T0@st

News Editor

- Joined

- Mar 7, 2023

- Messages

- 3,000 (3.83/day)

- Location

- South East, UK

| System Name | The TPU Typewriter |

|---|---|

| Processor | AMD Ryzen 5 5600 (non-X) |

| Motherboard | GIGABYTE B550M DS3H Micro ATX |

| Cooling | DeepCool AS500 |

| Memory | Kingston Fury Renegade RGB 32 GB (2 x 16 GB) DDR4-3600 CL16 |

| Video Card(s) | PowerColor Radeon RX 7800 XT 16 GB Hellhound OC |

| Storage | Samsung 980 Pro 1 TB M.2-2280 PCIe 4.0 X4 NVME SSD |

| Display(s) | Lenovo Legion Y27q-20 27" QHD IPS monitor |

| Case | GameMax Spark M-ATX (re-badged Jonsbo D30) |

| Audio Device(s) | FiiO K7 Desktop DAC/Amp + Philips Fidelio X3 headphones, or ARTTI T10 Planar IEMs |

| Power Supply | ADATA XPG CORE Reactor 650 W 80+ Gold ATX |

| Mouse | Roccat Kone Pro Air |

| Keyboard | Cooler Master MasterKeys Pro L |

| Software | Windows 10 64-bit Home Edition |

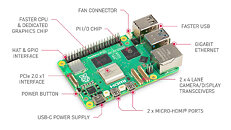

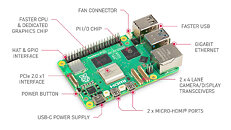

Bloomberg broke the news about Raspberry Pi leadership's lofty ambitions earlier this week—the news outlet reported on the UK-based "personal computer maker" appointing "bankers at Peel Hunt and Jefferies to prepare a London initial public offering (IPO)." In their opinion: "a listing that would be a win for the UK capital after an exodus of companies to the US." The Raspberry Pi 5 single-board computer launched last autumn, and proved to be a hit with hardware enthusiasts thanks to improved silicon delivering significant CPU and GPU uplifts (over Pi 4), and an in-house controller chip granting a fancier interface feature set. The Raspberry Pi Limited company is enjoying its many success stories, including an estimated valuation of ~$560 million and strategic investments courtesy of long-term partner, ARM Ltd.

Eben Upton, CEO of Raspberry Pi (Trading) Ltd., responded to a Tom's Hardware query regarding the Bloomberg news piece. He confirmed that banking firm "Peel Hunt and Jefferies" is involved in the preparation of an upcoming IPO, but nothing has been set in concrete. They expect to proceed: "when the market is ready. Right now there is no target valuation or a firm date." Upton discussed his firm's recent motivations: "We believe that London is the natural listing location for a company like Raspberry Pi, and that it wouldn't be an impediment to attracting US (or other international) investment, provided we're prepared to do the work to educate foreign investors." The listing is not expected to affect normal day-to-day operations, although he does not rule out the potential for growth: "If we do IPO at some point, I don't anticipate any changes to what Raspberry Pi Ltd does. Regardless, we're going to keep doing good engineering, designing the sorts of products we'd like to buy ourselves, and selling them to people (and companies) like us. Of course the Foundation would be able to use any money raised to do what it does at an even larger scale, which would be a great outcome."

View at TechPowerUp Main Site | Source

Eben Upton, CEO of Raspberry Pi (Trading) Ltd., responded to a Tom's Hardware query regarding the Bloomberg news piece. He confirmed that banking firm "Peel Hunt and Jefferies" is involved in the preparation of an upcoming IPO, but nothing has been set in concrete. They expect to proceed: "when the market is ready. Right now there is no target valuation or a firm date." Upton discussed his firm's recent motivations: "We believe that London is the natural listing location for a company like Raspberry Pi, and that it wouldn't be an impediment to attracting US (or other international) investment, provided we're prepared to do the work to educate foreign investors." The listing is not expected to affect normal day-to-day operations, although he does not rule out the potential for growth: "If we do IPO at some point, I don't anticipate any changes to what Raspberry Pi Ltd does. Regardless, we're going to keep doing good engineering, designing the sorts of products we'd like to buy ourselves, and selling them to people (and companies) like us. Of course the Foundation would be able to use any money raised to do what it does at an even larger scale, which would be a great outcome."

View at TechPowerUp Main Site | Source