TheLostSwede

News Editor

- Joined

- Nov 11, 2004

- Messages

- 18,450 (2.47/day)

- Location

- Sweden

| System Name | Overlord Mk MLI |

|---|---|

| Processor | AMD Ryzen 7 7800X3D |

| Motherboard | Gigabyte X670E Aorus Master |

| Cooling | Noctua NH-D15 SE with offsets |

| Memory | 32GB Team T-Create Expert DDR5 6000 MHz @ CL30-34-34-68 |

| Video Card(s) | Gainward GeForce RTX 4080 Phantom GS |

| Storage | 1TB Solidigm P44 Pro, 2 TB Corsair MP600 Pro, 2TB Kingston KC3000 |

| Display(s) | Acer XV272K LVbmiipruzx 4K@160Hz |

| Case | Fractal Design Torrent Compact |

| Audio Device(s) | Corsair Virtuoso SE |

| Power Supply | be quiet! Pure Power 12 M 850 W |

| Mouse | Logitech G502 Lightspeed |

| Keyboard | Corsair K70 Max |

| Software | Windows 10 Pro |

| Benchmark Scores | https://valid.x86.fr/yfsd9w |

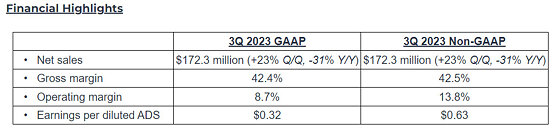

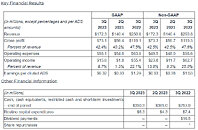

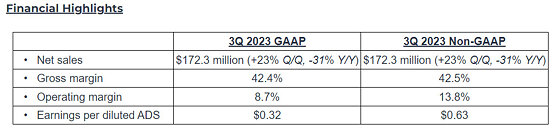

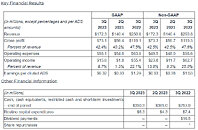

Silicon Motion Technology Corporation (NasdaqGS: SIMO) ("Silicon Motion", the "Company" or "we") today announced its financial results for the quarter ended September 30, 2023. For the third quarter of 2023, net sales (GAAP) increased sequentially to $172.3 million from $140.4 million in the second quarter of 2023. Net income (GAAP) decreased to $10.6 million, or $0.32 per diluted American Depositary Share of the Company ("ADS") (GAAP), from net income (GAAP) of $11.0 million, or $0.33 per diluted ADS (GAAP), in the second quarter of 2023.

For the third quarter of 2023, net income (non-GAAP) increased to $21.1 million, or $0.63 per diluted ADS (non-GAAP), from net income (non-GAAP) of $12.6 million, or $0.38 per diluted ADS (non-GAAP), in the second quarter of 2023.

Third Quarter 2023 Review

"We're pleased with our strong performance in the third quarter as we began to see inventory levels in the channel normalize and OEM order patterns accelerate ahead of the anticipated holiday season demand," said Wallace Kou, President and CEO of Silicon Motion. "eMMC+UFS sales rebounded while our SSD controller sales again saw sequential growth. Our continuing investment in technology leadership in storage controllers has expanded our customer base for SSD and eMMC+UFS controllers and diversified our end-markets, leading to more stable and sustainable long-term growth."

During the third quarter of 2023, we had $17.1 million of capital expenditures, including $6.3 million for the routine purchase of testing equipment, software, design tools and other items, and $10.8 million for building construction in Hsinchu.

Acquisition Update

On May 5, 2022, Silicon Motion and MaxLinear, Inc. ("MaxLinear") entered into a merger agreement (the "Merger Agreement"), pursuant to which Silicon Motion agreed to be acquired by MaxLinear, with (a) holders of Silicon Motion ordinary shares, par value $0.01 (each, a "Share"), to receive $23.385 in cash and 0.097 shares of MaxLinear common stock, par value $0.0001("MaxLinear Common Stock") for each Share that they hold (other than certain customary excluded Shares), and (b) ADS holders to receive $93.54 in cash and 0.388 shares of MaxLinear Common Stock for each ADS that they hold (other than ADSs representing certain customary excluded Shares), in each case, with cash in lieu of any fractional shares of MaxLinear Common Stock (collectively, the "Transaction"). On August 31, 2022, shareholders at Silicon Motion's Extraordinary General Meeting of Shareholders approved the Transaction.

