TheLostSwede

News Editor

- Joined

- Nov 11, 2004

- Messages

- 18,321 (2.46/day)

- Location

- Sweden

| System Name | Overlord Mk MLI |

|---|---|

| Processor | AMD Ryzen 7 7800X3D |

| Motherboard | Gigabyte X670E Aorus Master |

| Cooling | Noctua NH-D15 SE with offsets |

| Memory | 32GB Team T-Create Expert DDR5 6000 MHz @ CL30-34-34-68 |

| Video Card(s) | Gainward GeForce RTX 4080 Phantom GS |

| Storage | 1TB Solidigm P44 Pro, 2 TB Corsair MP600 Pro, 2TB Kingston KC3000 |

| Display(s) | Acer XV272K LVbmiipruzx 4K@160Hz |

| Case | Fractal Design Torrent Compact |

| Audio Device(s) | Corsair Virtuoso SE |

| Power Supply | be quiet! Pure Power 12 M 850 W |

| Mouse | Logitech G502 Lightspeed |

| Keyboard | Corsair K70 Max |

| Software | Windows 10 Pro |

| Benchmark Scores | https://valid.x86.fr/yfsd9w |

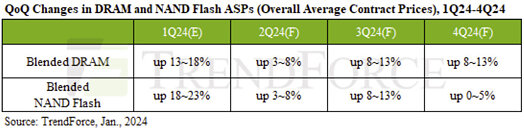

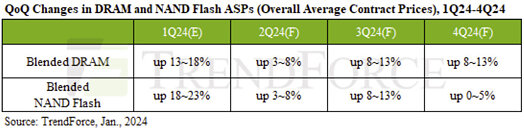

TrendForce's latest analysis reveals that the downswing of DRAM contract prices, which had lasted for eight consecutive quarters since 4Q21, was finally reversed in 4Q23. Likewise, NAND Flash rebounded in 3Q23 after four quarters of decline. The persistence of this rally in memory prices during 2024 will largely hinge on suppliers' ongoing and effective control over their capacity utilization rates.

According to TrendForce Senior Research Vice President, Avril Wu, the first quarter of this year is already shaping up to be a season of growth, with TrendForce confirming its initial projections: a hike of around 13-18% QoQ for DRAM contract prices and a hike of 18-23% for NAND Flash contract prices. Despite a generally conservative outlook for overall market demand in 2Q24, suppliers in both DRAM and NAND Flash markets have begun raising their capacity utilization rates since the end of 4Q23. Furthermore, NAND Flash buyers are anticipated to complete their inventory restocking in advance in 1Q24. Due to the rise in capacity utilization rates and earlier restocking efforts, leading to a more moderated QoQ price increase of 3-8% for both DRAM and NAND Flash contract prices for 2Q24.

As for 3Q24, the period will see the arrival of the traditional peak season, and North American CSPs are expected to become more energetic in restocking key components. DRAM and NAND Flash contract prices could continue to climb and show a wider QoQ increase of 8-13% if suppliers keep their capacity utilization rates below 100% (i.e., they are still not operating at fully loaded capacity). In the DRAM market, the rising DDR5 and HBM penetration rates will further push up the overall ASP, thereby widening the QoQ increase in contract prices.

Finally, in 4Q24, the general price rally is anticipated to continue if suppliers maintain an effective strategy for controlling output. DRAM contract prices are forecasted to increase by about 8-13% QoQ. It should be noted that the increase in DRAM contract prices will be primarily due to the rising market penetration of DDR5 and HBM products. However, looking at individual products or product types, such as DDR5, QoQ declines are a possibility. This means that the general rally of DRAM contract prices during 2024 reflects changes in the product mix rather than an across-the-board rise for all types of DRAM chips. As for NAND Flash products, their contract prices are forecasted to increase by 0-5% QoQ for 4Q24.

View at TechPowerUp Main Site | Source

According to TrendForce Senior Research Vice President, Avril Wu, the first quarter of this year is already shaping up to be a season of growth, with TrendForce confirming its initial projections: a hike of around 13-18% QoQ for DRAM contract prices and a hike of 18-23% for NAND Flash contract prices. Despite a generally conservative outlook for overall market demand in 2Q24, suppliers in both DRAM and NAND Flash markets have begun raising their capacity utilization rates since the end of 4Q23. Furthermore, NAND Flash buyers are anticipated to complete their inventory restocking in advance in 1Q24. Due to the rise in capacity utilization rates and earlier restocking efforts, leading to a more moderated QoQ price increase of 3-8% for both DRAM and NAND Flash contract prices for 2Q24.

As for 3Q24, the period will see the arrival of the traditional peak season, and North American CSPs are expected to become more energetic in restocking key components. DRAM and NAND Flash contract prices could continue to climb and show a wider QoQ increase of 8-13% if suppliers keep their capacity utilization rates below 100% (i.e., they are still not operating at fully loaded capacity). In the DRAM market, the rising DDR5 and HBM penetration rates will further push up the overall ASP, thereby widening the QoQ increase in contract prices.

Finally, in 4Q24, the general price rally is anticipated to continue if suppliers maintain an effective strategy for controlling output. DRAM contract prices are forecasted to increase by about 8-13% QoQ. It should be noted that the increase in DRAM contract prices will be primarily due to the rising market penetration of DDR5 and HBM products. However, looking at individual products or product types, such as DDR5, QoQ declines are a possibility. This means that the general rally of DRAM contract prices during 2024 reflects changes in the product mix rather than an across-the-board rise for all types of DRAM chips. As for NAND Flash products, their contract prices are forecasted to increase by 0-5% QoQ for 4Q24.

View at TechPowerUp Main Site | Source