TheLostSwede

News Editor

- Joined

- Nov 11, 2004

- Messages

- 18,400 (2.47/day)

- Location

- Sweden

| System Name | Overlord Mk MLI |

|---|---|

| Processor | AMD Ryzen 7 7800X3D |

| Motherboard | Gigabyte X670E Aorus Master |

| Cooling | Noctua NH-D15 SE with offsets |

| Memory | 32GB Team T-Create Expert DDR5 6000 MHz @ CL30-34-34-68 |

| Video Card(s) | Gainward GeForce RTX 4080 Phantom GS |

| Storage | 1TB Solidigm P44 Pro, 2 TB Corsair MP600 Pro, 2TB Kingston KC3000 |

| Display(s) | Acer XV272K LVbmiipruzx 4K@160Hz |

| Case | Fractal Design Torrent Compact |

| Audio Device(s) | Corsair Virtuoso SE |

| Power Supply | be quiet! Pure Power 12 M 850 W |

| Mouse | Logitech G502 Lightspeed |

| Keyboard | Corsair K70 Max |

| Software | Windows 10 Pro |

| Benchmark Scores | https://valid.x86.fr/yfsd9w |

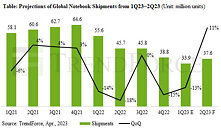

TrendForce research reveals that global notebook shipments reached 33.9 million units in 1Q23—a 13% QoQ and 39% YoY decline. This drop is primarily attributed to the continued impact of economic headwinds on consumer market confidence, which has hindered notebook channels as they destock. As a result, notebook brands have reduced ODM orders in an attempt to regulate inventory pressure, with this pressure on notebooks and their components expecting to be eased in 2Q23 as channels increase demand MoM. TrendForce predicts this will drive 2Q23 notebook shipments to 37.63 million units, an 11% QoQ increase but a 17.7% YoY decline.

Business markets face pressure, demand for niche products gradually growing

The U.S. Federal Reserve raised the benchmark interest rate a quarter of a percentage point, from 4.75% to 5%—the highest it's been since the eve of the 2007 financial crisis—in response to weak market demand and a continuous decline in corporate revenue. In the face of high financing and borrowing costs, businesses are strictly controlling financial expenditures, delaying procurement plans, and reducing manpower, all of which, impact the shipment volume of commercial models.

COMPUTEX will once again be held at the end of May after a three-year hiatus. During the exhibition, brands are planning to launch mid-range and entry-level models from the NVIDIA GeForce 40 series. TrendForce believes that more affordable pricing for entry-level customers will encourage them to purchase new graphics cards, thereby driving up demand. Furthermore, as interest in AI grows, high-performance gaming notebooks and models geared towards professional creators are gaining more attention. Even if they are niche products, they can be still be regarded as one of the factors that stimulates demand in the consumer market.

Unfortunately, delayed recovery from the pandemic and the effects of inflation has further widened the consumer gap, despite positive impacts from promotional activities in 2H23. TrendForce predicts that global notebook shipment volumes in 2023 may further decrease 13% YoY as businesses reduce expenditure.

View at TechPowerUp Main Site | Source

Business markets face pressure, demand for niche products gradually growing

The U.S. Federal Reserve raised the benchmark interest rate a quarter of a percentage point, from 4.75% to 5%—the highest it's been since the eve of the 2007 financial crisis—in response to weak market demand and a continuous decline in corporate revenue. In the face of high financing and borrowing costs, businesses are strictly controlling financial expenditures, delaying procurement plans, and reducing manpower, all of which, impact the shipment volume of commercial models.

COMPUTEX will once again be held at the end of May after a three-year hiatus. During the exhibition, brands are planning to launch mid-range and entry-level models from the NVIDIA GeForce 40 series. TrendForce believes that more affordable pricing for entry-level customers will encourage them to purchase new graphics cards, thereby driving up demand. Furthermore, as interest in AI grows, high-performance gaming notebooks and models geared towards professional creators are gaining more attention. Even if they are niche products, they can be still be regarded as one of the factors that stimulates demand in the consumer market.

Unfortunately, delayed recovery from the pandemic and the effects of inflation has further widened the consumer gap, despite positive impacts from promotional activities in 2H23. TrendForce predicts that global notebook shipment volumes in 2023 may further decrease 13% YoY as businesses reduce expenditure.

View at TechPowerUp Main Site | Source