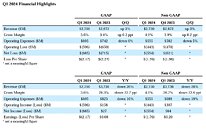

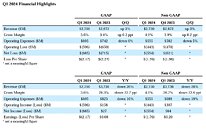

Western Digital Corp. (Nasdaq: WDC) today reported fiscal first quarter 2024 financial results. "Western Digital's fiscal first quarter results exceeded our expectations as the team's efforts to bolster business agility and develop differentiated and innovative products across a broad range of end-markets have resulted in sequential margin improvement across flash and HDD businesses," said David Goeckeler, Western Digital CEO. "Our Consumer and Client end markets continue to perform well and we now expect our Cloud end market to grow going forward. Our improved cost structure positions Western Digital to capitalize on enhanced earnings power as market conditions continue to improve."

The company had an operating cash outflow of $626 million and ended the quarter with $2.03 billion of total cash and cash equivalents.

In the fiscal first quarter:

View at TechPowerUp Main Site | Source

- First quarter revenue was $2.75 billion, up 3% sequentially (QoQ). Cloud revenue decreased 12% (QoQ), Client revenue increased 11% (QoQ) and Consumer revenue increased 14% (QoQ).

- First quarter GAAP earnings per share (EPS) was $(2.17) and Non-GAAP EPS was $(1.76), which includes $225 million of underutilization-related charges in Flash and HDD.

- Expect fiscal second quarter 2024 revenue to be in the range of $2.85 billion to $3.05 billion.

- Expect Non-GAAP EPS in the range of $(1.35) to $(1.05), which includes $110 to $130 million of underutilization-related charges in Flash and HDD.

The company had an operating cash outflow of $626 million and ended the quarter with $2.03 billion of total cash and cash equivalents.

In the fiscal first quarter:

- Cloud represented 32% of total revenue. Sequentially, the decline was primarily due to lower nearline hard drive shipments to data center customers. The year-over-year decrease was primarily due to declines in shipments for both hard drive and flash products.

- Client represented 42% of total revenue. Sequentially, the increase was due to growth in flash bit shipments. The year-over-year decrease was primarily due to declines in flash pricing.

- Consumer represented 26% of total revenue. On both a sequential and year-over-year basis, the increase was driven by both higher content per unit and unit shipments in flash.

View at TechPowerUp Main Site | Source