- Joined

- Oct 9, 2007

- Messages

- 47,504 (7.49/day)

- Location

- Hyderabad, India

| System Name | RBMK-1000 |

|---|---|

| Processor | AMD Ryzen 7 5700G |

| Motherboard | ASUS ROG Strix B450-E Gaming |

| Cooling | DeepCool Gammax L240 V2 |

| Memory | 2x 8GB G.Skill Sniper X |

| Video Card(s) | Palit GeForce RTX 2080 SUPER GameRock |

| Storage | Western Digital Black NVMe 512GB |

| Display(s) | BenQ 1440p 60 Hz 27-inch |

| Case | Corsair Carbide 100R |

| Audio Device(s) | ASUS SupremeFX S1220A |

| Power Supply | Cooler Master MWE Gold 650W |

| Mouse | ASUS ROG Strix Impact |

| Keyboard | Gamdias Hermes E2 |

| Software | Windows 11 Pro |

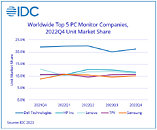

Along with the struggling PC market, PC monitor shipments contracted 18.3% year over year in the fourth quarter of 2022 (4Q22) leading to an annual decline of 5.9% for the full year 2022, according to the International Data Corporation (IDC) Worldwide Quarterly PC Monitor Tracker. At just over 30.5 million units, the 4Q22 results marked the lowest fourth quarter volume since IDC began tracking the market in 2008. However, the setback was expected due to the challenging macro environment, which hit both consumer and commercial demand, and the results hewed close to the forecast of a 16.2% decline in fourth quarter shipments.

After an unprecedented expansion during earlier periods of the pandemic, driven by work from home and gaming needs, consumer monitor demand began to slow. Commercial monitor purchases also were affected as economic sentiments deteriorated in the latter part of 2022. As a result of worsened economic conditions, IDC expects 2023 shipments to contract another 9.8% as lingering inventory and tepid demand weigh on the market. 2024 should see a slight recovery that will lift shipment volumes above pre-pandemic levels as inventory improves. Beyond 2024, IDC expects further stabilization based on the larger installed base that was created by hybrid work and the growth in gaming monitors.

"Monitors will remain an afterthought for many buyers in the short term," said Jay Chou, research manager for IDC's Worldwide Client Device Trackers. "Annual volume had averaged about 125 million before COVID-19, then shot up to over 135 million for each of the past three years. It will take a while for the dust to settle. Consumer and businesses are recalibrating their priorities, but we remain confident that much of the recently expanded installed base will be enticed to upgrade in the coming years."

IDC's Worldwide Quarterly PC Monitor Tracker gathers detailed market data in over 90 countries. The research includes historical and forecast trend analysis among other data.

View at TechPowerUp Main Site

After an unprecedented expansion during earlier periods of the pandemic, driven by work from home and gaming needs, consumer monitor demand began to slow. Commercial monitor purchases also were affected as economic sentiments deteriorated in the latter part of 2022. As a result of worsened economic conditions, IDC expects 2023 shipments to contract another 9.8% as lingering inventory and tepid demand weigh on the market. 2024 should see a slight recovery that will lift shipment volumes above pre-pandemic levels as inventory improves. Beyond 2024, IDC expects further stabilization based on the larger installed base that was created by hybrid work and the growth in gaming monitors.

"Monitors will remain an afterthought for many buyers in the short term," said Jay Chou, research manager for IDC's Worldwide Client Device Trackers. "Annual volume had averaged about 125 million before COVID-19, then shot up to over 135 million for each of the past three years. It will take a while for the dust to settle. Consumer and businesses are recalibrating their priorities, but we remain confident that much of the recently expanded installed base will be enticed to upgrade in the coming years."

IDC's Worldwide Quarterly PC Monitor Tracker gathers detailed market data in over 90 countries. The research includes historical and forecast trend analysis among other data.

View at TechPowerUp Main Site

)

)