TheLostSwede

News Editor

- Joined

- Nov 11, 2004

- Messages

- 18,109 (2.45/day)

- Location

- Sweden

| System Name | Overlord Mk MLI |

|---|---|

| Processor | AMD Ryzen 7 7800X3D |

| Motherboard | Gigabyte X670E Aorus Master |

| Cooling | Noctua NH-D15 SE with offsets |

| Memory | 32GB Team T-Create Expert DDR5 6000 MHz @ CL30-34-34-68 |

| Video Card(s) | Gainward GeForce RTX 4080 Phantom GS |

| Storage | 1TB Solidigm P44 Pro, 2 TB Corsair MP600 Pro, 2TB Kingston KC3000 |

| Display(s) | Acer XV272K LVbmiipruzx 4K@160Hz |

| Case | Fractal Design Torrent Compact |

| Audio Device(s) | Corsair Virtuoso SE |

| Power Supply | be quiet! Pure Power 12 M 850 W |

| Mouse | Logitech G502 Lightspeed |

| Keyboard | Corsair K70 Max |

| Software | Windows 10 Pro |

| Benchmark Scores | https://valid.x86.fr/yfsd9w |

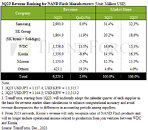

TrendForce reports a pivotal shift in the NAND Flash market for 3Q23, primarily driven by Samsung's strategic decision to reduce production. Initially, the market was clouded by uncertainty regarding end-user demand and fears of a subdued peak season, prompting buyers to adopt a conservative approach with low inventory and slow procurement. However, as market leaders like Samsung implemented substantial production cuts, buyers' attitudes shifted toward a more aggressive procurement strategy in anticipation of a market supply decrease. This led to a stabilization and even an uptick in NAND Flash contract prices by quarter-end, driving a 3% QoQ increase in bit shipments and culminating in a total revenue of US$9.229 billion, marking an approximate 2.9% increase.

The story unfolds with Kioxia and Micron—the only two to witness a dip in revenue rankings this quarter—while Samsung maintained its robust performance. Despite sluggish demand in the server sector, Samsung's fortunes rebounded thanks to a boost in consumer electronics, especially with high-capacity products in PCs and smartphones. Samsung emerged from a trough in Q3, with strategic inventory replenishments fueling further strategic stocking, and a shift in operational focus toward maximizing profit. This led to a minor 1-3% decrease in shipped bits, but a 1-3% increase in ASP, stabilizing Q3 NAND Flash revenue at US$2.9 billion.

Kioxia saw a 3% increase in Q3 ASP, boosted by rebounding wafer contract prices and early strategic stockpiling by laptop clients. However, a delay in orders from American smartphone brands led to a 10-15% decrease in shipped bits, causing a dip in NAND Flash revenue to US$1.34 billion, marking an 8.6% decline in QoQ.

Micron was characterized by steady orders from PC and mobile sectors and inventory restocking by some enterprise SSD clients. Despite maintaining bit shipments from Q2, a 15% drop in ASP led to a slight slip in revenue to US$1.15 billion, a 5.2% decrease in QoQ. Yet, Q4 forecasts a more vibrant scenario, with a comprehensive rebound in contract prices and a surge in order growth driven by price hikes, setting Micron up for over 20% revenue growth QoQ.

Other industry giants like SK Group (SK hynix & Solidigm) and WDC rode the wave of renewed demand in consumer electronics. SK Group, buoyed by renewed demand for high-capacity products in the PC and smartphone arenas, maintained a steady increase in bit shipments, catapulting Q3 NAND Flash revenue to US$1.86 billion-an 11.9% uptick. WDC's narrative echoed this success, with Q3 PC demand outstripping forecasts and resilient demand in mobile and gaming categories underscoring an effective price-driven increase in bit shipments, thus boosting the NAND Flash division's revenue to US$1.556 billion, a significant 13% climb in QoQ.

View at TechPowerUp Main Site | Source

The story unfolds with Kioxia and Micron—the only two to witness a dip in revenue rankings this quarter—while Samsung maintained its robust performance. Despite sluggish demand in the server sector, Samsung's fortunes rebounded thanks to a boost in consumer electronics, especially with high-capacity products in PCs and smartphones. Samsung emerged from a trough in Q3, with strategic inventory replenishments fueling further strategic stocking, and a shift in operational focus toward maximizing profit. This led to a minor 1-3% decrease in shipped bits, but a 1-3% increase in ASP, stabilizing Q3 NAND Flash revenue at US$2.9 billion.

Kioxia saw a 3% increase in Q3 ASP, boosted by rebounding wafer contract prices and early strategic stockpiling by laptop clients. However, a delay in orders from American smartphone brands led to a 10-15% decrease in shipped bits, causing a dip in NAND Flash revenue to US$1.34 billion, marking an 8.6% decline in QoQ.

Micron was characterized by steady orders from PC and mobile sectors and inventory restocking by some enterprise SSD clients. Despite maintaining bit shipments from Q2, a 15% drop in ASP led to a slight slip in revenue to US$1.15 billion, a 5.2% decrease in QoQ. Yet, Q4 forecasts a more vibrant scenario, with a comprehensive rebound in contract prices and a surge in order growth driven by price hikes, setting Micron up for over 20% revenue growth QoQ.

Other industry giants like SK Group (SK hynix & Solidigm) and WDC rode the wave of renewed demand in consumer electronics. SK Group, buoyed by renewed demand for high-capacity products in the PC and smartphone arenas, maintained a steady increase in bit shipments, catapulting Q3 NAND Flash revenue to US$1.86 billion-an 11.9% uptick. WDC's narrative echoed this success, with Q3 PC demand outstripping forecasts and resilient demand in mobile and gaming categories underscoring an effective price-driven increase in bit shipments, thus boosting the NAND Flash division's revenue to US$1.556 billion, a significant 13% climb in QoQ.

View at TechPowerUp Main Site | Source