brands continue to adjust their mobile DRAM inventory. Inventory levels are expected to be maintained at 7-9 weeks by the end of 3Q22 and variables remain in the seller's market. Therefore, smartphone brands continue to revise their annual production targets downward which increases the difficulty of destocking mobile DRAM. As the proportion of advanced processes utilized by manufacturers continues to grow, their contribution to mobile DRAM bit output has increased. These factories' consolidated price negotiation strategy in 2H22 has yet to bear fruit, so demand from client brands did not increase. Although new Apple products are bound to boost market demand in 4Q22, due to the pressure exerted by previously accumulated inventory and increased 4Q22 supply, pressure on factory inventory will worsen. The price of mobile DRAM is estimated to drop by approximately 13~18% in 4Q22 and it may continue to deteriorate.

In terms of Graphics DRAM, TrendForce expects another round of price cuts for graphics cards. However, various types of terminal promotions can only eliminate preexisting inventory, which possesses limited value in driving new demand. Demand for GDDR6 8 Gb and 16Gb has weakened simultaneously due to buyer inventory adjustment. Buyers' purchasing volume was not stimulated even though DRAM suppliers slashed prices in 3Q22. Therefore, preexisting graphics DRAM inventory continues to pile up, creating greater pressure coupled with the gradual production of previous wafer starts. From the perspective of 4Q22, although there are only two GDDR6 8 Gb suppliers, Samsung and SK hynix, due to huge inventory pressure, the two parties will inevitably compete for orders by undercutting the other's pricing. Therefore, the decline of GDDR6 8 Gb in 4Q22 may be higher than GDDR6 16Gb, lowering prices by approximately 10~15%.

In terms of consumer DRAM, although networking benefited from an alleviation of materials shortages and infrastructure upgrades in Europe and the United States stabilizing consumer DRAM shipments, offsetting declining demand for other end products proved difficult. In a down price cycle, customers have kept their inventories at healthy levels and are not actively stocking. Demand for consumer DRAM is expected to remain weak. Affected by downward revisions in smartphone production throughout the year, demand for image sensors (CIS) has also declined. Therefore, Korean manufacturers have slowed the pace of migrating old processes (DDR3/DDR4) to CIS, resulting in continuous output of heavy consumer DRAM bit volume and inventory pressure that has become difficult to reduce. As oversupply has not eased, DDR3 and DDR4 prices are expected to drop by 10-15% in 4Q22 and overall consumer prices will drop by 10-15%.

View at TechPowerUp Main Site | Source