Raevenlord

News Editor

- Joined

- Aug 12, 2016

- Messages

- 3,755 (1.18/day)

- Location

- Portugal

| System Name | The Ryzening |

|---|---|

| Processor | AMD Ryzen 9 5900X |

| Motherboard | MSI X570 MAG TOMAHAWK |

| Cooling | Lian Li Galahad 360mm AIO |

| Memory | 32 GB G.Skill Trident Z F4-3733 (4x 8 GB) |

| Video Card(s) | Gigabyte RTX 3070 Ti |

| Storage | Boot: Transcend MTE220S 2TB, Kintson A2000 1TB, Seagate Firewolf Pro 14 TB |

| Display(s) | Acer Nitro VG270UP (1440p 144 Hz IPS) |

| Case | Lian Li O11DX Dynamic White |

| Audio Device(s) | iFi Audio Zen DAC |

| Power Supply | Seasonic Focus+ 750 W |

| Mouse | Cooler Master Masterkeys Lite L |

| Keyboard | Cooler Master Masterkeys Lite L |

| Software | Windows 10 x64 |

The economic downturn keeps pushing the PC and related manufacturing markets down, following slumps in demand stemming from increased cost of living, the veritable arms race to technological products during COVID-19, and manufacturer's efforts to increase output to provide enough product to meet said demand. But all that goes up must eventually come down, and now South Korean manufacturers are facing the result of months of decreased consumption, with stock levels increasing ahead of actual product uptake (stocks have reached 67.3% of produced goods and factory shipments have declined 20.4%). This has now led to a 1.7% decline in August's output when compared to the same period last year - the first time the South Korean industry has seen negative growth since 2018.

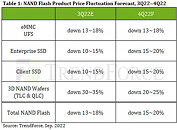

Samsung and Kioxia both have announced a reduction in production output in the months to come, which should give distribution enough time to clear some of the accumulated inventory. The scales of production typically occur in cycles - ones with excess manufacturing against demand, and other times where the reverse happens. It seems we're now in the descending part of the spectrum, with prices - especially of NAND - being expected to drop in the coming months. It will take a while until the manufacturing reduction makes itself felt in the overall IC pricing landscape. Micron too has announced it's slowing down the production ramp-up of its 232-layer 3D NAND so as not to contribute in excess towards an already over-saturated market.

Luckily for users, this general demand softening will lead to price reductions that aim to increase attractiveness of NAND-based products. It seems that 4Q 2022 will be the best time for users looking to upgrade or add to their storage subsystems, with industry analyst TrendForce expecting a further NAND price slump to the tune of 30% by the end of the year.

View at TechPowerUp Main Site | Source

Samsung and Kioxia both have announced a reduction in production output in the months to come, which should give distribution enough time to clear some of the accumulated inventory. The scales of production typically occur in cycles - ones with excess manufacturing against demand, and other times where the reverse happens. It seems we're now in the descending part of the spectrum, with prices - especially of NAND - being expected to drop in the coming months. It will take a while until the manufacturing reduction makes itself felt in the overall IC pricing landscape. Micron too has announced it's slowing down the production ramp-up of its 232-layer 3D NAND so as not to contribute in excess towards an already over-saturated market.

Luckily for users, this general demand softening will lead to price reductions that aim to increase attractiveness of NAND-based products. It seems that 4Q 2022 will be the best time for users looking to upgrade or add to their storage subsystems, with industry analyst TrendForce expecting a further NAND price slump to the tune of 30% by the end of the year.

View at TechPowerUp Main Site | Source