On July 26, 2023, Silicon Motion and MaxLinear received antitrust approval from the State Administration for Market Regulation of the People's Republic of China ("SAMR Approval"). Shortly after receiving SAMR Approval, Silicon Motion received notice from MaxLinear of its purported termination of the Merger Agreement. MaxLinear did not provide any factual basis for its purported termination, and Silicon Motion believes its actions constituted a willful and material breach of the Merger Agreement. Silicon Motion has filed a claim in the Singapore International Arbitration Centre, which is the venue for dispute resolution under the Merger Agreement, and is pursuing payment of the termination fee of $160 million, further substantial damages, interest and costs.

Business Outlook

"We expect our business to continue to rebound in the fourth quarter as channel inventory normalizes and OEM demand further improves, leading to better-than-seasonal sequential revenue growth," said Wallace Kou, President and CEO of Silicon Motion. "Order patterns and visibility have improved significantly since the start of this year and with inventory levels normalizing and a strong pipeline of design wins, we are well positioned to deliver growth in 2024."

View at TechPowerUp Main Site | Source

For the third quarter of 2023, net income (non-GAAP) increased to $21.1 million, or $0.63 per diluted ADS (non-GAAP), from net income (non-GAAP) of $12.6 million, or $0.38 per diluted ADS (non-GAAP), in the second quarter of 2023.

Third Quarter 2023 Review

"We're pleased with our strong performance in the third quarter as we began to see inventory levels in the channel normalize and OEM order patterns accelerate ahead of the anticipated holiday season demand," said Wallace Kou, President and CEO of Silicon Motion. "eMMC+UFS sales rebounded while our SSD controller sales again saw sequential growth. Our continuing investment in technology leadership in storage controllers has expanded our customer base for SSD and eMMC+UFS controllers and diversified our end-markets, leading to more stable and sustainable long-term growth."

During the third quarter of 2023, we had $17.1 million of capital expenditures, including $6.3 million for the routine purchase of testing equipment, software, design tools and other items, and $10.8 million for building construction in Hsinchu.

Acquisition Update

On May 5, 2022, Silicon Motion and MaxLinear, Inc. ("MaxLinear") entered into a merger agreement (the "Merger Agreement"), pursuant to which Silicon Motion agreed to be acquired by MaxLinear, with (a) holders of Silicon Motion ordinary shares, par value $0.01 (each, a "Share"), to receive $23.385 in cash and 0.097 shares of MaxLinear common stock, par value $0.0001("MaxLinear Common Stock") for each Share that they hold (other than certain customary excluded Shares), and (b) ADS holders to receive $93.54 in cash and 0.388 shares of MaxLinear Common Stock for each ADS that they hold (other than ADSs representing certain customary excluded Shares), in each case, with cash in lieu of any fractional shares of MaxLinear Common Stock (collectively, the "Transaction"). On August 31, 2022, shareholders at Silicon Motion's Extraordinary General Meeting of Shareholders approved the Transaction.

On July 26, 2023, Silicon Motion and MaxLinear received antitrust approval from the State Administration for Market Regulation of the People's Republic of China ("SAMR Approval"). Shortly after receiving SAMR Approval, Silicon Motion received notice from MaxLinear of its purported termination of the Merger Agreement. MaxLinear did not provide any factual basis for its purported termination, and Silicon Motion believes its actions constituted a willful and material breach of the Merger Agreement. Silicon Motion has filed a claim in the Singapore International Arbitration Centre, which is the venue for dispute resolution under the Merger Agreement, and is pursuing payment of the termination fee of $160 million, further substantial damages, interest and costs.

Business Outlook

"We expect our business to continue to rebound in the fourth quarter as channel inventory normalizes and OEM demand further improves, leading to better-than-seasonal sequential revenue growth," said Wallace Kou, President and CEO of Silicon Motion. "Order patterns and visibility have improved significantly since the start of this year and with inventory levels normalizing and a strong pipeline of design wins, we are well positioned to deliver growth in 2024."

View at TechPowerUp Main Site | Source