- Joined

- Oct 9, 2007

- Messages

- 47,618 (7.44/day)

- Location

- Dublin, Ireland

| System Name | RBMK-1000 |

|---|---|

| Processor | AMD Ryzen 7 5700G |

| Motherboard | Gigabyte B550 AORUS Elite V2 |

| Cooling | DeepCool Gammax L240 V2 |

| Memory | 2x 16GB DDR4-3200 |

| Video Card(s) | Galax RTX 4070 Ti EX |

| Storage | Samsung 990 1TB |

| Display(s) | BenQ 1440p 60 Hz 27-inch |

| Case | Corsair Carbide 100R |

| Audio Device(s) | ASUS SupremeFX S1220A |

| Power Supply | Cooler Master MWE Gold 650W |

| Mouse | ASUS ROG Strix Impact |

| Keyboard | Gamdias Hermes E2 |

| Software | Windows 11 Pro |

Intel Corporation today reported third-quarter 2022 financial results. "Despite the worsening economic conditions, we delivered solid results and made significant progress with our product and process execution during the quarter," said Pat Gelsinger, Intel CEO. "To position ourselves for this business cycle, we are aggressively addressing costs and driving efficiencies across the business to accelerate our IDM 2.0 flywheel for the digital future."

"As we usher in the next phase of IDM 2.0, we are focused on embracing an internal foundry model to allow our manufacturing group and business units to be more agile, make better decisions and establish a leadership cost structure," said David Zinsner, Intel CFO. "We remain committed to the strategy and long-term financial model communicated at our Investor Meeting."

Business Unit Summary

Intel previously announced several organizational changes to accelerate its execution and innovation by allowing it to capture growth in both large traditional markets and high-growth emerging markets. This includes the reorganization of Intel's business units to capture this growth and provide increased transparency, focus and accountability. As a result, the company modified its segment reporting in the first quarter of 2022 to align to the previously announced business reorganization. All prior-period segment data has been retrospectively adjusted to reflect the way the company internally manages and monitors operating segment performance starting in fiscal year 2022.

Business Highlights

As Intel embarks on its next phase of IDM 2.0, it is embracing a foundry mindset and model for its IFS customers and Intel product lines. To drive this, Intel created the IDM 2.0 Acceleration Office (IAO) led by Stuart Pann, chief business transformation officer. The IAO will be responsible for fully operationalizing Intel's IDM 2.0 model and for developing and implementing the systems and processes to support the company's internal requirements and external foundry customer commitments. This is intended to allow Intel to identify and address structural inefficiencies that exist in its current model, achieve more transparency on its financial execution, better measure itself against other foundries and drive to best-in-class foundry performance.

Business Outlook

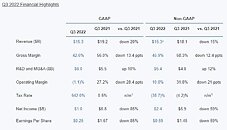

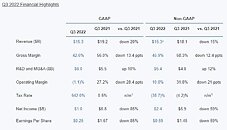

Intel's guidance for the fourth quarter and full year includes both GAAP and non-GAAP estimates. Reconciliations between GAAP and non-GAAP financial measures are included below.

Earnings Webcast

Intel will hold a public webcast at 2 p.m. PDT today to discuss the results for its third quarter of 2022. The live public webcast can be accessed on Intel's Investor Relations website at www.intc.com. The Q3'22 earnings presentation and webcast replay will also be available on the site.

View at TechPowerUp Main Site

"As we usher in the next phase of IDM 2.0, we are focused on embracing an internal foundry model to allow our manufacturing group and business units to be more agile, make better decisions and establish a leadership cost structure," said David Zinsner, Intel CFO. "We remain committed to the strategy and long-term financial model communicated at our Investor Meeting."

Business Unit Summary

Intel previously announced several organizational changes to accelerate its execution and innovation by allowing it to capture growth in both large traditional markets and high-growth emerging markets. This includes the reorganization of Intel's business units to capture this growth and provide increased transparency, focus and accountability. As a result, the company modified its segment reporting in the first quarter of 2022 to align to the previously announced business reorganization. All prior-period segment data has been retrospectively adjusted to reflect the way the company internally manages and monitors operating segment performance starting in fiscal year 2022.

Business Highlights

- Intel continues to make progress with its goal of achieving five nodes in four years. Intel 4 is progressing towards high-volume-manufacturing, and the company expects to tape out a production stepping of Meteor Lake in the fourth quarter, the final step in taking the 14th Gen Intel Core processors from the design phase to early production in silicon. Intel 3 continues to progress on schedule. On Intel 20A and Intel 18A, Intel's first internal test chips and those of a major potential foundry customer have taped out with products undergoing fabrication.

- In the third quarter, CCG launched the 13th Gen Intel Core processors, which offer the world's fastest desktop processor and optimized gaming, content creation and productivity. CCG also introduced Intel Unison to deliver best-in-industry multidevice user experiences.

- DCAI shipped its 4th Gen Intel Xeon Scalable processor high-volume SKUs. In addition, Google Introduced its C3 machine series powered by Intel's 4th Gen Intel Xeon Scalable processor and Google's custom Intel Infrastructure Processing Unit E3200.

- NEX introduced its 12th Gen Intel Core processors optimized for IoT applications, designed for use cases across retail, banking, hospitality, education, industrial manufacturing and healthcare.

- AXG launched the Intel Data Center GPU Flex Series, giving customers a single GPU solution for a wide range of visual cloud workloads, and the Intel Arc A770 and A750 desktop GPUs, bringing much-needed GPU pricing and performance balance to gamers around the world.

- This week Mobileye went public on the Nasdaq Stock Exchange, which Intel believes will unlock value for Intel's stockholders.

- IFS announced that NVIDIA has committed to joining the U.S. Department of Defense's (DOD) RAMP-C program, led by Intel, which enables both commercial foundry customers and the DOD to take advantage of Intel's at-scale investments in leading-edge technologies. In addition, since the second quarter, IFS has expanded engagements to seven of the 10 largest foundry customers, coupled with consistent pipeline growth to include 35 customer test chips.

As Intel embarks on its next phase of IDM 2.0, it is embracing a foundry mindset and model for its IFS customers and Intel product lines. To drive this, Intel created the IDM 2.0 Acceleration Office (IAO) led by Stuart Pann, chief business transformation officer. The IAO will be responsible for fully operationalizing Intel's IDM 2.0 model and for developing and implementing the systems and processes to support the company's internal requirements and external foundry customer commitments. This is intended to allow Intel to identify and address structural inefficiencies that exist in its current model, achieve more transparency on its financial execution, better measure itself against other foundries and drive to best-in-class foundry performance.

Business Outlook

Intel's guidance for the fourth quarter and full year includes both GAAP and non-GAAP estimates. Reconciliations between GAAP and non-GAAP financial measures are included below.

Earnings Webcast

Intel will hold a public webcast at 2 p.m. PDT today to discuss the results for its third quarter of 2022. The live public webcast can be accessed on Intel's Investor Relations website at www.intc.com. The Q3'22 earnings presentation and webcast replay will also be available on the site.

View at TechPowerUp Main Site