TheLostSwede

News Editor

- Joined

- Nov 11, 2004

- Messages

- 19,025 (2.51/day)

- Location

- Sweden

| System Name | Overlord Mk MLI |

|---|---|

| Processor | AMD Ryzen 7 7800X3D |

| Motherboard | Gigabyte X670E Aorus Master |

| Cooling | Noctua NH-D15 SE with offsets |

| Memory | 32GB Team T-Create Expert DDR5 6000 MHz @ CL30-34-34-68 |

| Video Card(s) | Gainward GeForce RTX 4080 Phantom GS |

| Storage | 1TB Solidigm P44 Pro, 2 TB Corsair MP600 Pro, 2TB Kingston KC3000 |

| Display(s) | Acer XV272K LVbmiipruzx 4K@160Hz |

| Case | Fractal Design Torrent Compact |

| Audio Device(s) | Corsair Virtuoso SE |

| Power Supply | be quiet! Pure Power 12 M 850 W |

| Mouse | Logitech G502 Lightspeed |

| Keyboard | Corsair K70 Max |

| Software | Windows 10 Pro |

| Benchmark Scores | https://valid.x86.fr/yfsd9w |

Intel Corporation today reported fourth-quarter and full-year 2022 financial results. The company also announced that its board of directors has declared a quarterly dividend of $0.365 per share on the company's common stock, which will be payable on March 1, 2023, to shareholders of record as of February 7, 2023.

"Despite the economic and market headwinds, we continued to make good progress on our strategic transformation in Q4, including advancing our product roadmap and improving our operational structure and processes to drive efficiencies while delivering at the low-end of our guided range," said Pat Gelsinger, Intel CEO. "In 2023, we will continue to navigate the short-term challenges while striving to meet our long-term commitments, including delivering leadership products anchored on open and secure platforms, powered by at-scale manufacturing and supercharged by our incredible team."

"In the fourth quarter, we took steps to right-size the organization and rationalize our investments, prioritizing the areas where we can deliver the highest value for the long term," said David Zinsner, Intel CFO. "These actions underpin our cost-reduction targets of $3 billion in 2023, and set the stage to achieve $8 billion to $10 billion by the end of 2025."

Business Unit Summary

Intel previously announced several organizational changes to accelerate its execution and innovation by allowing it to capture growth in both large traditional markets and high-growth emerging markets. This includes the reorganization of Intel's business units to capture this growth and provide increased transparency, focus and accountability. As a result, the company modified its segment reporting in the first quarter of 2022 to align to the previously announced business reorganization. All prior-period segment data has been retrospectively adjusted to reflect the way the company internally manages and monitors operating segment performance starting in fiscal year 2022.

Business Highlights

Business Outlook

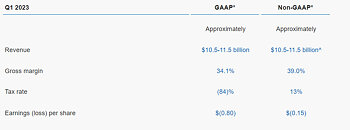

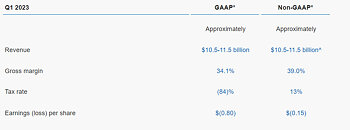

Intel's guidance for the first quarter of 2023 includes both GAAP and non-GAAP estimates. Reconciliations between GAAP and non-GAAP financial measures are included below.

View at TechPowerUp Main Site | Source

"Despite the economic and market headwinds, we continued to make good progress on our strategic transformation in Q4, including advancing our product roadmap and improving our operational structure and processes to drive efficiencies while delivering at the low-end of our guided range," said Pat Gelsinger, Intel CEO. "In 2023, we will continue to navigate the short-term challenges while striving to meet our long-term commitments, including delivering leadership products anchored on open and secure platforms, powered by at-scale manufacturing and supercharged by our incredible team."

"In the fourth quarter, we took steps to right-size the organization and rationalize our investments, prioritizing the areas where we can deliver the highest value for the long term," said David Zinsner, Intel CFO. "These actions underpin our cost-reduction targets of $3 billion in 2023, and set the stage to achieve $8 billion to $10 billion by the end of 2025."

Business Unit Summary

Intel previously announced several organizational changes to accelerate its execution and innovation by allowing it to capture growth in both large traditional markets and high-growth emerging markets. This includes the reorganization of Intel's business units to capture this growth and provide increased transparency, focus and accountability. As a result, the company modified its segment reporting in the first quarter of 2022 to align to the previously announced business reorganization. All prior-period segment data has been retrospectively adjusted to reflect the way the company internally manages and monitors operating segment performance starting in fiscal year 2022.

Business Highlights

- Intel continues to make progress with its goal of achieving five nodes in four years and is on track to regain transistor performance and power performance leadership by 2025. Intel 7 is now in high-volume manufacturing for both client and server. Intel 4 is manufacturing-ready, with the Meteor Lake ramp expected in the second half of 2023. Intel 3 continues to progress and is on track. On Intel 20A and Intel 18A, Intel's first internal test chips, and those of a major potential foundry customer, have taped out with products undergoing fabrication.

- In the fourth quarter of 2022, CCG's 13th Gen Intel Core desktop processor family became available, starting with desktop "K" processors and the Intel Z790 chipset. Additionally, in December 2022, in partnership with ASUS, Intel officially set a new world record for overclocking, pushing the 13th Gen Intel Core i9-13900K past the 9 gigahertz barrier for the first time ever.

- In January 2023, DCAI launched its 4th Gen Intel Xeon Scalable processors (formerly code-named Sapphire Rapids) with the support of customers and partners such as Dell Technologies, Google Cloud, Hewlett Packard Enterprise, Lenovo, Microsoft Azure, NVIDIA and many others, and is ramping production to meet a strong backlog of demand.

- NEX achieved a second consecutive year of double-digit revenue growth, hitting key product milestones with Intel IPU E2000 (Mount Evans), Raptor Lake P&S, Alder Lake N and Sapphire Rapids.

- AXG delivered record revenue for both the fourth quarter and full year. In January 2023, AXG launched the Intel Xeon CPU Max Series (formerly code-named Sapphire Rapids HBM) and the Intel Data Center GPU Max Series (formerly code-named Ponte Vecchio). Intel also announced that with AXG's flagship products now in production, the company is evolving AXG's structure to accelerate and scale its impact and drive go-to-market strategies with a unified voice to customers. Accordingly, the consumer graphics teams will join CCG, and the accelerated computing teams will join DCAI.

- IFS achieved record revenue for both the fourth quarter and full year, with active design engagements with seven of the 10 largest foundry customers. It also added a leading cloud, edge and data center solutions provider as a customer to Intel 3.

- Intel completed the IPO of Mobileye, which achieved record revenue for both the fourth quarter and full year of 2022. Mobileye continued to execute well in its core advanced driver-assistance systems (ADAS) business, as it launched systems into 233 distinct vehicle models in 2022.

Business Outlook

Intel's guidance for the first quarter of 2023 includes both GAAP and non-GAAP estimates. Reconciliations between GAAP and non-GAAP financial measures are included below.

View at TechPowerUp Main Site | Source